Form CT 222 Underpayment of Estimated Tax by a Corporation Tax Year 2022

What is the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

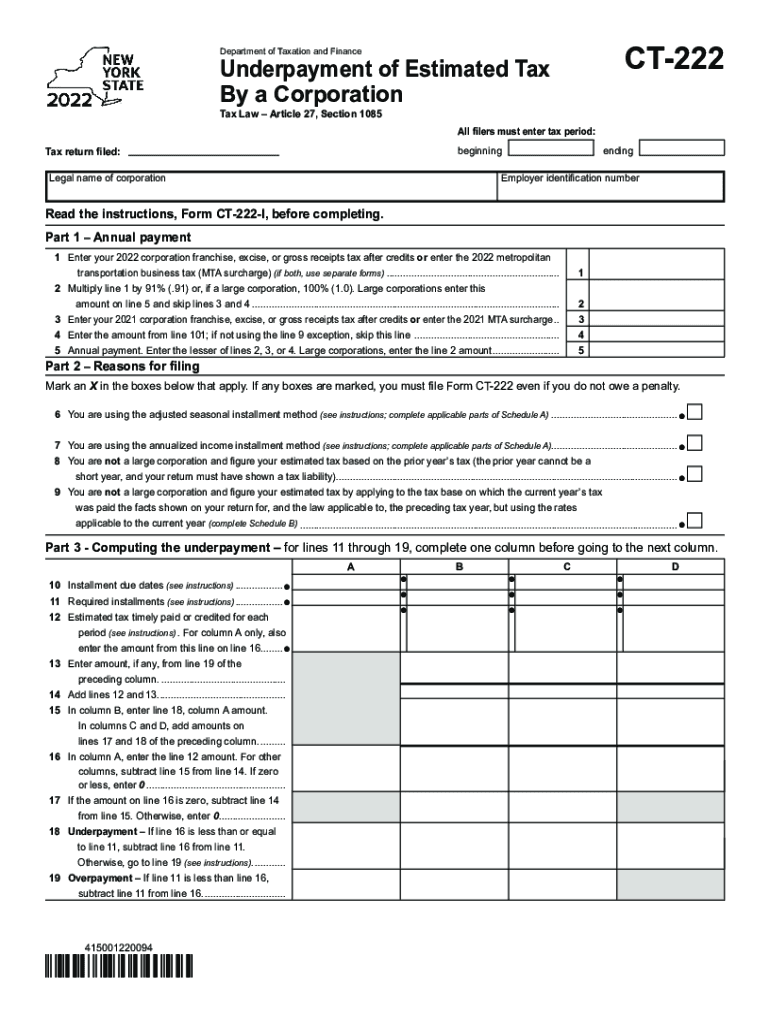

The Form CT 222 is used by corporations in the United States to report underpayment of estimated tax. This form is specifically designed for tax years where a corporation has not met the required estimated tax payments. It helps ensure compliance with state tax regulations and allows the corporation to calculate any penalties or interest due as a result of underpayment. Understanding the purpose of this form is crucial for corporations to avoid potential financial repercussions.

How to complete the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

Completing the Form CT 222 involves several key steps. First, gather all necessary financial documents and records related to the corporation's income and estimated tax payments. Next, accurately calculate the estimated tax liability for the year. The form requires specific information, including the total income, tax paid, and any applicable credits. Ensure that all calculations are precise, as errors can lead to penalties. After filling out the form, review it thoroughly before submission to confirm that all information is correct.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form CT 222 to avoid penalties. Typically, the form is due on the same date as the corporation's tax return. It is essential to stay informed about any changes to tax deadlines, as these can vary from year to year. Marking important dates on a calendar can help ensure timely submission and compliance with state tax regulations.

Legal use of the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

The legal use of Form CT 222 is grounded in compliance with state tax laws. This form must be accurately completed and submitted to avoid penalties for underpayment. The information provided on the form is used by tax authorities to assess whether the corporation has fulfilled its estimated tax obligations. Utilizing a reliable electronic signature platform can enhance the legal validity of the form, ensuring that all signatures and submissions meet regulatory standards.

Key elements of the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

Key elements of the Form CT 222 include the corporation's identification information, total income, estimated tax liability, and any payments made. Additionally, the form requires the calculation of any penalties for underpayment. Understanding these elements is vital for accurate completion and compliance with state tax laws. Each section of the form plays a crucial role in determining the corporation's tax standing and any potential liabilities.

Examples of using the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

Examples of using the Form CT 222 can include scenarios where a corporation underestimated its income for the tax year, leading to insufficient estimated tax payments. In such cases, the corporation would need to complete the form to report the underpayment and calculate any penalties. Another example could involve a corporation that experienced unexpected revenue growth, resulting in a higher tax liability than initially estimated. Properly utilizing the form in these situations helps corporations remain compliant and avoid further financial issues.

Quick guide on how to complete form ct 222 underpayment of estimated tax by a corporation tax year 2022

Effortlessly Prepare Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delay. Handle Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Edit and eSign Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year with Ease

- Find Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or mask sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, frustrating form searches, or errors requiring the reprinting of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 222 underpayment of estimated tax by a corporation tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form ct 222 underpayment of estimated tax by a corporation tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are ct 222 instructions?

CT 222 instructions refer to the guidelines provided for completing the CT-222 form, which is used for documenting certain financial transactions. Understanding the ct 222 instructions is crucial for compliance and accurate reporting, ensuring that businesses meet regulatory requirements.

-

How can I easily follow ct 222 instructions with airSlate SignNow?

With airSlate SignNow, you have the advantage of an intuitive platform that simplifies document signing and management. The solution allows you to include ct 222 instructions directly within your documents, ensuring that all parties are guided through the process smoothly.

-

Are there any costs associated with following ct 222 instructions using airSlate SignNow?

AirSlate SignNow offers a cost-effective solution for managing documents including those that require ct 222 instructions. Pricing depends on the plan you choose, but generally, it provides a range of affordable options suitable for businesses of all sizes.

-

What features does airSlate SignNow offer for managing documents with ct 222 instructions?

AirSlate SignNow includes features like customizable templates, real-time collaboration, and secure cloud storage, which are essential for handling documents that require ct 222 instructions. These features enhance productivity and minimize errors during the signing process.

-

Can I integrate airSlate SignNow with other tools for processing ct 222 instructions?

Yes, airSlate SignNow easily integrates with various business applications, making it simple to manage documents requiring ct 222 instructions alongside your existing workflows. Popular integrations include CRM systems, project management tools, and document storage solutions.

-

What are the benefits of using airSlate SignNow for ct 222 instructions?

Using airSlate SignNow for ct 222 instructions streamlines the document signing process, reduces paper usage, and ensures compliance. The platform is user-friendly, which can save your team valuable time while enhancing the overall efficiency of your operations.

-

How secure is airSlate SignNow for handling documents with ct 222 instructions?

AirSlate SignNow prioritizes security, ensuring that documents containing ct 222 instructions are protected. The platform features advanced encryption and compliance with various industry standards, safeguarding your sensitive information at all times.

Get more for Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

- Sc warranty deed form

- Quitclaim deed from corporation to llc south carolina form

- Quitclaim deed from corporation to corporation south carolina form

- Warranty deed from corporation to corporation south carolina form

- Quitclaim deed from corporation to two individuals south carolina form

- Warranty deed from corporation to two individuals south carolina form

- Warranty deed from individual to a trust south carolina form

- Warranty deed from husband and wife to a trust south carolina form

Find out other Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease