Form 8880 Credit for Qualified Retirement Savings Contributions 2022

What is the Form 8880 Credit For Qualified Retirement Savings Contributions

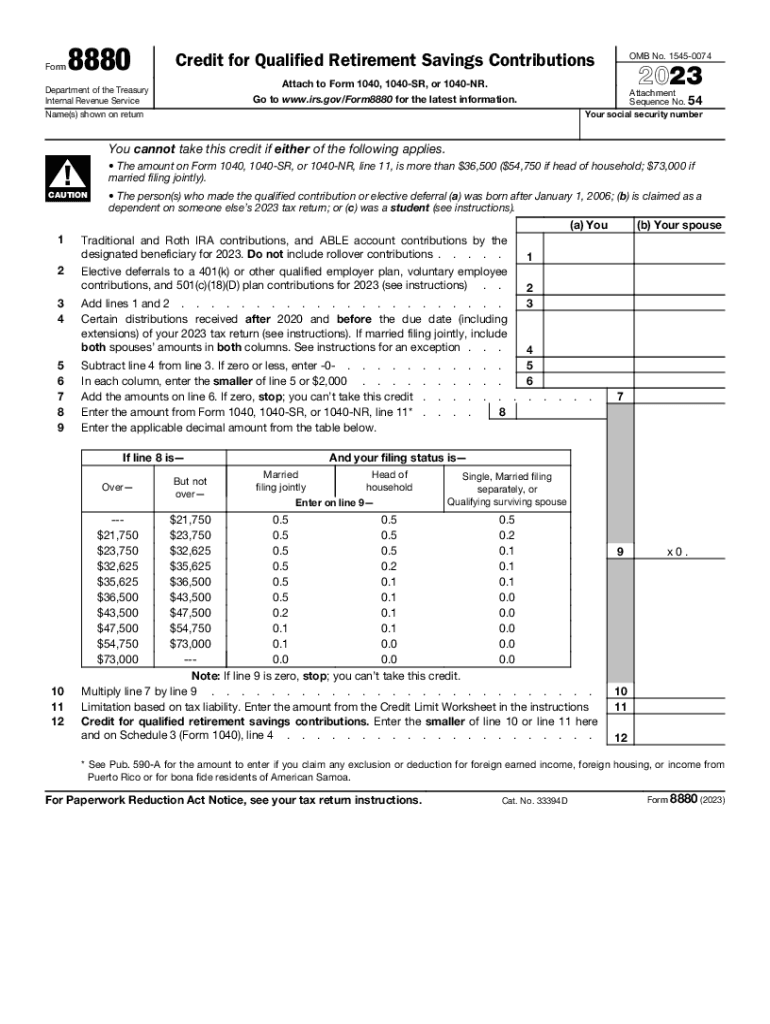

The Form 8880 is a tax form used to claim the Credit for Qualified Retirement Savings Contributions. This credit is designed to incentivize individuals to save for retirement by providing a reduction in their tax liability. Eligible taxpayers can receive a credit based on their contributions to qualified retirement accounts, such as 401(k) plans or IRAs. The amount of the credit depends on the taxpayer's income level and filing status, making it a valuable benefit for those who qualify.

Eligibility Criteria

To qualify for the credit, taxpayers must meet specific criteria. Individuals must be at least eighteen years old, not a full-time student, and cannot be claimed as a dependent on someone else's tax return. Additionally, the credit is available to those with adjusted gross income (AGI) below certain thresholds, which vary based on filing status. For example, single filers must have an AGI below a specified limit to qualify for the maximum credit amount.

Steps to complete the Form 8880 Credit For Qualified Retirement Savings Contributions

Completing Form 8880 involves several key steps. First, gather your financial documents, including proof of retirement contributions made during the tax year. Next, fill out the form by providing your personal information and income details. Ensure you calculate your credit amount accurately based on your contributions and AGI. Finally, attach the completed form to your tax return when filing, whether electronically or by mail, to claim your credit.

Required Documents

When preparing to fill out Form 8880, certain documents are necessary. Taxpayers should have records of their retirement contributions, such as W-2 forms, 1099 forms, or account statements from retirement plans. Additionally, documentation verifying your income, such as pay stubs or tax returns, is essential to determine eligibility for the credit. Keeping these documents organized will streamline the filing process.

Filing Deadlines / Important Dates

Taxpayers must be aware of the deadlines associated with filing Form 8880. The form should be submitted along with your annual tax return, which is typically due on April fifteenth. If you require additional time to file, you may request an extension, but any owed taxes must still be paid by the original deadline to avoid penalties. Staying informed about these dates is crucial for successful tax filing.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 8880. Taxpayers should refer to the official IRS instructions for detailed information on eligibility, calculation of the credit, and any recent changes to the tax code that may affect the credit. Following these guidelines ensures compliance and maximizes the potential benefits of the credit for qualified retirement savings contributions.

Quick guide on how to complete form 8880 credit for qualified retirement savings contributions

Complete Form 8880 Credit For Qualified Retirement Savings Contributions effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a perfect environmentally friendly option to conventional printed and signed documents, as you can find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle Form 8880 Credit For Qualified Retirement Savings Contributions on any device using airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

The easiest method to alter and electronically sign Form 8880 Credit For Qualified Retirement Savings Contributions without breaking a sweat

- Obtain Form 8880 Credit For Qualified Retirement Savings Contributions and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device of your choosing. Modify and eSign Form 8880 Credit For Qualified Retirement Savings Contributions and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8880 credit for qualified retirement savings contributions

Create this form in 5 minutes!

How to create an eSignature for the form 8880 credit for qualified retirement savings contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8880 Credit For Qualified Retirement Savings Contributions?

The Form 8880 Credit For Qualified Retirement Savings Contributions is a tax form that individuals can use to claim a credit for contributing to retirement savings accounts. This credit is designed to encourage low to moderate-income taxpayers to save for retirement. By filling out this form, you may be eligible to reduce your tax liability, making retirement saving more affordable.

-

How can airSlate SignNow assist with Form 8880 filings?

airSlate SignNow streamlines the document signing process, making it easy to eSign and send your Form 8880 Credit For Qualified Retirement Savings Contributions. With our user-friendly interface, you can prepare and finalize your form quickly, ensuring that you meet all necessary deadlines for filing. This efficiency saves you time and helps to avoid errors, which is crucial for tax implications.

-

Are there any costs associated with using airSlate SignNow for signing tax forms like Form 8880?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning documents, there are subscription plans that vary depending on the features you need. These plans can help you save money on printing and mailing costs associated with traditional document handling. By using airSlate SignNow, you can sign your Form 8880 Credit For Qualified Retirement Savings Contributions efficiently and affordably.

-

What features does airSlate SignNow provide for signing Form 8880?

airSlate SignNow offers a range of features that facilitate the signing of the Form 8880 Credit For Qualified Retirement Savings Contributions, including templates for quick access, in-app signing, and secure storage. These features ensure that all your documents are easily accessible and securely signed, meeting all regulatory requirements. Our platform also allows for real-time tracking of document status.

-

Can I integrate airSlate SignNow with other tax software for Form 8880 submissions?

Absolutely! airSlate SignNow integrates with various tax preparation software that can assist in the completion and review of your Form 8880 Credit For Qualified Retirement Savings Contributions. This integration ensures that your documents are synchronized across platforms, streamlining your workflow and improving efficiency. It allows for a seamless experience when managing your tax forms.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for signing documents like the Form 8880 Credit For Qualified Retirement Savings Contributions provides numerous benefits, including enhanced security, time savings, and ease of use. Our platform complies with industry standards to keep your data safe, while electronic signatures can signNowly speed up the signing process. Additionally, your documents can be accessible from any device, anywhere.

-

Is airSlate SignNow compliant with IRS requirements for tax forms like Form 8880?

Yes, airSlate SignNow is fully compliant with IRS requirements for electronic signatures, including those needed for the Form 8880 Credit For Qualified Retirement Savings Contributions. This compliance ensures that your digitally signed documents are valid and recognized by the IRS, eliminating any concerns about the acceptance of your submissions. Trust airSlate SignNow to handle your confidential paperwork securely.

Get more for Form 8880 Credit For Qualified Retirement Savings Contributions

- Hanuman vadvanal stotra pdf form

- Spark 3 workbook answers form

- Caremore authorization form

- Soccer academy registration form

- Zimsec a level geography notes pdf download form

- Bir form 2303 pdf

- Application for building permit mamaroneck townofmamaroneck form

- Cancelling u 39 revised revised cal p u c sheet form

Find out other Form 8880 Credit For Qualified Retirement Savings Contributions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors