Form CT 222 Underpayment of Estimated Tax by a Corporation Tax Year 2023

Understanding Form CT 222 for Underpayment of Estimated Tax by Corporations

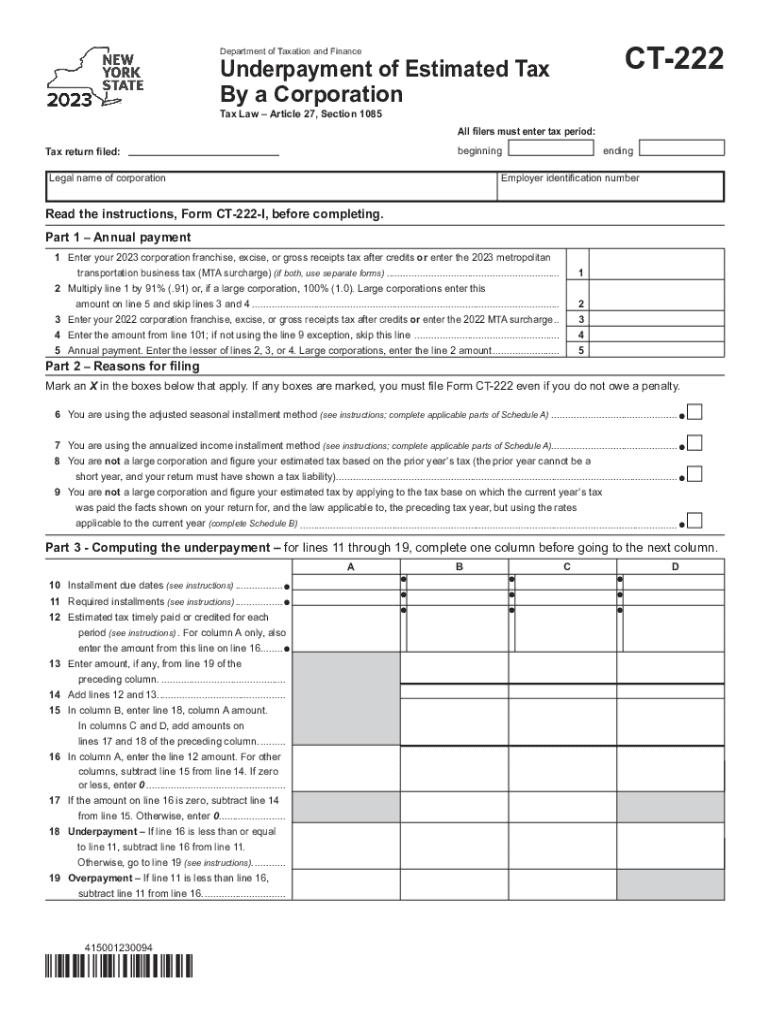

Form CT 222 is used by corporations in Connecticut to report underpayment of estimated taxes. This form is essential for ensuring compliance with state tax regulations. Corporations are required to pay estimated taxes throughout the year, and if they underpay, they may face penalties. The form helps calculate the amount owed for the tax year based on the corporation's income and previous payments.

Steps to Complete Form CT 222

Completing Form CT 222 involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated tax liability for the year.

- Determine any prior estimated tax payments made during the year.

- Use the form's worksheet to calculate any underpayment and the penalty, if applicable.

- Complete the form by filling in all required fields accurately.

- Review the form for accuracy before submission.

Obtaining Form CT 222

Corporations can obtain Form CT 222 from the Connecticut Department of Revenue Services (DRS) website. The form is available for download in PDF format, allowing for easy access and printing. Additionally, physical copies may be requested directly from the DRS office if needed.

Filing Deadlines for Form CT 222

Corporations must adhere to specific deadlines when submitting Form CT 222. Generally, the form is due on the same date as the corporate income tax return. It is crucial to be aware of these deadlines to avoid penalties for late filing. Corporations should check the Connecticut DRS website for the most current deadlines and any changes that may occur annually.

Penalties for Non-Compliance with Form CT 222

Failure to file Form CT 222 or underpayment of estimated taxes can result in significant penalties. The state may impose fines based on the amount of underpayment and the duration of the delay. It is important for corporations to understand these penalties to ensure timely compliance and avoid unnecessary costs.

Examples of Using Form CT 222

Corporations may find themselves needing to use Form CT 222 in various scenarios, such as:

- A corporation that experiences fluctuating income throughout the year may underpay its estimated taxes.

- Newly established corporations may not accurately predict their tax liabilities, leading to underpayment.

- Corporations that have made significant changes in their business operations or revenue streams may need to reassess their estimated tax payments.

Legal Use of Form CT 222

Form CT 222 is legally required for corporations that do not meet their estimated tax obligations. Proper completion and timely submission of the form ensure that corporations remain compliant with state tax laws. Understanding the legal implications of underpayment can help corporations avoid potential audits and legal issues.

Quick guide on how to complete form ct 222 underpayment of estimated tax by a corporation tax year

Accomplish Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Handle Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year on any gadget using airSlate SignNow's Android or iOS applications and simplify your document-driven tasks today.

How to modify and electronically sign Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year with ease

- Locate Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant portions of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Formulate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to preserve your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 222 underpayment of estimated tax by a corporation tax year

Create this form in 5 minutes!

How to create an eSignature for the form ct 222 underpayment of estimated tax by a corporation tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the CT 222 instructions?

The CT 222 instructions provide a comprehensive guide on how to properly complete your CT 222 form for tax filing. It includes important details on eligibility, necessary documentation, and specific steps to follow, ensuring you accurately report your information. For more details, please refer to the official documentation.

-

How does airSlate SignNow facilitate the CT 222 instructions process?

airSlate SignNow streamlines the process of completing and submitting documents, including adhering to the CT 222 instructions. Our platform allows you to upload, edit, and electronically sign documents, ensuring compliance with all guidelines. This signNowly increases efficiency and reduces the likelihood of errors.

-

Are there any costs associated with using airSlate SignNow for CT 222 instructions?

airSlate SignNow offers several pricing plans that cater to different business needs, ensuring you get the best value for facilitating your CT 222 instructions. Pricing may vary based on features and number of users, but we provide a cost-effective solution for managing documents. Explore our pricing page to find the best option for you.

-

What features does airSlate SignNow offer that support the CT 222 instructions?

Our platform includes features like eSignature, document templates, and real-time tracking that can help you adhere to the CT 222 instructions efficiently. These tools simplify document management and enhance collaboration, making it easier to handle tax-related filings. Experience seamless integration into your existing workflows.

-

Can I integrate airSlate SignNow with other applications while following CT 222 instructions?

Yes, airSlate SignNow supports integrations with various applications, which can simplify the process of following CT 222 instructions. Popular platforms such as Google Drive, Salesforce, and Dropbox can be integrated, allowing you to access your documents effortlessly. This creates a cohesive digital ecosystem for your business.

-

What are the benefits of using airSlate SignNow for my CT 222 instructions?

Using airSlate SignNow provides a user-friendly interface and efficient workflow that can enhance your experience in completing the CT 222 instructions. Our electronic signature feature accelerates the signing process, while secure document storage ensures that your sensitive information is protected. Simplify your tax filings with our innovative solutions.

-

Is customer support available for users following the CT 222 instructions?

Absolutely, airSlate SignNow offers robust customer support to assist users with any questions related to the CT 222 instructions. Our support team is available via chat, phone, and email to help guide you through any challenges you may face. Ensure your document processes are smooth and hassle-free.

Get more for Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

- Declaration of applicant wbmcin form

- Pbl template pdf form

- Form 8233

- Cooling down foods tracking chart form

- Mille lacs band of ojibwe per capita form

- Credit application for net 30 terms campbell scientific form

- Phone 801 614 9626 form

- Butler tax ampamp accounting tax accounting firm in salt lake city form

Find out other Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online