Form 3520 2014

What is the Form 3520

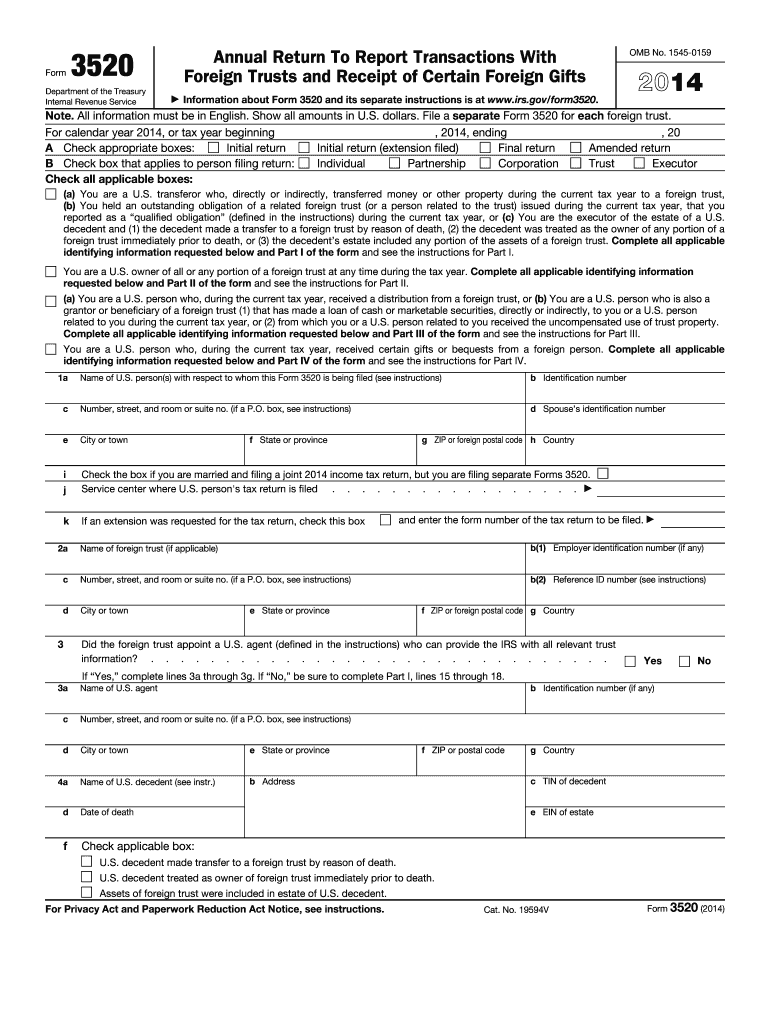

The Form 3520 is a United States Internal Revenue Service (IRS) form used to report certain transactions with foreign trusts, as well as the receipt of foreign gifts. It is essential for U.S. taxpayers who have foreign trusts or receive gifts from foreign individuals or entities exceeding specific thresholds. The form helps the IRS track foreign assets and ensure compliance with U.S. tax laws. Failure to file this form when required can result in significant penalties.

How to use the Form 3520

To effectively use the Form 3520, taxpayers must first determine if they meet the filing requirements. This involves assessing whether they have received gifts from foreign sources or have engaged in transactions with foreign trusts. Once the need to file is established, the taxpayer should accurately complete the form, providing detailed information about the transactions or gifts. Proper documentation and accompanying statements may be required to support the information reported on the form.

Steps to complete the Form 3520

Completing the Form 3520 involves several key steps:

- Gather necessary information, including details about the foreign trust or the foreign gifts received.

- Fill out the form accurately, ensuring all sections are completed as required by the IRS.

- Attach any required statements or documentation that support the information provided.

- Review the completed form for accuracy before submission.

- Submit the form by the appropriate deadline, either electronically or via mail.

Filing Deadlines / Important Dates

The deadline for filing Form 3520 typically aligns with the annual tax return due date, which is April 15 for most taxpayers. However, if additional time is needed, taxpayers can file for an extension, which generally allows for an additional six months. It is crucial to be aware of these deadlines to avoid penalties associated with late filing.

Penalties for Non-Compliance

Failing to file the Form 3520 when required can lead to severe penalties. The IRS imposes a penalty of up to $10,000 for failure to report a foreign trust or for not reporting foreign gifts accurately. In cases of intentional disregard or fraudulent activity, penalties can be even more substantial. Understanding these consequences underscores the importance of compliance with reporting requirements.

Legal use of the Form 3520

The legal use of Form 3520 is grounded in U.S. tax law, requiring taxpayers to disclose specific foreign transactions and gifts. This form is essential for maintaining transparency with the IRS and ensuring that all foreign assets are reported correctly. By adhering to the legal requirements associated with this form, taxpayers can mitigate the risk of audits and penalties.

Quick guide on how to complete 2014 form 3520

Effortlessly Prepare Form 3520 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form 3520 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The Easiest Method to Alter and eSign Form 3520 with Minimal Effort

- Locate Form 3520 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive data with tools specifically designed by airSlate SignNow for such tasks.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign Form 3520 to guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 3520

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 3520

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 3520 and why is it important?

Form 3520 is an IRS form used to report certain transactions with foreign trusts and the receipt of foreign gifts. Understanding Form 3520 is crucial for ensuring compliance with U.S. tax regulations and avoiding potential penalties. airSlate SignNow provides tools to easily manage the signing and submission of Form 3520.

-

How can airSlate SignNow help with Form 3520?

airSlate SignNow simplifies the process of preparing and signing Form 3520, making it easy for businesses and individuals to manage their documents electronically. With customizable templates and secure eSigning features, users can streamline their workflows and ensure compliance with IRS requirements regarding Form 3520.

-

What features does airSlate SignNow offer for managing Form 3520?

airSlate SignNow offers a range of features tailored for Form 3520 management, including customizable templates, reminders for deadlines, and audit trails for compliance. Users can also integrate Form 3520 with other applications to automate workflows and increase efficiency in document handling.

-

Is airSlate SignNow affordable for users needing Form 3520 services?

Yes, airSlate SignNow offers competitive pricing plans that cater to both individual and business users who require Form 3520 services. With a cost-effective solution, users can enjoy comprehensive eSigning and document management capabilities without breaking the bank.

-

Can I integrate airSlate SignNow with other software for handling Form 3520?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to connect their existing tools for managing Form 3520. This enhances productivity by streamlining workflows and ensuring all relevant documents are seamlessly handled within the user's preferred ecosystem.

-

What benefits does airSlate SignNow provide for Form 3520 users?

Using airSlate SignNow for Form 3520 offers several benefits, including enhanced security, ease of use, and signNow time savings. Users can electronically sign documents, store them securely, and easily access them when needed, contributing to a smoother filing process.

-

Is it easy to get started with airSlate SignNow for Form 3520?

Yes, getting started with airSlate SignNow for Form 3520 is incredibly easy. New users can sign up for an account, access customizable templates for Form 3520, and begin sending documents for eSignatures within minutes. Comprehensive support resources are also available to guide you through the process.

Get more for Form 3520

Find out other Form 3520

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure