Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version 2022

What is the Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version

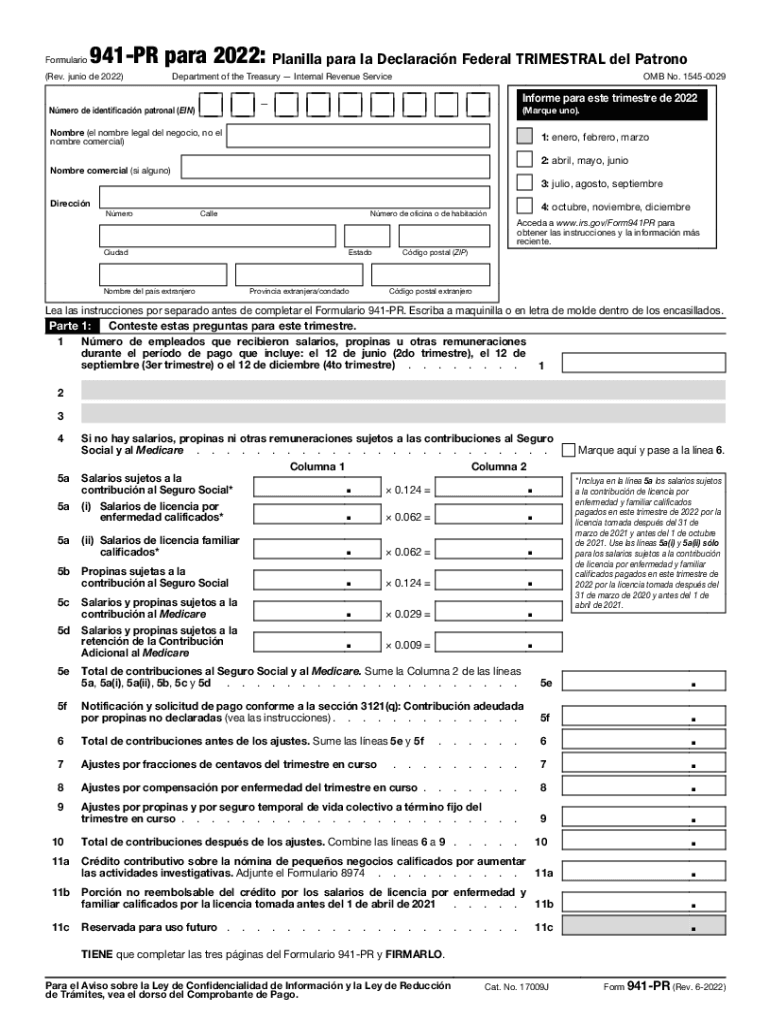

The Form 941 PR Rev June is the Employer's Quarterly Federal Tax Return specifically designed for employers in Puerto Rico. This form is used to report income taxes withheld from employee wages, as well as the employer's share of Social Security and Medicare taxes. It is essential for businesses operating in Puerto Rico to use this version to comply with federal tax requirements while also adhering to local regulations. This form ensures that the IRS receives accurate information regarding payroll taxes, which is crucial for maintaining proper tax records and fulfilling legal obligations.

Steps to complete the Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version

Completing the Form 941 PR involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including employee wages, tax withholdings, and the employer's tax liability. Next, fill out the form by entering the total number of employees, total wages paid, and the amounts withheld for federal income tax, Social Security, and Medicare. It is important to double-check all calculations to avoid errors. After completing the form, review it for completeness and accuracy before submitting it to the IRS. Finally, ensure that you keep a copy for your records, as it may be needed for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941 PR are critical for compliance. Employers must submit the form quarterly, with specific due dates for each quarter. For the first quarter, the deadline is usually April 30, for the second quarter, July 31, for the third quarter, October 31, and for the fourth quarter, January 31 of the following year. It is essential to be aware of these dates to avoid penalties and interest on late submissions. Employers should also consider any additional state-specific deadlines that may apply in Puerto Rico.

Penalties for Non-Compliance

Failure to file the Form 941 PR on time or inaccuracies in the submitted information can lead to significant penalties. The IRS may impose fines for late filings, which can accumulate quickly. Additionally, if an employer fails to pay the taxes owed, interest will accrue on the unpaid amount. It is crucial for businesses to stay informed about their filing obligations and ensure timely submissions to avoid these financial repercussions. Understanding the potential penalties can motivate employers to prioritize compliance with tax regulations.

Digital vs. Paper Version

Employers have the option to file the Form 941 PR either digitally or on paper. The digital version offers several advantages, including faster processing times and the ability to easily correct any errors. Electronic filing also provides a confirmation of submission, which can be beneficial for record-keeping. On the other hand, some employers may prefer the traditional paper method, especially if they are more comfortable with physical documents. Regardless of the chosen method, it is important to ensure that the form is completed accurately and submitted by the deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 941 PR. These guidelines include detailed instructions on how to fill out each section of the form, what information is required, and how to calculate tax liabilities. Employers should carefully review these guidelines to ensure compliance and avoid mistakes. Adhering to IRS instructions is crucial for ensuring that the form is accepted without issues and that all tax obligations are met accurately.

Quick guide on how to complete form 941 pr rev june 2022 employers quarterly federal tax return puerto rican version

Complete Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow offers you all the resources necessary to create, modify, and electronically sign your documents quickly and easily. Manage Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric activity today.

How to modify and electronically sign Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version effortlessly

- Locate Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 pr rev june 2022 employers quarterly federal tax return puerto rican version

Create this form in 5 minutes!

People also ask

-

What is Form 941 for 2022 and why is it important?

Form 941 for 2022 is a quarterly tax return that employers file with the IRS to report income taxes, social security tax, and Medicare tax withheld from employee paychecks. It's essential for compliance and ensures that businesses accurately report their payroll taxes on time.

-

How can airSlate SignNow help with the 941 for 2022?

airSlate SignNow streamlines the process of completing and signing Form 941 for 2022. Our platform allows businesses to easily fill out, eSign, and send the form securely, reducing the time spent on paperwork and minimizing errors.

-

Is there a cost associated with using airSlate SignNow for Form 941 for 2022?

Yes, airSlate SignNow offers affordable pricing plans based on your business needs. By investing in our solution, you enhance your ability to efficiently manage your necessary filings, including the 941 for 2022, while saving time and resources.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as document templates, electronic signatures, secure cloud storage, and real-time tracking. These tools collectively simplify the preparation and submission of important tax forms like the 941 for 2022.

-

Can I integrate airSlate SignNow with my accounting software for Form 941 for 2022?

Absolutely! airSlate SignNow integrates seamlessly with major accounting software, allowing you to import payroll data directly into your 941 for 2022 forms. This integration helps streamline your workflow and ensures accuracy in your filings.

-

How does eSigning documents for Form 941 for 2022 work?

eSigning documents with airSlate SignNow is straightforward; simply upload your Form 941 for 2022, add signers, and send it for signature. Signers can review and sign the document from any device, making the process quick and convenient.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow enhances the efficiency of your tax document management by providing a user-friendly interface, reducing the risk of errors, and ensuring compliance with IRS regulations. This is particularly important when filing critical forms like the 941 for 2022.

Get more for Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version

- Estate planning questionnaire and worksheets nevada form

- Document locator and personal information package including burial information form nevada

- Demand to produce copy of will from heir to executor or person in possession of will nevada form

- New york form 497321067

- Bill of sale of automobile and odometer statement new york form

- Bill of sale for automobile or vehicle including odometer statement and promissory note new york form

- Promissory note in connection with sale of vehicle or automobile new york form

- Bill of sale for watercraft or boat new york form

Find out other Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement