941 Pr Form 2015

What is the 941 Pr Form

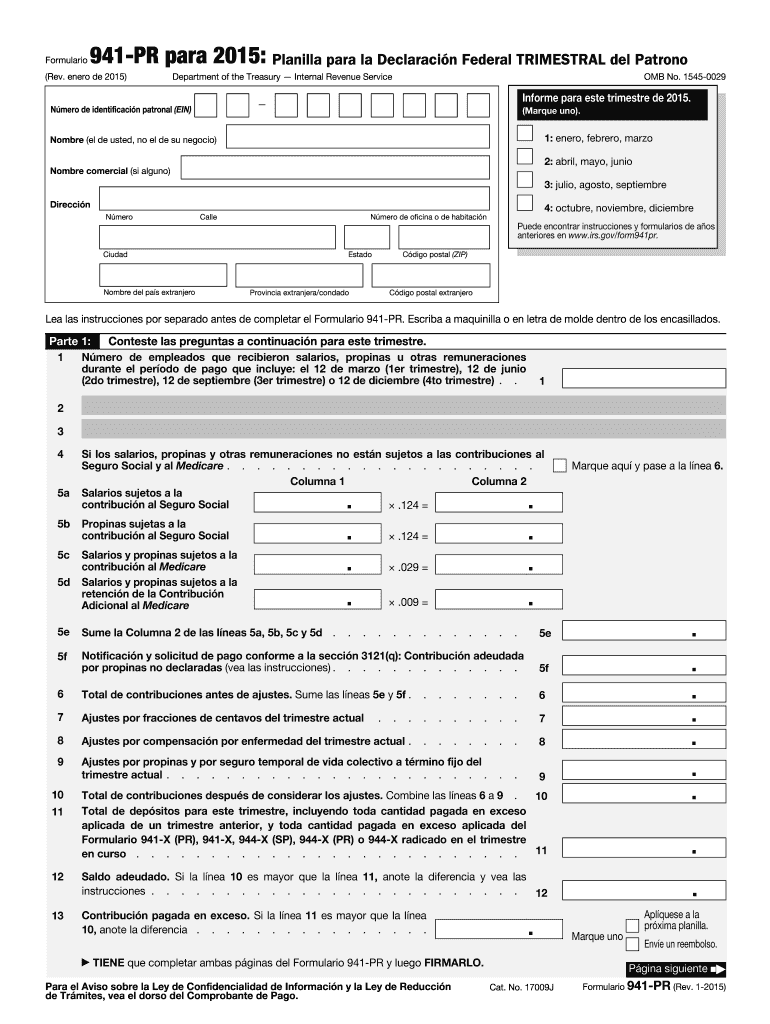

The 941 Pr Form is a specific tax form used by employers in Puerto Rico to report income taxes, Social Security taxes, and Medicare taxes withheld from employee wages. This form is essential for compliance with federal tax regulations and is filed quarterly. It helps the Internal Revenue Service (IRS) track the taxes that employers are responsible for remitting on behalf of their employees. Understanding the purpose and requirements of the 941 Pr Form is crucial for employers to maintain accurate tax records and avoid penalties.

How to use the 941 Pr Form

Using the 941 Pr Form involves several steps to ensure accurate reporting of tax information. Employers must gather all necessary data, including total wages paid, tips reported, and the amounts withheld for federal income tax, Social Security, and Medicare. Once the data is compiled, employers fill out the form, ensuring all fields are completed accurately. After completing the form, it must be submitted to the IRS by the specified deadline, either through electronic filing or by mail. Proper use of the form helps maintain compliance with tax obligations.

Steps to complete the 941 Pr Form

Completing the 941 Pr Form requires careful attention to detail. Here are the essential steps:

- Gather employee wage information, including total wages and tips.

- Calculate the amounts withheld for federal income tax, Social Security, and Medicare.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the due date.

Following these steps helps ensure that the form is completed correctly and submitted on time, minimizing the risk of penalties.

Legal use of the 941 Pr Form

The 941 Pr Form is legally binding when completed and submitted according to IRS guidelines. Employers must ensure that the information reported is accurate and truthful, as any discrepancies can lead to audits or penalties. The form serves as a record of the taxes withheld and must be retained for a specified period for compliance purposes. Understanding the legal implications of the form helps employers navigate their tax responsibilities effectively.

Filing Deadlines / Important Dates

Filing deadlines for the 941 Pr Form are critical for compliance. Employers are generally required to file this form quarterly. The deadlines are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Missing these deadlines can result in penalties, so it's essential for employers to stay informed about these important dates.

Form Submission Methods (Online / Mail / In-Person)

The 941 Pr Form can be submitted through various methods, providing flexibility for employers. The available submission methods include:

- Online filing through the IRS e-file system, which is the most efficient method.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Choosing the right submission method helps ensure timely processing of the form and compliance with IRS requirements.

Quick guide on how to complete 2015 941 pr form

Complete 941 Pr Form effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle 941 Pr Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign 941 Pr Form without difficulty

- Locate 941 Pr Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of sharing your form, by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign 941 Pr Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 941 pr form

Create this form in 5 minutes!

How to create an eSignature for the 2015 941 pr form

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the 941 Pr Form and why is it important?

The 941 Pr Form is an essential tax document used by employers in Puerto Rico to report income taxes withheld from employees and the employer's share of Social Security and Medicare taxes. Understanding how to properly complete the 941 Pr Form is crucial for compliance with tax regulations and avoiding penalties.

-

How can airSlate SignNow help me with the 941 Pr Form?

airSlate SignNow streamlines the process of completing and submitting the 941 Pr Form by allowing you to easily send, sign, and store documents securely online. Our platform ensures that your 941 Pr Form is filled out accurately and submitted on time, simplifying your payroll tax management.

-

Is there a cost associated with using airSlate SignNow for the 941 Pr Form?

Yes, airSlate SignNow offers a range of pricing plans to suit different business needs. Each plan includes features that facilitate the efficient handling of documents, including the 941 Pr Form, ensuring you only pay for what you need without unnecessary costs.

-

Can I integrate airSlate SignNow with other software for managing my 941 Pr Form?

Absolutely! airSlate SignNow provides seamless integrations with various accounting and payroll software. This means you can easily sync your data and manage your 941 Pr Form alongside your other business processes for enhanced efficiency.

-

What features does airSlate SignNow offer for filling out the 941 Pr Form?

airSlate SignNow offers features such as customizable templates, electronic signatures, and document tracking specifically designed to simplify the process of completing the 941 Pr Form. These tools help ensure that your forms are accurate and compliant with tax requirements.

-

How does airSlate SignNow ensure the security of my 941 Pr Form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your 941 Pr Form and other sensitive documents, giving you peace of mind that your data is safe and accessible only to authorized users.

-

Can I access the 941 Pr Form from multiple devices using airSlate SignNow?

Yes, airSlate SignNow is designed for accessibility across devices. You can fill out, sign, and manage your 941 Pr Form from anywhere, whether you’re using a computer, tablet, or smartphone, making it convenient for busy professionals.

Get more for 941 Pr Form

- Bchp dental reimbursement form

- Abc voucher application form sc

- Click here to email completed form

- Epayment enrollment authorization form providers select health of south carolina epayment enrollment authorization form

- Va baptist music and worship arts camp instructions for form

- Animalagriculture form

- Arizona dcs forms

- Endocrinology utcvm form

Find out other 941 Pr Form

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement