for Calendar Year , or Tax Year Beginning 2020

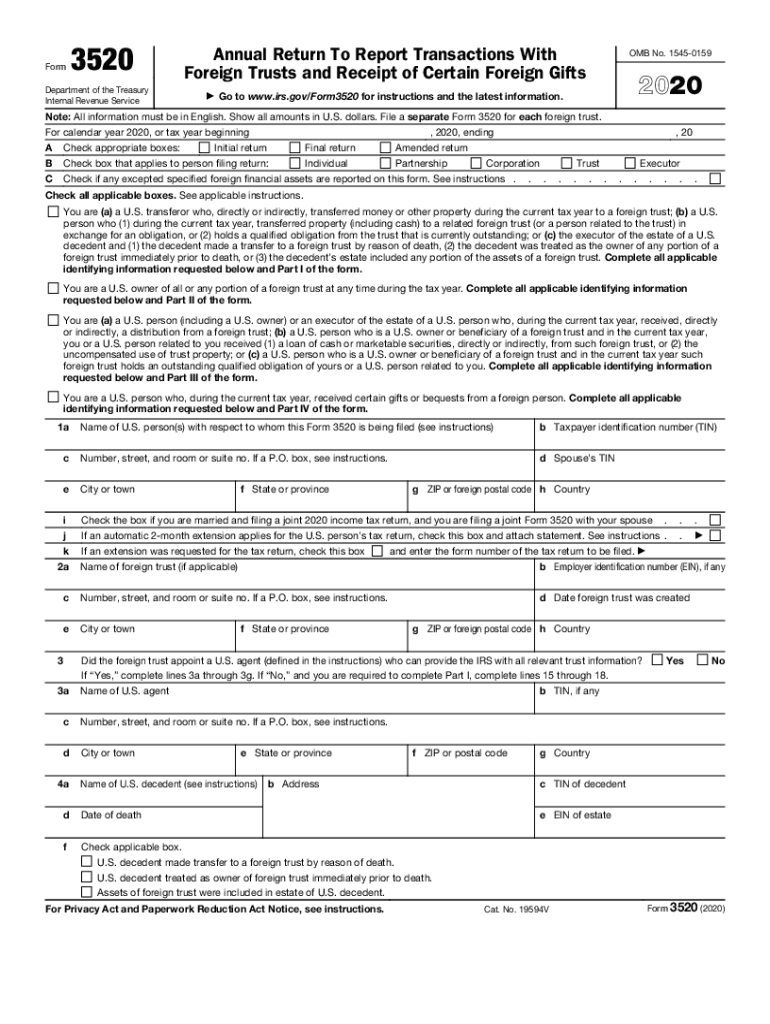

What is the Form No 3520?

The Form No 3520, officially known as the IRS Form 3520, is a crucial document for U.S. taxpayers who receive certain foreign gifts or inheritances. It is designed to report transactions with foreign trusts and the receipt of foreign gifts over a specified threshold. Understanding this form is essential for compliance with U.S. tax laws and avoiding potential penalties.

How to Complete the Form No 3520

Completing the Form No 3520 involves several steps. First, gather all necessary information regarding the foreign gift or inheritance, including the amount, the relationship with the donor, and any relevant trust details. Next, accurately fill out the form, ensuring that all sections are completed as required. Pay special attention to the reporting thresholds and any specific instructions provided by the IRS for the tax year in question. Once completed, review the form for accuracy before submission.

Filing Deadlines for Form No 3520

The Form No 3520 must be filed by the due date of your income tax return, including extensions. For most taxpayers, this is typically April 15 of the following year. However, if you are unable to meet this deadline, it is crucial to file for an extension to avoid penalties. Keep in mind that the IRS does not automatically grant extensions for this form, so proactive measures are necessary.

Penalties for Non-Compliance with Form No 3520

Failure to file the Form No 3520 can result in significant penalties. The IRS imposes a penalty of five percent of the amount of the foreign gift or inheritance for each month the form is late, up to a maximum of twenty-five percent. Additionally, if the form is not filed at all, the penalties can escalate, leading to further legal complications. Therefore, timely and accurate submission is essential.

IRS Guidelines for Form No 3520

The IRS provides detailed guidelines for completing and submitting the Form No 3520. It is important to refer to the latest IRS instructions for the specific tax year you are filing for, as requirements may change. These guidelines cover everything from eligibility criteria to the types of foreign gifts that need to be reported, ensuring that taxpayers have a clear understanding of their obligations.

Form Submission Methods for Form No 3520

Taxpayers can submit the Form No 3520 through various methods. The form can be filed electronically using approved e-filing software or submitted via mail. When mailing the form, it is advisable to send it via certified mail to ensure delivery and maintain a record of submission. In-person submission is generally not available for this form, making electronic and mail options the primary methods for filing.

Quick guide on how to complete for calendar year 2020 or tax year beginning

Complete For Calendar Year , Or Tax Year Beginning effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct format and safely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents quickly and without issues. Manage For Calendar Year , Or Tax Year Beginning on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign For Calendar Year , Or Tax Year Beginning with ease

- Find For Calendar Year , Or Tax Year Beginning and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign For Calendar Year , Or Tax Year Beginning and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year 2020 or tax year beginning

Create this form in 5 minutes!

How to create an eSignature for the for calendar year 2020 or tax year beginning

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is Form No 3520 to IRS and why is it important?

Form No 3520 to IRS is a tax form used to report certain transactions with foreign trusts and the receipt of certain foreign gifts. It is crucial for ensuring compliance with U.S. tax laws. Filing this form helps avoid potential penalties and ensures proper reporting of international financial activities.

-

How can airSlate SignNow assist in submitting Form No 3520 to IRS?

AirSlate SignNow offers a streamlined platform that allows users to prepare, sign, and send Form No 3520 to IRS efficiently. With its user-friendly interface, businesses can easily manage their document workflows and ensure timely submissions. The solution also provides secure e-signature capabilities to enhance the submission process.

-

Is there a cost associated with using airSlate SignNow for Form No 3520 to IRS?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan includes features that facilitate the preparation and e-signing of Form No 3520 to IRS. You can choose a plan that fits your budget while ensuring you have access to all essential tools.

-

What features does airSlate SignNow provide for handling Form No 3520 to IRS?

AirSlate SignNow provides a range of features such as customizable templates, secure document storage, and electronic signatures designed for the efficient handling of Form No 3520 to IRS. These tools help simplify the filing process while ensuring compliance with IRS regulations. Additionally, it offers workflow automation to save time and reduce errors.

-

Can airSlate SignNow integrate with other software for filing Form No 3520 to IRS?

Yes, airSlate SignNow integrates seamlessly with several other software solutions, which can be valuable when preparing to file Form No 3520 to IRS. These integrations enhance productivity by allowing users to connect data from various platforms. This subsequently streamlines documentation and filing processes.

-

What are the benefits of using airSlate SignNow for IRS form submissions?

Using airSlate SignNow for IRS form submissions, including Form No 3520 to IRS, offers several benefits such as increased efficiency, reduced paperwork, and better organization of documents. By leveraging electronic signatures, businesses can expedite their filing processes, ensuring they meet IRS deadlines without hassle. Moreover, the platform's security features protect sensitive financial information.

-

How secure is the process of sending Form No 3520 to IRS through airSlate SignNow?

AirSlate SignNow takes security seriously, employing industry-standard encryption and secure data storage to protect your information while submitting Form No 3520 to IRS. This ensures that all documents and signatures remain confidential and secure during the submission process. Users can be confident in the platform's commitment to safeguarding sensitive data.

Get more for For Calendar Year , Or Tax Year Beginning

- Employment interview package wyoming form

- Employment employee personnel file package wyoming form

- Assignment of mortgage package wyoming form

- Assignment of lease package wyoming form

- Wyoming purchase form

- Satisfaction cancellation or release of mortgage package wyoming form

- Premarital agreements package wyoming form

- Painting contractor package wyoming form

Find out other For Calendar Year , Or Tax Year Beginning

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word