Form 941 PR Rev January Internal Revenue Service 2020

What is the Form 941 PR?

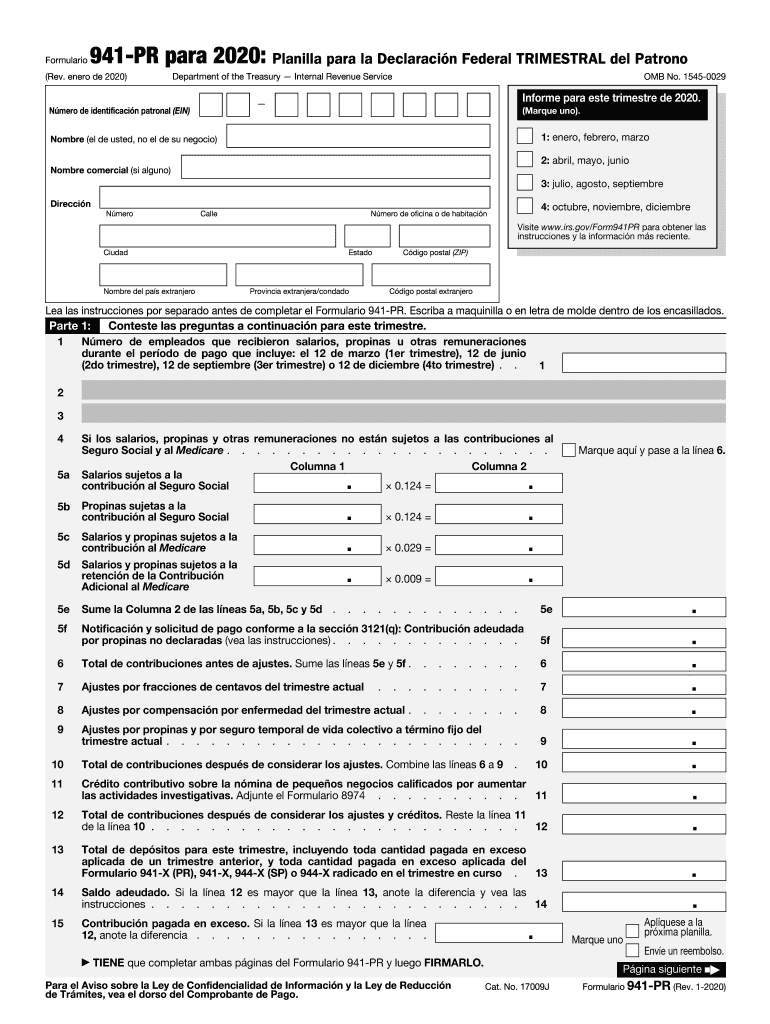

The Form 941 PR, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in Puerto Rico to report income taxes withheld from employee wages, as well as the employer's share of Social Security and Medicare taxes. This form is essential for maintaining compliance with federal tax regulations and ensuring proper reporting to the Internal Revenue Service (IRS). The 941 PR is specifically tailored for businesses operating in Puerto Rico, reflecting local tax requirements while adhering to federal guidelines.

Steps to Complete the Form 941 PR

Completing the Form 941 PR involves several important steps to ensure accuracy and compliance. Here’s a simplified guide:

- Gather Employee Information: Collect all necessary data regarding employee wages, tips, and other compensation.

- Calculate Tax Liabilities: Determine the total income tax withheld, along with the employer's contributions for Social Security and Medicare taxes.

- Fill Out the Form: Enter the calculated figures into the appropriate sections of the form, ensuring all information is accurate and complete.

- Review for Accuracy: Double-check all entries for errors or omissions to avoid potential penalties.

- Submit the Form: File the completed form with the IRS by the designated deadline, either online or via mail.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 941 PR is essential for compliance. Employers must submit this form quarterly, with specific due dates:

- First Quarter: Due by April 30 for the period covering January to March.

- Second Quarter: Due by July 31 for the period covering April to June.

- Third Quarter: Due by October 31 for the period covering July to September.

- Fourth Quarter: Due by January 31 for the period covering October to December.

Legal Use of the Form 941 PR

The Form 941 PR serves as an official document for reporting tax liabilities to the IRS. It is legally binding and must be filled out accurately to reflect the employer's tax obligations. Failure to file correctly can result in penalties and interest charges. Employers are advised to maintain thorough records of all submitted forms and related documentation to ensure compliance with federal regulations.

