Sentinel 403b Program Form

What is the Sentinel 403b Program Form

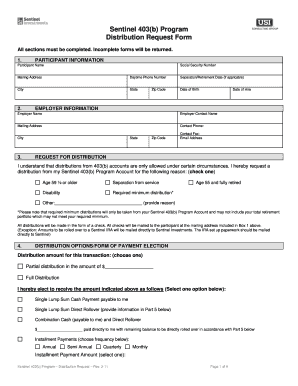

The Sentinel 403b Program Form is a crucial document used by employees of eligible nonprofit organizations and public schools to enroll in a 403(b) retirement plan. This form facilitates the process of setting up contributions to a tax-advantaged retirement account, allowing participants to save for their future while benefiting from potential tax savings. It typically includes personal information, contribution amounts, and investment choices, ensuring that all necessary details are captured for effective plan management.

How to use the Sentinel 403b Program Form

Using the Sentinel 403b Program Form involves a few straightforward steps. First, obtain the form from your employer or the plan administrator. Next, fill in your personal details, including your name, address, and Social Security number. After that, indicate your desired contribution amount and select your investment options. Once completed, review the form for accuracy before submitting it to your employer or plan administrator. This ensures that your enrollment in the retirement plan is processed without delays.

Steps to complete the Sentinel 403b Program Form

Completing the Sentinel 403b Program Form requires attention to detail. Follow these steps:

- Gather necessary information: Collect your personal information, including your Social Security number and employment details.

- Determine contribution amounts: Decide how much you wish to contribute to your 403(b) account.

- Select investment options: Review and choose from the available investment options provided by your plan.

- Review the form: Check all entries for accuracy to avoid any processing issues.

- Submit the form: Send the completed form to your employer or plan administrator for processing.

Legal use of the Sentinel 403b Program Form

The legal use of the Sentinel 403b Program Form is governed by federal regulations and the specific rules of the retirement plan. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with the plan's guidelines. Compliance with the Employee Retirement Income Security Act (ERISA) and other relevant laws is essential for protecting both the participant's rights and the plan's integrity.

Eligibility Criteria

Eligibility for participating in the Sentinel 403b Program typically includes being employed by an eligible organization, such as a nonprofit or public educational institution. Employees must also meet any specific requirements set forth by the plan, which may include minimum service time or age criteria. It is important to review these eligibility criteria to ensure that you qualify for participation in the program.

Form Submission Methods

The Sentinel 403b Program Form can be submitted through various methods, depending on the guidelines established by your employer or plan administrator. Common submission methods include:

- Online submission: Many organizations allow for digital submission via secure portals.

- Mail: You may also send the completed form via postal service to the designated address.

- In-person: Submitting the form directly to your HR department or plan administrator is another option.

Quick guide on how to complete sentinel 403b program form

Complete Sentinel 403b Program Form seamlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Manage Sentinel 403b Program Form on any device using airSlate SignNow’s Android or iOS applications and streamline your document-centric tasks today.

How to modify and eSign Sentinel 403b Program Form effortlessly

- Obtain Sentinel 403b Program Form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tiresome form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Sentinel 403b Program Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sentinel 403b program form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sentinel 403b Program Form?

The Sentinel 403b Program Form is a document used for enrollment or changes in a 403(b) retirement plan. It facilitates the management of your retirement contributions, ensuring your participation in the Sentinel 403b program is smooth and compliant. Understanding this form helps you maximize your retirement savings efficiently.

-

How can I access the Sentinel 403b Program Form?

You can access the Sentinel 403b Program Form directly through the airSlate SignNow platform. Simply log in to your account, navigate to the relevant section, and you will find easy access to the form. This user-friendly experience simplifies the completion and submission process.

-

Is there a fee to use the Sentinel 403b Program Form?

Using the Sentinel 403b Program Form through airSlate SignNow is part of our subscription plan, which is designed to be cost-effective. We offer various pricing tiers that cater to different organizational needs, ensuring you get the best value for your investment in seamless eSigning and document management.

-

What features does the Sentinel 403b Program Form offer?

The Sentinel 403b Program Form includes features like electronic signature capabilities, customizable templates, and secure document storage. These features streamline your enrollment process and provide peace of mind with full compliance and easy management of all your retirement plan documents.

-

Can I integrate the Sentinel 403b Program Form with other software?

Yes, airSlate SignNow allows you to integrate the Sentinel 403b Program Form with other software applications like CRM systems and cloud storage solutions. This integration enhances your workflow by connecting your document signing and management processes with your existing tools.

-

What are the benefits of using the Sentinel 403b Program Form?

Using the Sentinel 403b Program Form streamlines the process of managing retirement contributions, saving time and reducing paperwork. It enhances accuracy by minimizing manual entry errors and ensures that your submissions are tracked and compliant with regulatory standards.

-

How secure is the Sentinel 403b Program Form process?

The Sentinel 403b Program Form is processed with high-level security measures, including encryption and user authentication. airSlate SignNow prioritizes the protection of your personal and financial information, ensuring that all transactions and document exchanges are secure.

Get more for Sentinel 403b Program Form

- 2019 form 1099 a acquisition or abandonment of secured property

- 2019 instructions for forms 1099 int and 1099 oid instructions for forms 1099 int and 1099 oid interest income and original

- 2019 form 1099 oid original issue discount

- 2019 instructions for form 1099 misc irsgov

- Form 2290 rev july 2019 heavy highway vehicle use tax return

- For 2019 you expect a refund of all form

- 2019 form 1099 r distributions from pensions annuitiesretirement or profit sharing plans iras insurance contracts etc

- Volunteer intake form

Find out other Sentinel 403b Program Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors