Form 3520 2010

What is the Form 3520

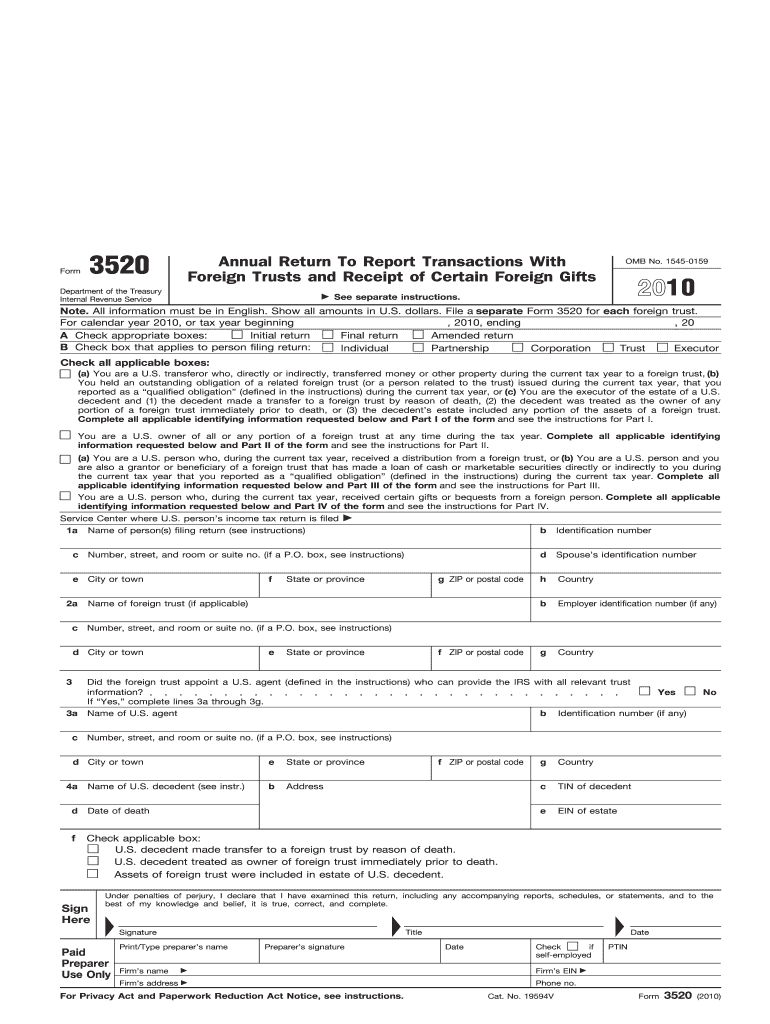

The Form 3520, officially known as the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, is a tax form required by the Internal Revenue Service (IRS) for U.S. taxpayers. This form is primarily used to report transactions with foreign trusts, as well as to disclose certain foreign gifts. It is crucial for maintaining compliance with U.S. tax laws, especially for individuals who have foreign financial interests or receive significant gifts from abroad.

How to use the Form 3520

To effectively use the Form 3520, taxpayers must first determine if they are required to file it based on their financial activities. If you have received a gift from a foreign person exceeding a specified amount or have engaged in transactions with a foreign trust, you will need to complete this form. The form consists of various sections that require detailed information about the foreign trust or gift, including the identity of the foreign person and the nature of the transaction. Accurate completion is essential to avoid penalties.

Steps to complete the Form 3520

Completing the Form 3520 involves several steps:

- Gather necessary documentation, including details about the foreign trust or gift.

- Fill out the identifying information section, including your name, address, and taxpayer identification number.

- Provide information about the foreign trust or the foreign gift, detailing the amount and nature of the transaction.

- Review the form for accuracy and completeness before submission.

Once completed, the form must be submitted to the IRS by the designated deadline, typically aligned with your annual tax return.

Filing Deadlines / Important Dates

The deadline for filing the Form 3520 is generally the same as the due date for your income tax return, including extensions. For most taxpayers, this means April 15. If you require an extension, you can file Form 4868 to extend your income tax return, which also extends the filing deadline for Form 3520. However, it is important to note that extensions do not apply to any taxes owed, which must be paid by the original due date to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form 3520 when required can result in significant penalties. The IRS imposes a penalty of five percent of the amount of the foreign gift or trust assets for each month the form is late, up to a maximum of twenty-five percent. Additional penalties may apply for inaccurate information or failure to report foreign financial interests. It is advisable to consult a tax professional if you are unsure about your filing requirements to avoid these penalties.

Digital vs. Paper Version

Taxpayers have the option to file the Form 3520 either electronically or via paper submission. The digital version allows for easier completion and submission, as well as instant confirmation of receipt by the IRS. However, not all taxpayers may be eligible to file electronically. For those who prefer or need to submit a paper form, ensure that it is mailed to the correct address as specified by the IRS to avoid delays in processing.

Quick guide on how to complete 2010 form 3520

Easily Prepare Form 3520 on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 3520 on any device with the airSlate SignNow applications for Android or iOS, and simplify any document-related process today.

How to Modify and eSign Form 3520 Effortlessly

- Obtain Form 3520 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate issuing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and eSign Form 3520 while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 3520

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 3520

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is Form 3520 and who needs to file it?

Form 3520 is an IRS form that reports certain transactions with foreign trusts and the receipt of certain foreign gifts. Generally, U.S. persons who receive gifts from foreign persons exceeding $100,000 or who have transactions with foreign trusts must file Form 3520. Understanding this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with Form 3520 processing?

airSlate SignNow streamlines the process of signing and sending Form 3520 by providing an intuitive platform for eSigning documents. Users can easily upload, send, and receive signed forms without dealing with paper clutter. This ensures compliance and efficiency in managing critical financial documents.

-

What are the pricing plans available for airSlate SignNow users?

airSlate SignNow offers flexible pricing plans tailored to different needs, including individual, business, and enterprise options. Each plan provides access to essential features for managing forms like Form 3520 efficiently. Users can choose a plan that fits their budget and document management requirements.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various popular applications, enhancing its functionality for users. You can connect it with tools for accounting, document management, and customer relationship management to simplify the filing and signing of Form 3520. These integrations make it easier to handle workflows and data.

-

Is it safe to use airSlate SignNow for sensitive documents like Form 3520?

Absolutely, airSlate SignNow prioritizes security and complies with industry standards to ensure that your documents, including Form 3520, are safely handled. The platform uses encryption and secure data storage to protect your confidential information. You can eSign and share documents with confidence.

-

Can I track the status of my Form 3520 submissions with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all sent documents, including Form 3520. Users can easily monitor the signing status and receive notifications when documents are viewed or signed. This feature helps ensure that important deadlines are met.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a variety of features including customizable templates, document routing, and in-app commenting. These tools are particularly useful for managing documents like Form 3520, allowing users to streamline workflows and collaborate effectively. This makes the documentation process faster and more organized.

Get more for Form 3520

- Ca 12 2019 pdf remplissable form

- Asnt level 3 application form 2018

- Profit participation agreement template innet form

- Equipment request form coleysolutionscom

- Coe dat participant application form 2018 nato

- Benevolence form new covenant ministries cogic ncmcogic

- Dte planning and design form

- Contrato de servicio movistar en casa tarifa plana zonal form

Find out other Form 3520

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online