Key Elements of the Form 941 PR

Several key elements are essential to understand when filling out the Form 941 PR:

- Employer Identification Number (EIN): This unique number identifies the business entity and must be included on the form.

- Tax Period: Clearly indicate the specific quarter for which the form is being filed.

- Wages and Tax Withheld: Report total wages paid and the amount of federal income tax withheld from employees.

- Social Security and Medicare Taxes: Include both employee and employer contributions for these taxes.

How to Obtain the Form 941 PR

The Form 941 PR can be obtained directly from the IRS website or through authorized tax preparation services. It is available in a printable format, allowing employers to fill it out manually. Additionally, many accounting software programs include the form, making it easier for businesses to complete and submit electronically. Always ensure you are using the most current version of the form to comply with the latest regulations.

Quick guide on how to complete form 941 pr rev january 2020 internal revenue service

Accomplish Form 941 PR Rev January Internal Revenue Service seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to design, modify, and eSign your documents swiftly without challenges. Tackle Form 941 PR Rev January Internal Revenue Service on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to adjust and eSign Form 941 PR Rev January Internal Revenue Service effortlessly

- Locate Form 941 PR Rev January Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, through email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in a few clicks from any device you prefer. Modify and eSign Form 941 PR Rev January Internal Revenue Service and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 pr rev january 2020 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 941 pr rev january 2020 internal revenue service

How to create an electronic signature for the Form 941 Pr Rev January 2020 Internal Revenue Service in the online mode

How to make an eSignature for the Form 941 Pr Rev January 2020 Internal Revenue Service in Google Chrome

How to make an eSignature for putting it on the Form 941 Pr Rev January 2020 Internal Revenue Service in Gmail

How to generate an electronic signature for the Form 941 Pr Rev January 2020 Internal Revenue Service straight from your smart phone

How to create an electronic signature for the Form 941 Pr Rev January 2020 Internal Revenue Service on iOS devices

How to make an eSignature for the Form 941 Pr Rev January 2020 Internal Revenue Service on Android devices

People also ask

-

What is 941 pr and how does airSlate SignNow simplify its completion?

The 941 pr form is a critical document for businesses to report payroll taxes. airSlate SignNow streamlines the process by allowing users to fill out, sign, and send the 941 pr electronically. This reduces the chances of errors and ensures timely submissions, helping you stay compliant with IRS requirements.

-

How much does airSlate SignNow cost for users needing to manage 941 pr forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes needing to manage 941 pr forms efficiently. Users can choose from monthly or annual subscriptions, ensuring flexibility and cost savings. Explore our pricing page to find a plan that suits your needs.

-

What features does airSlate SignNow offer for completing 941 pr forms?

airSlate SignNow offers a range of features that enhance the handling of 941 pr forms, including customizable templates, an easy drag-and-drop editor, and secure cloud storage. Additionally, the platform supports multiple file formats, making it user-friendly and versatile for document management.

-

Can I integrate airSlate SignNow with my current accounting software for 941 pr submissions?

Yes, airSlate SignNow seamlessly integrates with popular accounting software solutions, making it easier to manage 941 pr submissions. This integration saves time and minimizes errors by allowing direct access to your financial data and documents within a single platform.

-

What are the benefits of using airSlate SignNow for 941 pr document management?

Using airSlate SignNow for 941 pr management brings many benefits, including reduced paperwork, faster processing times, and enhanced document security. The platform also provides tracking capabilities, so you can effortlessly monitor the status of your submissions and ensure compliance.

-

Is it easy to use airSlate SignNow for those unfamiliar with 941 pr forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible even for those unfamiliar with 941 pr forms. The intuitive interface, step-by-step guidance, and rich support resources help users navigate the process with ease.

-

What security measures does airSlate SignNow implement for 941 pr documents?

airSlate SignNow prioritizes document security with bank-level encryption and secure access protocols, especially for sensitive 941 pr documents. You can trust that your information is protected while allowing for easy collaboration among authorized team members.

Get more for Form 941 PR Rev January Internal Revenue Service

- Unavailable check cancellation agency gsa form

- Form 1187 request for payroll deductions for labor afge

- Fillable online opm for labor organization dues cancellation form

- Fillable online store bought pastry shells crusts and fillings are form

- Valuable information for government contractors unanet

- Preaward survey of prospective contractor technical gsa form

- Preaward survey prospective contractor quality gsa form

- Preaward survey prospective form

Find out other Form 941 PR Rev January Internal Revenue Service

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure