Form Et 14

What is the Form Et 14

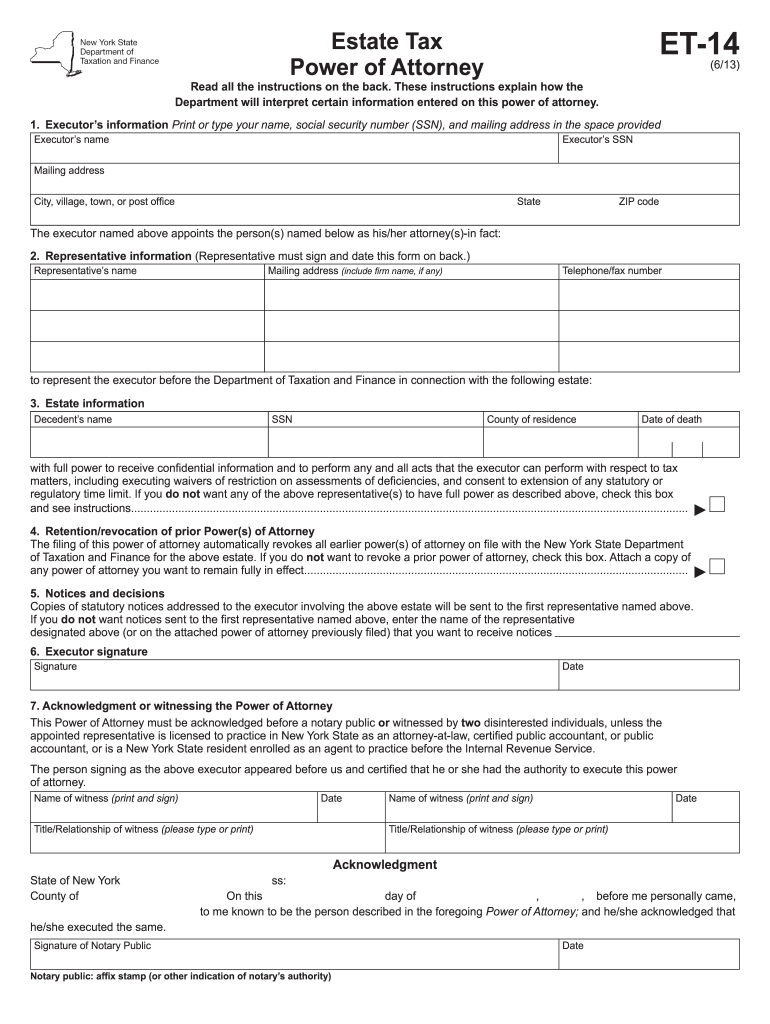

The Form Et 14 is a specific document utilized by the New York State Department of Taxation and Finance. It is primarily designed for taxpayers who need to report certain financial information related to their tax obligations. This form plays a crucial role in ensuring compliance with state tax regulations and helps facilitate the accurate assessment of taxes owed by individuals and businesses.

How to use the Form Et 14

Using the Form Et 14 involves several straightforward steps. First, ensure that you have the most recent version of the form, which can be obtained from the New York State Department of Taxation and Finance website. Next, carefully read the instructions provided with the form to understand the specific information required. Fill out the form accurately, ensuring that all fields are completed to avoid delays in processing. Once completed, submit the form according to the guidelines provided, either online, by mail, or in person, depending on your preference and the requirements set forth by the department.

Steps to complete the Form Et 14

Completing the Form Et 14 requires attention to detail. Follow these steps for a successful submission:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Download the Form Et 14 from the official New York State Department of Taxation and Finance website.

- Carefully fill in each section of the form, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions before finalizing it.

- Submit the completed form through the method specified in the instructions, ensuring you keep a copy for your records.

Legal use of the Form Et 14

The legal use of the Form Et 14 is governed by New York State tax laws. It must be completed and submitted in accordance with these regulations to ensure that it is considered valid. Failure to comply with the legal requirements associated with the form can result in penalties or delays in processing. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies could lead to legal repercussions.

Key elements of the Form Et 14

The Form Et 14 includes several key elements that are critical for its completion. These elements typically consist of:

- Taxpayer identification information, including name and address.

- Detailed financial information relevant to the tax year being reported.

- Signature and date fields to validate the submission.

- Instructions for submission and any additional documentation that may be required.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form Et 14 can be done through various methods, depending on your preference and the guidelines provided by the New York State Department of Taxation and Finance. The available submission methods include:

- Online: Many taxpayers can submit the form electronically through the department's secure online portal.

- Mail: The form can be printed and mailed to the appropriate address as indicated in the instructions.

- In-Person: Taxpayers may also have the option to submit the form in person at designated department offices.

Quick guide on how to complete form et 14 department of taxation and finance new york state tax ny

Effortlessly Prepare Form Et 14 on Any Device

Managing documents online has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary format and securely store it online. airSlate SignNow provides you with all the essential tools to swiftly create, modify, and eSign your documents without delays. Handle Form Et 14 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The easiest method to alter and eSign Form Et 14 effortlessly

- Find Form Et 14 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to apply your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form Et 14 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What are the implications if the NY State passes the TRUST Act, authorizing the Department of taxation and Finance to turn over his state tax return if Congress request them for a specific and legislative purpose? Will it restore Congress' checks?

It’s clear that some people here don’t understand what this law is and/or don’t know how government works.The law affects (in this case) Trump’s state tax return. SCOTUS has no jurisdiction over state tax law. I’m not even sure how SCOTUS could weigh in on this insofar as there is no constitutional right of tax return privacy. Tax return privacy is an IRS law and only applies to federal tax returns. NY is free to write its own tax and privacy laws.Furthermore, it only pertains to releasing tax information to a congressional investigation on request, not plastering it on billboards or sending it to the media.And, let’s be clear, congress already has the unambiguous right to see Trump’s federal tax return now under Section 6103 of IRS law. Just because Trump has his minions trying to drag this out into a court fight that they will ultimately lose doesn’t mean that right doesn’t exist.

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

Create this form in 5 minutes!

How to create an eSignature for the form et 14 department of taxation and finance new york state tax ny

How to generate an electronic signature for the Form Et 14 Department Of Taxation And Finance New York State Tax Ny online

How to create an eSignature for the Form Et 14 Department Of Taxation And Finance New York State Tax Ny in Chrome

How to make an electronic signature for putting it on the Form Et 14 Department Of Taxation And Finance New York State Tax Ny in Gmail

How to create an electronic signature for the Form Et 14 Department Of Taxation And Finance New York State Tax Ny right from your smartphone

How to generate an electronic signature for the Form Et 14 Department Of Taxation And Finance New York State Tax Ny on iOS devices

How to make an electronic signature for the Form Et 14 Department Of Taxation And Finance New York State Tax Ny on Android OS

People also ask

-

What is the cost of using airSlate SignNow for et 14?

The pricing for airSlate SignNow starts at an affordable rate that ensures businesses can utilize the eSigning features without breaking the bank. For the et 14 plan, you'll find detailed pricing on our website, reflecting the flexibility and cost-effectiveness that airSlate SignNow offers for your eSigning needs.

-

What features are included in the et 14 plan?

The et 14 plan includes comprehensive eSigning features such as document templates, in-person signing, and advanced security options. These features ensure that your business can efficiently manage documents while maintaining high security, all at a cost-effective price with airSlate SignNow.

-

How can airSlate SignNow benefit my business with et 14?

By choosing the et 14 plan with airSlate SignNow, your business can streamline document workflows and enhance productivity. The ease of use and flexibility offered by our platform allows teams to focus on what matters most, making et 14 a wise investment for your organization.

-

Does airSlate SignNow integrate with other software under the et 14 plan?

Yes, the et 14 plan offers seamless integration with various third-party software applications. This makes it easy for businesses to incorporate eSigning within their existing workflows, enhancing overall efficiency and collaboration with airSlate SignNow.

-

Is airSlate SignNow secure for handling sensitive documents with et 14?

Absolutely! The et 14 plan of airSlate SignNow prioritizes security by employing advanced encryption and compliance with industry standards. This ensures that sensitive documents remain protected throughout the eSigning process, providing peace of mind for your business.

-

Can I try airSlate SignNow features in the et 14 plan before purchasing?

Yes, airSlate SignNow offers a free trial for the et 14 plan, allowing you to experience the features and benefits firsthand. This trial is an excellent opportunity to assess whether our eSigning solution aligns with your business needs before making a commitment.

-

What types of documents can I sign using airSlate SignNow with et 14?

With the et 14 plan from airSlate SignNow, you can sign a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple document types, making it versatile for various business needs and ensuring smooth document management.

Get more for Form Et 14

- S corporation state business tax filing software taxact form

- Articles of incorporation general stock corporation form arts gs

- 2022 form 8453 llc california e file return authorization for limited liability companies

- S 1040 form 2022xls

- Kentucky inheritance tax return department of revenue form

- Chapter 2 persons subject to tax and exemptionstngov form

- Form it 638 start up ny tax elimination credit tax year

- Use whole dollar amounts form

Find out other Form Et 14

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later