Form 941 Printable for 2018

What is the Form 941 Printable For

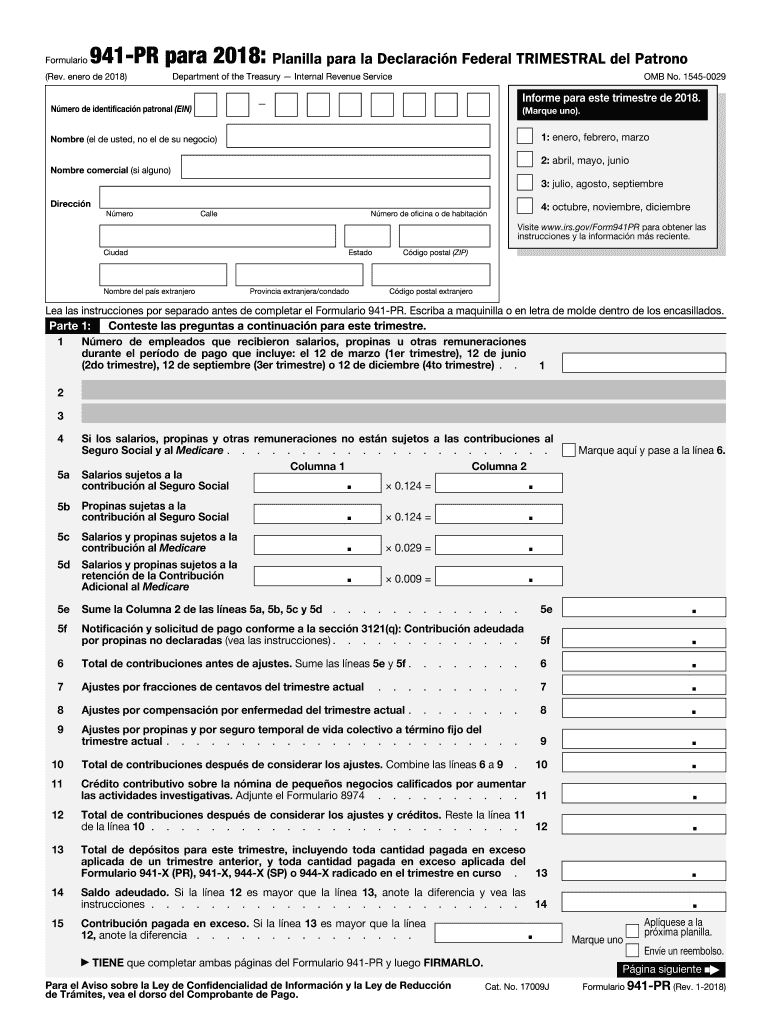

The Form 941, also known as the Employer's Quarterly Federal Tax Return, is essential for businesses in the United States. This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It also details the employer's share of Social Security and Medicare taxes. The forma 941 pr 2019 specifically refers to the version of this form applicable for the tax year 2019, which must be filed quarterly by employers to remain compliant with federal tax regulations.

Steps to Complete the Form 941 Printable For

Completing the forma 941 pr 2019 involves several key steps:

- Begin by gathering all necessary payroll information, including total wages paid, tips reported, and the amount of taxes withheld.

- Fill out the identification section with your employer details, including your Employer Identification Number (EIN).

- Report the total number of employees and the wages paid during the quarter.

- Calculate the total taxes owed, including the employee and employer portions of Social Security and Medicare taxes.

- Complete the section for any adjustments, such as overpayments or corrections from previous filings.

- Sign and date the form before submission.

How to Obtain the Form 941 Printable For

The forma 941 pr 2019 can be obtained directly from the Internal Revenue Service (IRS) website. It is available for download in PDF format, allowing you to print and fill it out manually. Additionally, many tax preparation software programs offer the option to generate this form electronically, streamlining the process for users.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when submitting the forma 941 pr 2019. The form is due on the last day of the month following the end of each quarter. The deadlines for 2019 are:

- First Quarter: April 30, 2019

- Second Quarter: July 31, 2019

- Third Quarter: October 31, 2019

- Fourth Quarter: January 31, 2020

Filing late may result in penalties, so it's crucial to keep track of these dates.

Form Submission Methods (Online / Mail / In-Person)

The forma 941 pr 2019 can be submitted in several ways. Employers have the option to file electronically through the IRS e-file system, which is efficient and secure. Alternatively, you can mail the completed form to the appropriate IRS address based on your location. In-person submission is generally not an option for this form, as the IRS encourages electronic filing for quicker processing.

Legal Use of the Form 941 Printable For

Using the forma 941 pr 2019 correctly is essential for legal compliance. This form must be filled out accurately to reflect all payroll taxes withheld and owed. Inaccurate reporting can lead to audits, penalties, and interest on unpaid taxes. Employers should ensure that they are using the correct version of the form and that all information is complete and truthful to avoid any legal complications.

