Hawaii Form N 311 2022

What is the Hawaii Form N 311?

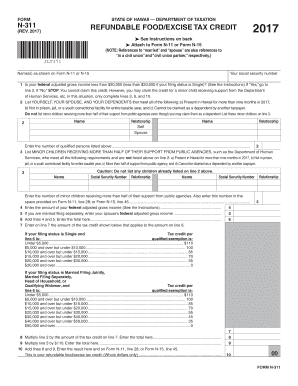

The Hawaii Form N 311, also known as the 2017 form N 311 food credit, is a crucial document for residents of Hawaii who wish to claim a food credit on their state tax return. This form is specifically designed for individuals and families who meet certain income thresholds, allowing them to receive a tax credit aimed at alleviating the cost of food expenses. The form must be accurately filled out and submitted to ensure eligibility for the credit.

How to use the Hawaii Form N 311

Using the Hawaii Form N 311 involves several steps to ensure that you correctly claim the food credit. First, gather all necessary documentation, including income statements and any relevant tax information. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once the form is filled out, it can be submitted electronically or via mail, depending on your preference. It is essential to keep a copy of the completed form for your records.

Steps to complete the Hawaii Form N 311

Completing the Hawaii Form N 311 requires a systematic approach. Follow these steps:

- Gather required documents, including proof of income and identification.

- Download the form from the official state website or access it through reliable tax software.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details regarding your household size and income.

- Calculate the food credit based on the guidelines provided in the form.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the food credit through the Hawaii Form N 311, applicants must meet specific eligibility criteria. Generally, this includes having a household income that falls below a certain threshold, which varies based on family size. Additionally, applicants must be residents of Hawaii and must not have claimed the food credit on another tax return. It is important to review the eligibility requirements carefully before submitting the form.

Form Submission Methods

The Hawaii Form N 311 can be submitted through various methods to accommodate different preferences. Residents have the option to file the form online, which is often the quickest method, or they can choose to mail a paper copy to the appropriate state tax office. In-person submissions may also be possible at designated tax offices. It is advisable to check the latest guidelines for submission methods as they may change over time.

Legal use of the Hawaii Form N 311

The legal use of the Hawaii Form N 311 is governed by state tax laws, which outline the requirements for claiming the food credit. It is essential for users to ensure that the information provided on the form is accurate and truthful, as discrepancies may lead to penalties or denial of the credit. The form must be used in accordance with the guidelines set forth by the Hawaii Department of Taxation to maintain its legal validity.

Quick guide on how to complete hawaii form n 311

Complete Hawaii Form N 311 effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without interruptions. Manage Hawaii Form N 311 on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign Hawaii Form N 311 effortlessly

- Find Hawaii Form N 311 and select Get Form to initiate the process.

- Use the tools available to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Hawaii Form N 311 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii form n 311

Create this form in 5 minutes!

How to create an eSignature for the hawaii form n 311

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2017 form n 311 food credit?

The 2017 form n 311 food credit is a tax form used in certain states to claim food credits on eligible expenses. This form helps individuals and businesses to receive credit for food purchases made during the tax year. It's important to fill it out accurately to ensure you receive the maximum benefit.

-

How can airSlate SignNow assist with filling out the 2017 form n 311 food credit?

airSlate SignNow streamlines the eSigning process for the 2017 form n 311 food credit, enabling users to fill it out and get it signed quickly and securely. Our platform provides an intuitive interface that simplifies document completion and ensures that all necessary fields are filled. This saves business owners time and reduces errors during the submission process.

-

Is there a cost associated with using airSlate SignNow for the 2017 form n 311 food credit?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. While there's a fee to use our platform, the efficiency and accuracy you gain in managing forms like the 2017 form n 311 food credit can result in signNow time and cost savings. You can explore our pricing page for detailed information on subscription options.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, in-app messaging, and audit trails, enhancing your document management experience. For the 2017 form n 311 food credit, these features ensure that all edits are tracked, and collaboration is seamless. You can also easily share documents for eSignature, improving workflow efficiency.

-

Can I integrate airSlate SignNow with other software for the 2017 form n 311 food credit?

Absolutely! airSlate SignNow offers integrations with various third-party applications that can facilitate the filing of the 2017 form n 311 food credit. By connecting with CRM and accounting software, you streamline your workflow, ensuring that all necessary information is easily accessible and can be pre-filled on the form.

-

What are the benefits of using airSlate SignNow for tax forms like the 2017 form n 311 food credit?

Using airSlate SignNow for tax forms like the 2017 form n 311 food credit provides several benefits, including enhanced accuracy, faster completion, and secure storage. Our eSigning solution ensures that your completed forms are legally binding and compliant with regulations. You'll also have peace of mind knowing your sensitive information is protected.

-

How secure is airSlate SignNow when handling forms like the 2017 form n 311 food credit?

Security is a priority at airSlate SignNow. We use advanced encryption technologies to protect your data while handling the 2017 form n 311 food credit and other sensitive documents. Our platform is regularly updated to ensure compliance with security standards, so you can confidently use our service knowing your information is safe.

Get more for Hawaii Form N 311

Find out other Hawaii Form N 311

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement