Form 3520 2023-2026

What is the Form 3520

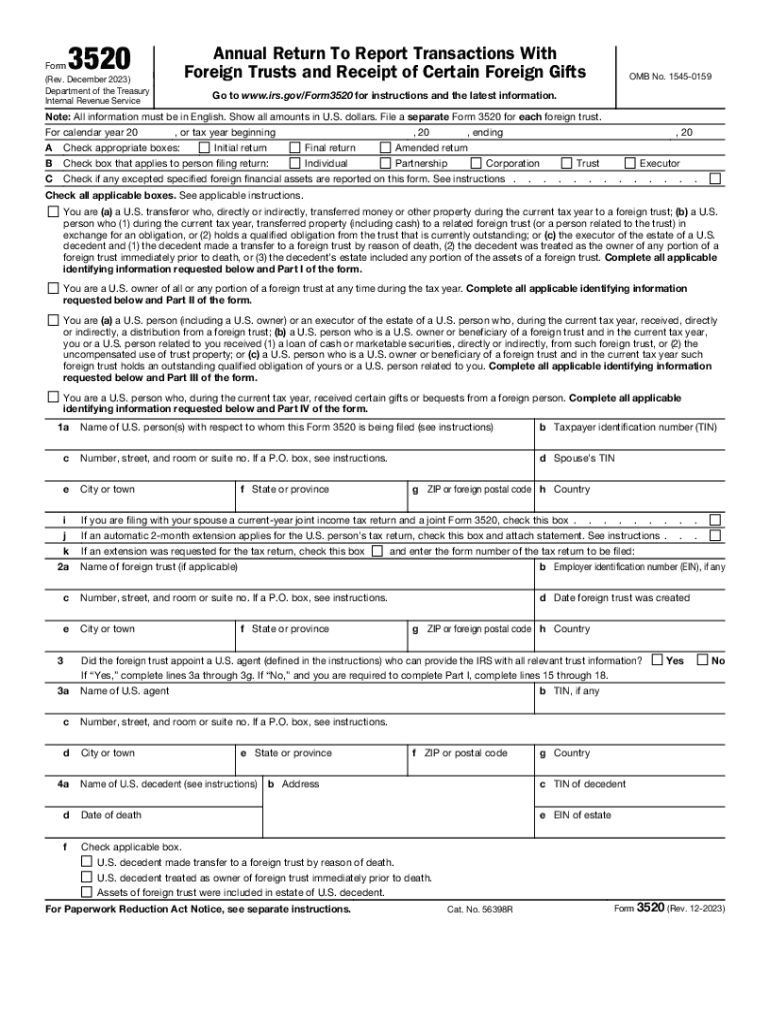

The Form 3520 is an important tax document used by U.S. taxpayers to report certain transactions with foreign trusts, as well as the receipt of foreign gifts or inheritances. Specifically, it is required when a U.S. person receives more than one hundred thousand dollars from a foreign individual or entity, or if they have an interest in a foreign trust. The form helps the IRS monitor compliance with tax obligations related to foreign assets and gifts.

How to use the Form 3520

To use the Form 3520, taxpayers must first determine if they are required to file based on their financial transactions involving foreign trusts or gifts. If required, they should complete the form accurately, providing detailed information about the foreign trust or gift received. It is essential to include all necessary information to avoid penalties. The completed form must be submitted alongside the taxpayer's annual income tax return.

Steps to complete the Form 3520

Completing the Form 3520 involves several steps:

- Gather all relevant information about the foreign trust or gift, including the name, address, and identification details of the foreign party.

- Fill out the form by providing details about the amount received, the nature of the transaction, and any other required information.

- Review the completed form for accuracy and completeness.

- File the form by attaching it to your income tax return or submitting it separately if necessary.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 3520. Taxpayers must adhere to the reporting requirements to avoid penalties. These guidelines include instructions on who must file, the types of transactions that require reporting, and the deadlines for submission. It is crucial to stay updated on any changes to these guidelines to ensure compliance.

Filing Deadlines / Important Dates

The filing deadline for Form 3520 aligns with the taxpayer's annual income tax return, typically due on April fifteenth. However, if an extension is filed for the income tax return, the deadline for Form 3520 is also extended. It is important to note that failure to file on time can result in significant penalties, so timely submission is essential.

Penalties for Non-Compliance

Failure to file Form 3520 when required can lead to substantial penalties. The IRS imposes fines that can reach up to ten thousand dollars for each failure to report a foreign gift or trust. Additionally, if the failure to file is deemed willful, the penalties can be even more severe. Understanding these consequences underscores the importance of compliance with IRS regulations regarding foreign transactions.

Quick guide on how to complete form 3520 702386909

Prepare Form 3520 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly option to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents swiftly without any delays. Handle Form 3520 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form 3520 with ease

- Find Form 3520 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 3520 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3520 702386909

Create this form in 5 minutes!

How to create an eSignature for the form 3520 702386909

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3520 and why is it important?

Form 3520 is an IRS document required for reporting certain transactions with foreign trusts and foreign gifts. Filing this form is essential to ensure compliance with U.S. tax laws and avoid potential penalties. Understanding form 3520 can help you manage your financial reporting effectively.

-

How can airSlate SignNow help me with form 3520?

With airSlate SignNow, you can easily eSign and send your form 3520 securely from anywhere. Our platform simplifies the process, allowing you to focus on completing your documentation rather than worrying about the logistics of sending and signing. Leverage our user-friendly solution to handle your form 3520 with confidence.

-

Is there a cost associated with using airSlate SignNow for form 3520?

Yes, airSlate SignNow offers various pricing plans tailored to your needs, including options for individual users and businesses. By investing in our affordable solutions, you ensure that your form 3520 is handled efficiently and securely, ultimately saving time and reducing frustration.

-

What features does airSlate SignNow provide for handling form 3520?

airSlate SignNow includes features such as eSignature capabilities, document templates, and real-time collaboration for managing form 3520. These tools make it easy to gather signatures and provide a streamlined way to ensure all necessary documentation is completed correctly. Enhance your workflow with our robust feature set.

-

Can I integrate airSlate SignNow with other software for form 3520 processing?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and Microsoft Office. This interoperability ensures that you can efficiently manage all aspects of your form 3520 while working within your preferred software ecosystem. Simplify your operations with these powerful integrations.

-

What benefits does airSlate SignNow offer for businesses submitting form 3520?

Using airSlate SignNow for submitting form 3520 provides numerous benefits, including increased efficiency, enhanced security, and reduced turnaround times. Our platform ensures your sensitive documents are protected while allowing easy access for authorized personnel. Streamline your document processes and improve compliance with our solution.

-

Is airSlate SignNow user-friendly for completing form 3520?

Absolutely! airSlate SignNow is designed with user experience in mind, making the process of completing form 3520 straightforward for everyone. Our intuitive interface allows users to navigate seamlessly, ensuring they can send, sign, and finalize documents without technical issues. Experience effortless document management with airSlate SignNow.

Get more for Form 3520

Find out other Form 3520

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple