Form 540 2ez 2022

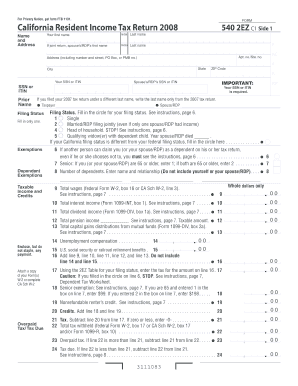

What is the Form 540 2ez

The Form 540 2ez is a simplified California state income tax return designed for individuals with straightforward tax situations. It is specifically tailored for residents who meet certain eligibility criteria, allowing them to file their taxes efficiently. This form is particularly beneficial for those who do not have complex income sources or significant deductions, making it an ideal choice for many taxpayers in California.

How to use the Form 540 2ez

Using the Form 540 2ez involves several key steps. First, gather all necessary financial documents, such as W-2 forms and any relevant income statements. Next, ensure that you meet the eligibility requirements, which typically include income limits and filing status. Once you have confirmed your eligibility, accurately fill out the form, ensuring that all information is complete and correct. Finally, submit the form either electronically or by mail, depending on your preference and compliance with state regulations.

Steps to complete the Form 540 2ez

Completing the Form 540 2ez involves a series of straightforward steps:

- Gather your financial documents, including W-2s and any other income statements.

- Check your eligibility based on income limits and filing status.

- Fill out the personal information section accurately.

- Report your income, including wages and any other taxable income.

- Claim any applicable credits and deductions.

- Review the completed form for accuracy.

- Submit the form electronically or by mailing it to the appropriate address.

Legal use of the Form 540 2ez

The legal use of the Form 540 2ez is governed by California tax laws. When completed correctly, this form serves as a legally binding document for reporting income and calculating tax liability. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or legal issues. Utilizing a reliable eSignature solution can enhance the security and validity of the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540 2ez typically align with federal tax deadlines. Generally, the form must be filed by April 15 of each year, unless that date falls on a weekend or holiday, in which case the deadline may be extended. It is important to stay informed about any changes to deadlines or extensions that may occur, as these can impact your filing obligations.

Required Documents

To successfully complete the Form 540 2ez, you will need several key documents:

- W-2 forms from employers

- 1099 forms for any additional income

- Records of any other income sources

- Documentation for any applicable tax credits or deductions

- Personal identification information, such as Social Security numbers

Quick guide on how to complete form 540 2ez

Easily prepare Form 540 2ez on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 540 2ez on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign Form 540 2ez effortlessly

- Locate Form 540 2ez and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 540 2ez and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 540 2ez

Create this form in 5 minutes!

How to create an eSignature for the form 540 2ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 540 2ez and who should use it?

Form 540 2ez is a simplified tax return for California residents that meets specific eligibility criteria. It is designed for single or joint filers with straightforward income sources, making it ideal for individuals seeking to file their taxes quickly and efficiently.

-

How can airSlate SignNow help with submitting Form 540 2ez?

airSlate SignNow enables users to electronically sign and send Form 540 2ez, streamlining the submission process. By using our platform, you can ensure that your form is securely signed and delivered without the hassle of printing or mailing.

-

What are the pricing options for airSlate SignNow?

Our pricing for airSlate SignNow is competitive and designed to fit various business needs. We offer different plans that cater to individual users, small businesses, and large organizations, ensuring you have the right tools for handling documents like Form 540 2ez.

-

What features does airSlate SignNow provide for handling Form 540 2ez?

With airSlate SignNow, you get features such as template creation, automated workflows, and secure storage that make managing documents like Form 540 2ez easier. Our platform also includes real-time tracking and notifications to keep you updated on the status of your documents.

-

Is it easy to integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integration with various software applications, enhancing your workflow efficiency. Whether you're using CRM systems, cloud storage, or accounting tools, you can easily incorporate our services for managing documents like Form 540 2ez.

-

What are the benefits of using airSlate SignNow for Form 540 2ez?

Using airSlate SignNow for your Form 540 2ez submission provides signNow benefits, including reduced turnaround time and improved accuracy. The platform's robust security features ensure your sensitive information is protected while facilitating faster communication with tax authorities.

-

Can I use airSlate SignNow on mobile devices for Form 540 2ez?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage, sign, and submit your Form 540 2ez on the go. Whether you're at the office or working remotely, you can conveniently access and handle your documents anytime, anywhere.

Get more for Form 540 2ez

- 15h form download

- All eyecare optometry new patient intake form

- Tamu dining form

- 760cg series grid virginia department of taxation tax virginia form

- Dhcs 5082 administrator or director information administrator or director information dhcs ca

- Unit owner information sheet condominium corporation clubcitadelle

- Exercise plan for non commercial kennel dogs form

- Denver health referral form

Find out other Form 540 2ez

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation