Gifts from Foreign PersonInternal Revenue Service IRS Gov 2012

What is the Gifts From Foreign PersonInternal Revenue Service IRS gov

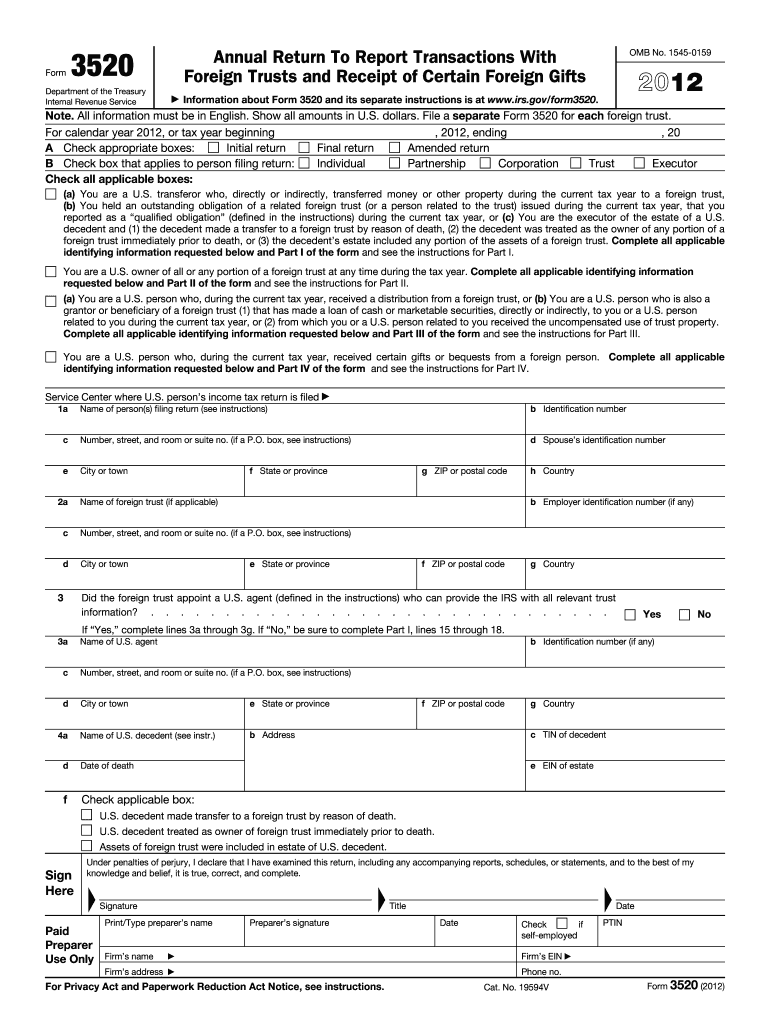

The Gifts From Foreign Person form, as outlined by the Internal Revenue Service (IRS), is a crucial document for U.S. taxpayers who receive gifts from foreign individuals. This form is essential for reporting any gifts exceeding a certain threshold, which is determined annually by the IRS. Understanding this form is vital for compliance with U.S. tax laws, as it helps ensure that taxpayers accurately report foreign gifts and avoid potential penalties.

Steps to complete the Gifts From Foreign PersonInternal Revenue Service IRS gov

Completing the Gifts From Foreign Person form involves several key steps. First, gather all necessary information regarding the gift, including the name and address of the donor, the value of the gift, and the date it was received. Next, fill out the form accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submission. Finally, submit the form to the IRS by the appropriate deadline to ensure compliance with tax regulations.

Legal use of the Gifts From Foreign PersonInternal Revenue Service IRS gov

The legal use of the Gifts From Foreign Person form is critical for U.S. taxpayers to properly report foreign gifts. According to IRS regulations, failing to report such gifts can lead to significant penalties. The form serves as a legal declaration of the gift and provides transparency in financial dealings. It is essential to ensure that the form is filled out in accordance with IRS guidelines to maintain compliance and avoid legal repercussions.

IRS Guidelines

The IRS provides specific guidelines regarding the Gifts From Foreign Person form, including the reporting thresholds and required information. Taxpayers must be aware of the annual exclusion amount, which determines whether a gift must be reported. The IRS also outlines the process for determining the fair market value of the gift, which is crucial for accurate reporting. Adhering to these guidelines helps taxpayers fulfill their obligations and minimizes the risk of errors.

Filing Deadlines / Important Dates

Filing deadlines for the Gifts From Foreign Person form are typically aligned with the annual tax return deadlines. It is important for taxpayers to be aware of these dates to ensure timely submission. Missing the deadline can result in penalties and interest on any unpaid taxes. Taxpayers should mark their calendars for the specific dates set by the IRS each year to avoid complications.

Required Documents

To complete the Gifts From Foreign Person form, taxpayers must gather several required documents. This includes documentation of the gift’s value, such as appraisals or receipts, as well as any correspondence with the donor. Additionally, taxpayers may need to provide identification information for both themselves and the donor. Having these documents ready will facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to comply with the reporting requirements for the Gifts From Foreign Person form can lead to severe penalties. The IRS imposes fines for not reporting gifts that exceed the threshold amount, which can accumulate over time. Additionally, taxpayers may face increased scrutiny during audits if they fail to disclose foreign gifts. Understanding these potential penalties underscores the importance of accurate and timely reporting.

Quick guide on how to complete gifts from foreign personinternal revenue service irsgov

Prepare Gifts From Foreign PersonInternal Revenue Service IRS gov seamlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Gifts From Foreign PersonInternal Revenue Service IRS gov on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to alter and eSign Gifts From Foreign PersonInternal Revenue Service IRS gov effortlessly

- Find Gifts From Foreign PersonInternal Revenue Service IRS gov and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Gifts From Foreign PersonInternal Revenue Service IRS gov to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gifts from foreign personinternal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the gifts from foreign personinternal revenue service irsgov

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What are the tax implications of receiving Gifts From Foreign PersonInternal Revenue Service IRS gov?

Receiving gifts from a foreign person can have specific tax implications under the Gifts From Foreign PersonInternal Revenue Service IRS gov guidelines. It is essential to report such gifts to avoid potential penalties. Consult a tax professional to understand how these gifts may affect your tax obligations.

-

How does airSlate SignNow help with eSigning documents related to Gifts From Foreign PersonInternal Revenue Service IRS gov?

airSlate SignNow simplifies the process of eSigning documents related to Gifts From Foreign PersonInternal Revenue Service IRS gov. With an intuitive interface, you can easily create, send, and sign documents digitally, ensuring compliance with IRS requirements without the hassle of paper-based processes.

-

Are there any fees associated with using airSlate SignNow for Gifts From Foreign PersonInternal Revenue Service IRS gov documentation?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there are minimal fees associated with using the service, the efficiency and compliance provided for managing documents linked to Gifts From Foreign PersonInternal Revenue Service IRS gov often outweigh these costs. Check our pricing page for more details.

-

What features does airSlate SignNow offer to manage Gifts From Foreign PersonInternal Revenue Service IRS gov declarations?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for documents related to Gifts From Foreign PersonInternal Revenue Service IRS gov. These features ensure you can manage declarations efficiently and maintain clear records for IRS compliance.

-

Can I integrate airSlate SignNow with other tools for managing Gifts From Foreign PersonInternal Revenue Service IRS gov processes?

Absolutely! airSlate SignNow offers seamless integrations with various platforms such as CRM systems and payment processing tools. This helps create a cohesive workflow for managing Gifts From Foreign PersonInternal Revenue Service IRS gov documents and tasks efficiently.

-

What benefits does airSlate SignNow provide for businesses dealing with Gifts From Foreign PersonInternal Revenue Service IRS gov requirements?

By using airSlate SignNow, businesses can streamline the process of documentation and ensure compliance with Gifts From Foreign PersonInternal Revenue Service IRS gov requirements. The ability to quickly eSign and securely store documents reduces both time and risks associated with errors and IRS penalties.

-

Is there a mobile application for airSlate SignNow for managing Gifts From Foreign PersonInternal Revenue Service IRS gov documentation?

Yes, airSlate SignNow has a mobile application that allows you to manage Gifts From Foreign PersonInternal Revenue Service IRS gov documentation on the go. This mobile accessibility ensures you can eSign, send, and track documents from anywhere, enhancing your productivity and flexibility.

Get more for Gifts From Foreign PersonInternal Revenue Service IRS gov

- 2010 i1120s form

- 2010 instruction 1098 e amp t internal revenue service irs form

- 2010 8888 form

- Form8404 2010

- Join instruction form five 2010

- Form 1120 w estimated tax for corporations for calendar year 2010 or tax year beginning 2010 and ending 20 omb no

- How to fill sbrdtd 1235 yearmis 2010 form

- 2010 form 1120 l us life insurance company income tax return

Find out other Gifts From Foreign PersonInternal Revenue Service IRS gov

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online