Form 3520 2017

What is the Form 3520

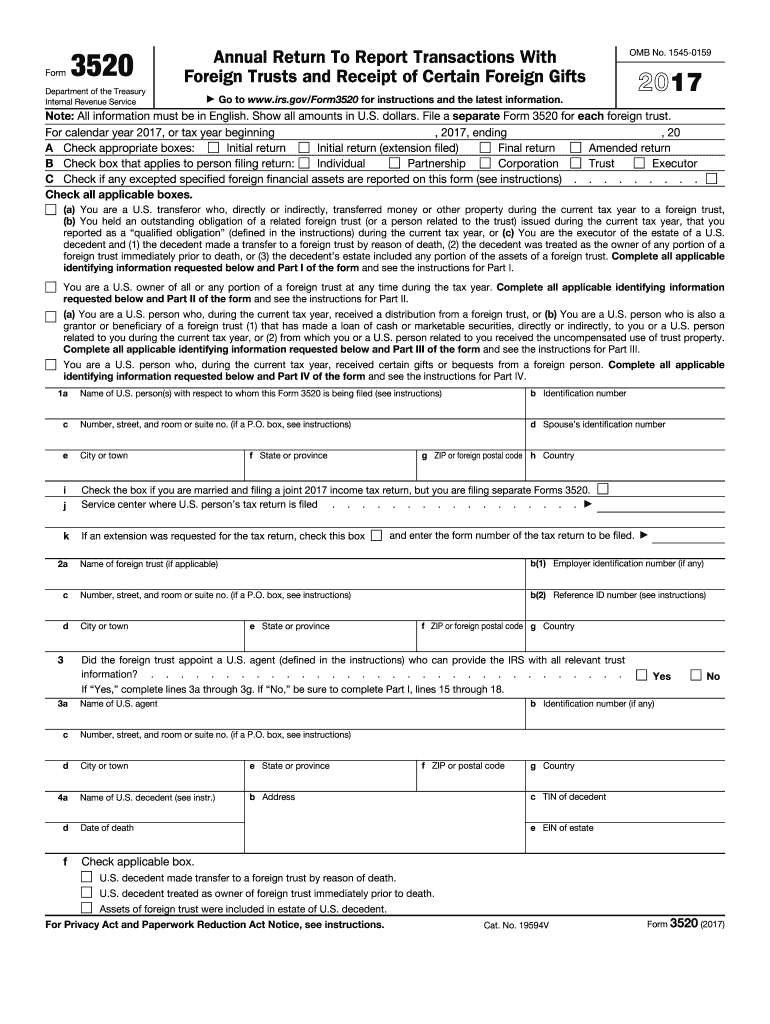

The Form 3520 is an informational return required by the Internal Revenue Service (IRS) for U.S. taxpayers who receive certain foreign gifts or inheritances, or who have transactions with foreign trusts. This form is essential for reporting these financial activities to ensure compliance with U.S. tax laws. Failure to file Form 3520 when required can lead to significant penalties.

How to use the Form 3520

To use the Form 3520 effectively, taxpayers must first determine if they are required to file it based on their financial activities involving foreign entities. The form requires detailed information about the source of the foreign gifts or inheritances, as well as any foreign trusts involved. It is crucial to provide accurate and complete information to avoid complications with the IRS.

Steps to complete the Form 3520

Completing the Form 3520 involves several key steps:

- Gather all necessary documentation related to foreign gifts, inheritances, or trusts.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Attach any additional forms or schedules as required by the IRS.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

The deadline for filing Form 3520 is typically the same as the tax return due date, which is April 15 for most taxpayers. However, if you are filing for an extension, the deadline may be extended to October 15. It is important to keep track of these dates to avoid penalties for late filing.

Penalties for Non-Compliance

Failing to file Form 3520 when required can result in substantial penalties. The IRS may impose fines that can reach up to $10,000 or more, depending on the circumstances. Additionally, if the failure to file is deemed willful, the penalties can be even more severe. Understanding the importance of timely and accurate filing is essential for avoiding these consequences.

Form Submission Methods (Online / Mail / In-Person)

Form 3520 can be submitted to the IRS in several ways. Taxpayers can file the form by mailing it to the appropriate address provided by the IRS. Currently, electronic filing options for Form 3520 are limited, so many taxpayers choose to submit it by mail. It is advisable to use a secure method, such as certified mail, to ensure the form is received by the IRS.

Quick guide on how to complete form 3520 2017

Uncover the most efficient method to complete and sign your Form 3520

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior way to complete and sign your Form 3520 and similar forms for public services. Our advanced eSignature solution equips you with everything required to work on documents swiftly and in accordance with official standards - comprehensive PDF editing, managing, protecting, signing, and sharing tools all accessible within an easy-to-use interface.

Only a few steps are needed to finalize and endorse your Form 3520:

- Upload the editable template to the editor using the Get Form key.

- Verify what information you need to enter in your Form 3520.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the blanks with your details.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what truly matters or Obscure parts that are no longer relevant.

- Click on Sign to create a legally accepted eSignature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Form 3520 in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also provides versatile form sharing options. There’s no need to print your forms when submitting them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 3520 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the form 3520 2017

How to create an electronic signature for your Form 3520 2017 in the online mode

How to make an eSignature for your Form 3520 2017 in Chrome

How to create an eSignature for putting it on the Form 3520 2017 in Gmail

How to create an electronic signature for the Form 3520 2017 right from your smartphone

How to generate an eSignature for the Form 3520 2017 on iOS

How to create an electronic signature for the Form 3520 2017 on Android

People also ask

-

What is Form 3520 and why is it important?

Form 3520 is an IRS form used to report transactions with foreign trusts and the receipt of certain foreign gifts. It is essential for U.S. taxpayers to file this form to avoid penalties and ensure compliance with tax regulations when dealing with foreign financial interests.

-

How can airSlate SignNow help with managing Form 3520?

airSlate SignNow provides a user-friendly platform to easily prepare and eSign Form 3520. Our digital tools simplify the gathering of required signatures and the document can be securely stored and shared, ensuring compliance and organization in your tax reporting process.

-

Is there a cost associated with using airSlate SignNow for Form 3520?

airSlate SignNow offers affordable pricing plans that suit various business needs. With a subscription, users can access robust features tailored for processing documents like Form 3520, making it a cost-effective solution for eSigning and document management.

-

Are there templates available for Form 3520 in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates that can streamline the completion of Form 3520. This feature saves time and reduces errors, ensuring that all necessary information is included before submission to the IRS.

-

Can I integrate airSlate SignNow with my current software for Form 3520 processing?

Absolutely! airSlate SignNow offers seamless integrations with popular apps and platforms to enhance your workflow. This allows you to easily handle Form 3520 alongside your existing business tools, ensuring efficiency and convenience.

-

What features does airSlate SignNow offer to simplify the Form 3520 process?

airSlate SignNow includes features such as secure cloud storage, advanced eSigning, and collaboration tools that streamline the Form 3520 process. These functionalities help businesses manage their documents effectively while maintaining compliance with IRS regulations.

-

Is customer support available for questions related to Form 3520 on airSlate SignNow?

Yes, airSlate SignNow provides excellent customer support for all inquiries, including assistance with Form 3520. Our support team is available to help users navigate the platform and ensure they can efficiently complete and manage their documents.

Get more for Form 3520

Find out other Form 3520

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online