Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version 2023-2026

What is the Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

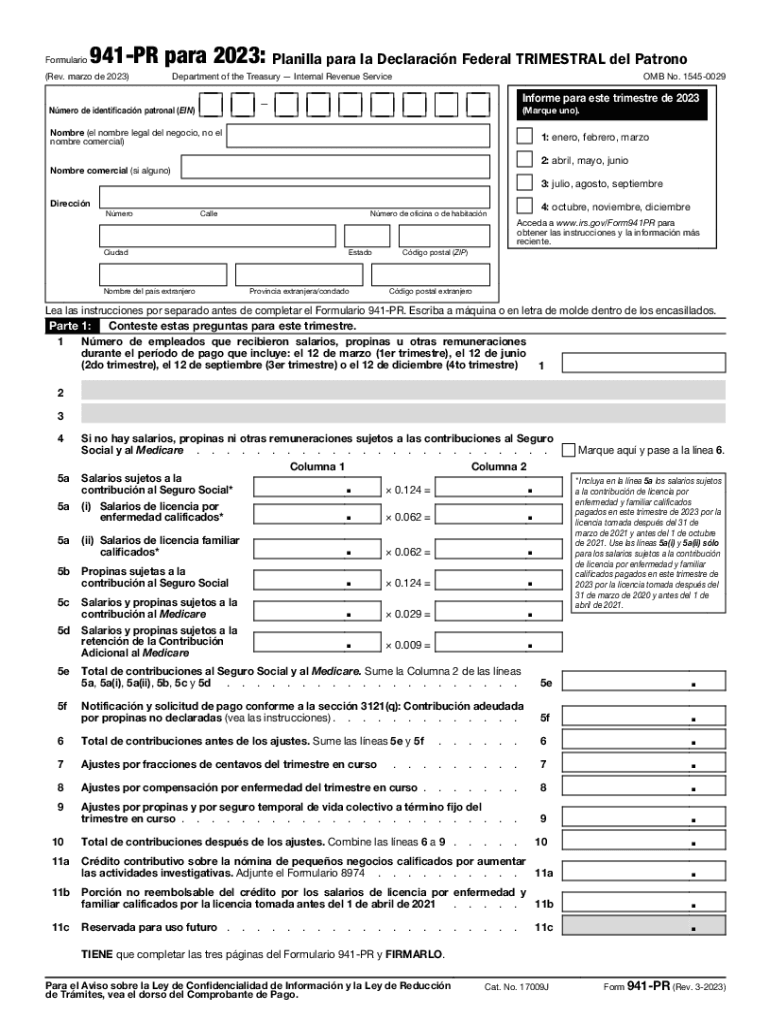

The Form 941 PR Rev March is the Employer's Quarterly Federal Tax Return specifically designed for employers operating in Puerto Rico. This form is used to report income taxes withheld from employee wages, as well as the employer's share of Social Security and Medicare taxes. It is essential for compliance with federal tax regulations in Puerto Rico, ensuring that employers accurately report their tax liabilities on a quarterly basis. The form captures critical information regarding the number of employees, total wages paid, and the amounts withheld for federal taxes.

How to use the Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

To effectively use the Form 941 PR, employers must first download the form from a reliable source, ensuring they have the most current version. After obtaining the form, employers should fill it out with accurate information regarding their payroll for the quarter. This includes detailing the total wages paid, taxes withheld, and any adjustments necessary for prior periods. Once completed, the form can be submitted either electronically or via mail, depending on the employer's preference and compliance requirements. It is crucial to keep a copy of the submitted form for record-keeping and future reference.

Steps to complete the Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

Completing the Form 941 PR involves several key steps:

- Download the latest version of the form from a trusted source.

- Gather necessary information, including employee details, total wages paid, and tax withholdings.

- Fill out the form accurately, ensuring all sections are completed, including the signature area.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mail, adhering to the filing deadlines.

Legal use of the Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

The legal use of the Form 941 PR is governed by federal tax regulations. Employers must file this form to comply with the Internal Revenue Service (IRS) requirements for reporting payroll taxes. Failure to file accurately and on time can result in penalties and interest charges. The form must be completed truthfully, as providing false information can lead to legal repercussions. Using a reliable electronic signature solution can enhance the legal validity of the submitted form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 941 PR to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. This means the deadlines are as follows:

- For the first quarter (January to March): due by April 30

- For the second quarter (April to June): due by July 31

- For the third quarter (July to September): due by October 31

- For the fourth quarter (October to December): due by January 31 of the following year

Key elements of the Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

The Form 941 PR includes several key elements that employers must complete:

- Employer identification information, including name and address.

- Total number of employees during the quarter.

- Total wages paid to employees.

- Federal income tax withheld from employee wages.

- Employer and employee portions of Social Security and Medicare taxes.

- Adjustments for any prior quarter discrepancies.

Quick guide on how to complete form 941 pr rev march employers quarterly federal tax return puerto rican version

Prepare Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without complications. Manage Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and electronically sign Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version with ease

- Locate Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version and select Get Form to begin.

- Use the available tools to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements within a few clicks from your preferred device. Adjust and electronically sign Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 pr rev march employers quarterly federal tax return puerto rican version

Create this form in 5 minutes!

How to create an eSignature for the form 941 pr rev march employers quarterly federal tax return puerto rican version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 2020 941 pr download for businesses?

The 2020 941 pr download is essential for businesses to report their quarterly federal tax withholding and payroll taxes accurately. By downloading this form, companies can ensure compliance with IRS requirements and avoid penalties. Utilizing airSlate SignNow streamlines the process, making it easier to send and eSign the necessary documents.

-

How can I access the 2020 941 pr download through airSlate SignNow?

You can easily access the 2020 941 pr download by logging into your airSlate SignNow account and navigating to the Forms section. Once there, you can search for this specific form and download it directly for your use. Our platform provides a user-friendly interface, making it simple to find and manage forms.

-

Is there a cost associated with downloading the 2020 941 pr using airSlate SignNow?

While signing up for airSlate SignNow offers a variety of pricing plans, downloading the 2020 941 pr document is part of the services included in our subscription. We provide cost-effective solutions for businesses seeking to manage their document needs efficiently. Review our pricing page to choose a plan that suits your requirements.

-

What features does airSlate SignNow offer for managing the 2020 941 pr download?

airSlate SignNow offers several features for managing the 2020 941 pr download, including eSignature capabilities, document sharing, and cloud storage. You can also automate workflows to send reminders for form submissions, ensuring timely completion of tax documents. Our platform enhances overall efficiency in document management.

-

Are there integrations available for the 2020 941 pr download in airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance the functionality surrounding the 2020 941 pr download. You can connect with popular tools such as Google Drive, Salesforce, and Zapier, which allows for streamlined workflows. These integrations facilitate easier access and storage for your tax documents.

-

How does airSlate SignNow protect my information when I download the 2020 941 pr?

airSlate SignNow prioritizes the security of your information during the 2020 941 pr download process. We utilize advanced encryption methods and secure servers to ensure your sensitive data is protected. Our commitment to compliance with data protection regulations gives you peace of mind while handling important tax documents.

-

Can I eSign the 2020 941 pr download directly in airSlate SignNow?

Absolutely! Once you download the 2020 941 pr through airSlate SignNow, you can eSign it directly within the platform. Our intuitive eSignature solution lets you sign documents electronically, making the submission process faster and more efficient. This reduces the hassle of printing and scanning.

Get more for Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

- Dwc form 001 employers first report of injury or illness

- Application for attorney fees application for attorney fees form

- Workers compensation form dwc 1 ampamp notice of potential

- Texas department of insurance attorney fee processing form

- Texas claims kit cover doc atlas general insurance form

- Dwc use only microfilm form

- Fillable online tdi texas what is addendum form fax email

- Rates rules and forms manual south carolina wind and hail

Find out other Form 941 PR Rev March Employer's Quarterly Federal Tax Return Puerto Rican Version

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure