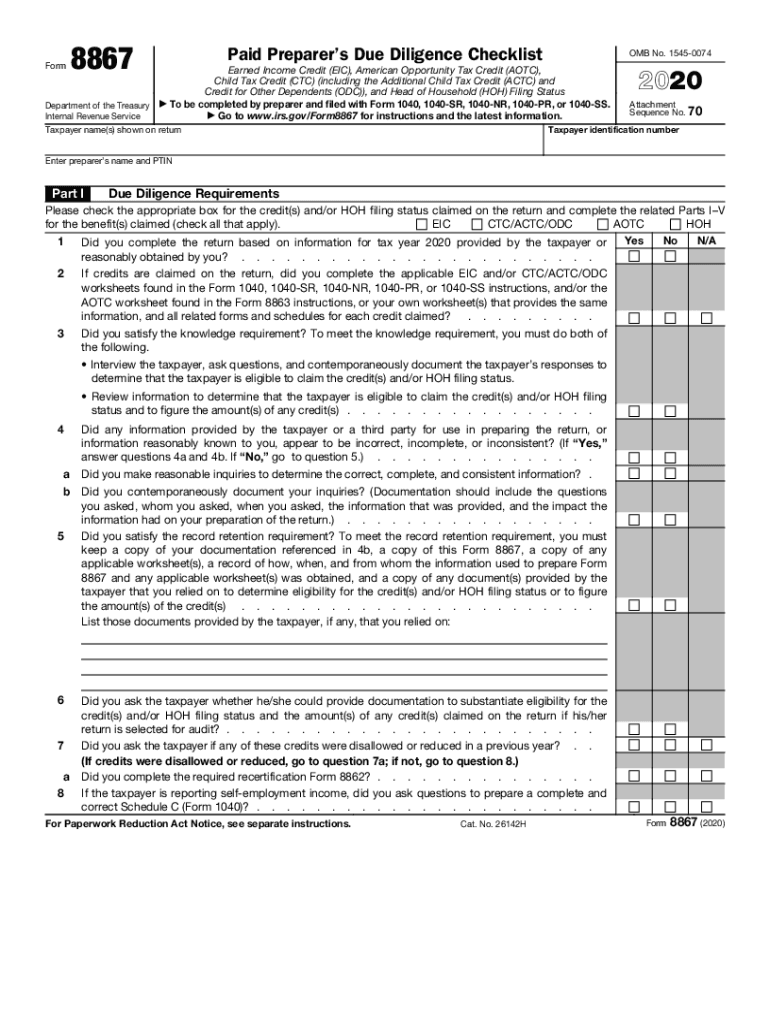

Earned Income Credit EIC, American Opportunity Tax Credit AOTC, 2020

What is the Earned Income Credit (EIC)?

The Earned Income Credit (EIC) is a tax benefit designed to assist low to moderate-income working individuals and families. This refundable credit reduces the amount of tax owed and may result in a refund if the credit exceeds the amount of taxes owed. The EIC is particularly beneficial for those with children, as the credit amount increases with the number of qualifying children. Understanding the EIC is essential for maximizing tax benefits and ensuring compliance with IRS regulations.

Eligibility Criteria for the Earned Income Credit (EIC)

To qualify for the Earned Income Credit, taxpayers must meet specific criteria set by the IRS. Key eligibility requirements include:

- Must have earned income from employment or self-employment.

- Filing status cannot be "Married Filing Separately."

- Must have a valid Social Security number.

- Income must fall within the specified limits, which can vary based on filing status and number of qualifying children.

- Must be a U.S. citizen or resident alien for the entire tax year.

It's important to review these criteria each tax year, as they may change. Taxpayers should also ensure they have the necessary documentation to support their eligibility when filing.

Steps to Complete the Earned Income Credit (EIC)

Completing the Earned Income Credit involves a series of steps to ensure accurate filing. Here are the essential steps:

- Gather all necessary documents, including W-2 forms, 1099 forms, and any other records of earned income.

- Determine your filing status and the number of qualifying children, if applicable.

- Use the IRS EIC table or an earned income credit 2017 calculator to estimate your credit amount.

- Fill out the IRS Form 1040, including the EIC section, and attach any required schedules.

- Review your completed tax return for accuracy before submission.

Following these steps can help ensure that you receive the maximum credit available to you.

IRS Guidelines for the Earned Income Credit (EIC)

The IRS provides specific guidelines for claiming the Earned Income Credit. These guidelines include detailed instructions on eligibility, documentation requirements, and how to calculate the credit. Taxpayers should refer to the IRS website or the latest tax publications for the most current information. Compliance with these guidelines is crucial to avoid potential penalties or delays in processing tax returns.

Required Documents for the Earned Income Credit (EIC)

When claiming the Earned Income Credit, taxpayers must provide certain documentation to support their claim. Required documents typically include:

- W-2 forms from employers showing earned income.

- 1099 forms for any self-employment income.

- Proof of residency for qualifying children, such as school records or medical documents.

- Social Security numbers for all individuals listed on the tax return.

Having these documents ready can streamline the filing process and help ensure compliance with IRS requirements.

Examples of Using the Earned Income Credit (EIC)

Understanding how the Earned Income Credit can benefit taxpayers can be illustrated through examples. For instance, a single parent with two children earning $30,000 may qualify for a significant EIC, reducing their tax liability and potentially resulting in a refund. Conversely, a married couple with no children earning $25,000 may qualify for a smaller credit. These examples highlight the importance of calculating the EIC based on individual circumstances and income levels.

Quick guide on how to complete earned income credit eic american opportunity tax credit aotc

Complete Earned Income Credit EIC, American Opportunity Tax Credit AOTC, effortlessly on any device

Internet document handling has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed paperwork, as you can retrieve the proper format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, revise, and eSign your documents swiftly without interruptions. Manage Earned Income Credit EIC, American Opportunity Tax Credit AOTC, on any device with airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest method to modify and eSign Earned Income Credit EIC, American Opportunity Tax Credit AOTC, seamlessly

- Locate Earned Income Credit EIC, American Opportunity Tax Credit AOTC, and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Choose your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Earned Income Credit EIC, American Opportunity Tax Credit AOTC, and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct earned income credit eic american opportunity tax credit aotc

Create this form in 5 minutes!

How to create an eSignature for the earned income credit eic american opportunity tax credit aotc

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the earned income credit 2017 calculator?

The earned income credit 2017 calculator is a tool designed to help individuals determine their eligibility and potential refund amounts related to the Earned Income Tax Credit (EITC) for the year 2017. By inputting relevant income and tax information, users can estimate their credit efficiently.

-

How do I use the earned income credit 2017 calculator?

To use the earned income credit 2017 calculator, simply enter your filing status, number of qualifying children, and your total earned income for 2017. The calculator will process this information and provide an estimated credit amount, making tax planning simpler.

-

Is the earned income credit 2017 calculator free to use?

Yes, the earned income credit 2017 calculator is offered free of charge, allowing users to estimate their potential EITC without any financial commitment. This accessibility makes it an excellent resource for taxpayers looking to maximize their refunds.

-

What are the benefits of using the earned income credit 2017 calculator?

Using the earned income credit 2017 calculator helps you quickly identify any credits you may be eligible for, which can signNowly increase your tax refund. It simplifies the process, ensuring that you have accurate estimates to inform your financial decisions.

-

Can I integrate the earned income credit 2017 calculator with other tax tools?

Yes, the earned income credit 2017 calculator can be integrated with various tax software and tools, enhancing your overall tax preparation process. These integrations streamline your workflow by providing a seamless experience between different platforms.

-

What features should I look for in an earned income credit 2017 calculator?

When searching for an earned income credit 2017 calculator, look for features such as user-friendly input fields, accurate calculations, and comprehensive explanations of the requirements for EITC eligibility. These features ensure that you receive a reliable estimate.

-

How accurate is the earned income credit 2017 calculator?

The earned income credit 2017 calculator provides estimates based on the information you input, adhering to the IRS guidelines for the 2017 tax year. While it aims for accuracy, it's essential to verify your actual eligibility with a tax professional.

Get more for Earned Income Credit EIC, American Opportunity Tax Credit AOTC,

- Vgh ultrasound requisition form

- Immunization information form vancouver coastal health childhood immunization history

- Application for a permit to construct or demolish form

- City of brampton fillable form certificate of insurance

- Form 24a

- Job search form 484277141

- Declaration form for international travel online

- Dmu ic application form de montfort university

Find out other Earned Income Credit EIC, American Opportunity Tax Credit AOTC,

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe