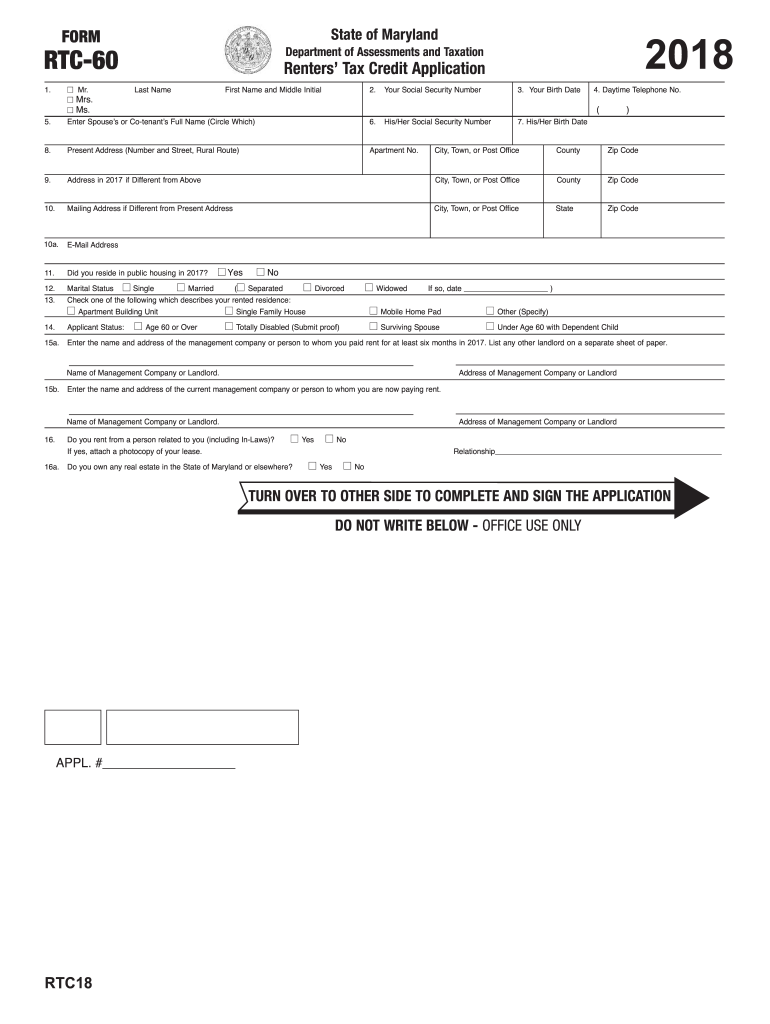

Maryland Renters Tax Credit Form

What is the Maryland Renters Tax Credit

The Maryland Renters Tax Credit is a program designed to provide financial assistance to eligible renters in the state of Maryland. This credit helps reduce the burden of housing costs for low-income households by offering a tax refund based on the rent paid and the income level of the tenant. The program aims to support those who may struggle to afford their rent, ensuring that housing remains accessible and affordable.

Eligibility Criteria

To qualify for the Maryland Renters Tax Credit, applicants must meet specific criteria. Generally, eligible individuals must be residents of Maryland, have a gross income below a certain threshold, and have paid rent for their primary residence. Additionally, applicants must be at least sixty years old, or if under sixty, must be receiving certain disability benefits. It is important to review the detailed income limits and other eligibility requirements set by the state to ensure compliance.

Steps to complete the Maryland Renters Tax Credit

Completing the Maryland Renters Tax Credit application involves several straightforward steps. First, gather necessary documentation, including proof of income and rental payments. Next, fill out the application form accurately, ensuring all information is complete. Once the form is filled, submit it through the preferred method, whether online, by mail, or in person. Finally, keep a copy of the submitted application for your records, as you may need it for future reference.

Required Documents

When applying for the Maryland Renters Tax Credit, several documents are required to support your application. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Rental agreement or lease to verify your residency and rental payments.

- Identification documents, such as a driver's license or state ID.

Having these documents ready will streamline the application process and help ensure that your submission is complete.

Form Submission Methods

Applicants can submit the Maryland Renters Tax Credit application through various methods. The options include:

- Online submission via the Maryland State Department of Assessments and Taxation website.

- Mailing the completed application to the appropriate local assessment office.

- In-person submission at designated local offices for those who prefer face-to-face assistance.

Choosing the method that best suits your needs can help facilitate a smoother application process.

Application Process & Approval Time

The application process for the Maryland Renters Tax Credit involves completing the necessary forms and submitting them along with required documentation. After submission, the processing time can vary, but applicants typically receive notification of their approval status within a few weeks. It is advisable to check the status of your application if you do not receive a response within the expected timeframe, as this can help address any potential issues early on.

Quick guide on how to complete maryland renters tax credit

Prepare Maryland Renters Tax Credit with ease on any device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Maryland Renters Tax Credit on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Maryland Renters Tax Credit effortlessly

- Obtain Maryland Renters Tax Credit and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal significance as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Maryland Renters Tax Credit and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland renters tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the renters tax credit Maryland?

The renters tax credit Maryland is a state program designed to provide financial assistance to eligible renters based on their income and housing costs. This credit helps make housing more affordable for low-income individuals and families. To qualify, you must meet specific income criteria and residency requirements.

-

Who is eligible for the renters tax credit Maryland?

To be eligible for the renters tax credit Maryland, you must have been a Maryland resident for the entire tax year, meet income limits, and be renting a dwelling. The program is primarily aimed at those with low to moderate incomes, ensuring that it targets individuals who need the most assistance. It’s essential to check the latest state guidelines for specific eligibility details.

-

How do I apply for the renters tax credit Maryland?

To apply for the renters tax credit Maryland, you must complete a specific application form known as the DC-1000, which can be obtained online or through local county offices. Along with the application, you may need to provide proof of income and other relevant documentation. Submit your application by the established deadline to be considered for the credit.

-

What is the maximum benefit for the renters tax credit Maryland?

The maximum benefit for the renters tax credit Maryland varies based on your income, rent amount, and household size. Generally, low-income renters can receive a more substantial credit, with the potential for credits signNowing up to hundreds of dollars annually. It’s advisable to calculate your estimated credit using the state’s guidelines.

-

Can I eSign documents related to my renters tax credit Maryland application?

Yes, airSlate SignNow allows you to eSign documents related to your renters tax credit Maryland application securely and efficiently. Using our platform, you can quickly send and sign necessary paperwork without printing or mailing any documents. This feature enhances convenience and speeds up the application process.

-

How does the renters tax credit Maryland benefit low-income families?

The renters tax credit Maryland provides signNow financial relief to low-income families, helping them afford their housing costs. By reducing the burden of rent expenses, families can allocate funds to other essential needs, such as healthcare and education. This tax credit plays a crucial role in promoting housing stability within the community.

-

Are there any changes to the renters tax credit Maryland in 2023?

Changes to the renters tax credit Maryland may happen annually, including adjustments to eligibility criteria, income limits, and credit amounts. It’s important to stay updated by checking the Maryland State Department of Assessments and Taxation website or consulting with local tax professionals. These updates can influence the benefits you may receive.

Get more for Maryland Renters Tax Credit

- Coverage selection partnership connecticut form

- Notice of intention to be included connecticut form

- Office lease agreement connecticut form

- Commercial sublease connecticut form

- Residential lease renewal agreement connecticut form

- Notice to lessor exercising option to purchase connecticut form

- Ct assignment 497301133 form

- Assignment of lease from lessor with notice of assignment connecticut form

Find out other Maryland Renters Tax Credit

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now