Quick guide on how to complete irs form 941 pr 2018 2019

Discover the most efficient method to complete and endorse your Form 941 Printable For

Are you still spending time preparing your official paperwork on paper instead of online? airSlate SignNow provides an enhanced approach to complete and endorse your Form 941 Printable For and other documents for public services. Our advanced electronic signature solution equips you with all the tools necessary to process documents swiftly and in compliance with official standards - robust PDF editing, management, protection, signing, and sharing features are all readily available within an easy-to-use interface.

Only a few steps are needed to fill out and endorse your Form 941 Printable For:

- Upload the editable template to the editor by using the Get Form button.

- Review the information you need to enter in your Form 941 Printable For.

- Navigate through the sections using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is crucial or Conceal fields that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Form 941 Printable For in the Documents folder of your profile, download it, or transfer it to your preferred cloud service. Our platform also offers versatile file sharing options. There's no need to print your forms when you can send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 941 pr 2018 2019

FAQs

-

What is the penalty for failing to file an IRS Form 941 2018?

The penalties are for not paying the 941 tax on time according to the payment schedule, which depends on the amount of tax. Small companies may be required to pay only quarterly or monthly, but larger companies have payments due within 3 business days after every payroll. The penalties depend on how late the payments are, bit they go up rapidly, and can be 100% if there is no payment.There is often no penalty for not filing the 941 on time if the payments have been made, but the IRS will be sending you a lot of mail to get it filed.

-

How long does it take the IRS to accept or reject an IRS Form 941 return?

If you e-file, you should get your e-file acknowledgement back within the hour. Your software provider should provide you with your ack code, which they receive from the IRS.The IRS servers are lightning fast now after they upgraded them a few years ago after the Russians hacked into them back in 2015. (IRS believes Russians are behind tax return data bsignNow - CNNPolitics). No more waiting 24 -48 hours for an ack code, even though they still tell you officially that’s how long it will take.If you paper file, the whole process slows down to a crawl, and if you make a mistake, the interest and penalties add up before you even know there’s a problem.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 941 pr 2018 2019

How to generate an eSignature for your Irs Form 941 Pr 2018 2019 in the online mode

How to generate an eSignature for the Irs Form 941 Pr 2018 2019 in Chrome

How to make an electronic signature for signing the Irs Form 941 Pr 2018 2019 in Gmail

How to create an eSignature for the Irs Form 941 Pr 2018 2019 right from your smartphone

How to generate an eSignature for the Irs Form 941 Pr 2018 2019 on iOS devices

How to generate an electronic signature for the Irs Form 941 Pr 2018 2019 on Android devices

People also ask

-

What is Form 941 Printable For and who needs it?

Form 941 Printable For is a quarterly tax form used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. Businesses of all sizes that have employees are required to file this form with the IRS. Using airSlate SignNow, you can easily fill out and eSign Form 941 Printable For, making the filing process seamless.

-

How can airSlate SignNow help me with Form 941 Printable For?

airSlate SignNow provides a user-friendly platform that allows you to create, edit, and eSign Form 941 Printable For effortlessly. You can save time and reduce errors with our intuitive interface, ensuring that your tax forms are filled out correctly and submitted on time. Plus, our cloud storage ensures you have access to your documents anytime, anywhere.

-

Is there a cost associated with using airSlate SignNow for Form 941 Printable For?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for those who frequently use Form 941 Printable For. Our plans are cost-effective and designed to provide great value, ensuring you get the features you need without overspending. You can start with a free trial to explore our services.

-

What features are included when using airSlate SignNow for Form 941 Printable For?

When you use airSlate SignNow for Form 941 Printable For, you gain access to features like customizable templates, secure eSignature options, and real-time document tracking. Additionally, our platform allows for collaboration with team members, ensuring that everyone involved can contribute to the document efficiently.

-

Can I integrate airSlate SignNow with other software for Form 941 Printable For?

Absolutely! airSlate SignNow offers seamless integrations with popular software like Google Drive, Dropbox, and various CRM systems. This allows you to streamline your workflow and manage your Form 941 Printable For alongside other essential business applications, enhancing productivity.

-

What are the benefits of using airSlate SignNow for Form 941 Printable For?

Using airSlate SignNow for Form 941 Printable For simplifies the filing process, reduces paperwork, and enhances compliance. Our electronic signing capabilities speed up the approval process, while our secure storage ensures your documents are protected. Overall, this solution promotes efficiency and allows you to focus on your business.

-

Is airSlate SignNow secure for handling Form 941 Printable For?

Yes, airSlate SignNow prioritizes security and compliance. Our platform uses industry-standard encryption and security protocols to protect sensitive information on Form 941 Printable For. You can confidently eSign and share documents knowing that your data is safe from unauthorized access.

Get more for Form 941 Printable For

Find out other Form 941 Printable For

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT