Ny Form Ct 222 2018

What is the NY Form CT-222

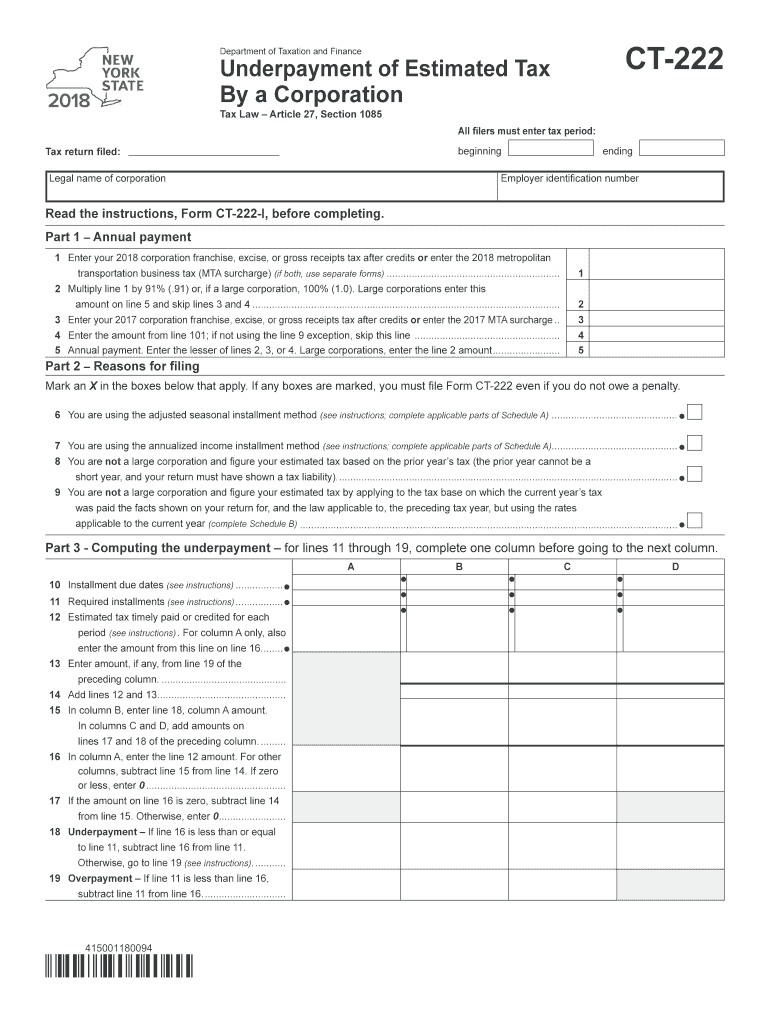

The NY Form CT-222 is a tax form used by businesses in New York to report and pay the state's corporate franchise tax. This form is essential for corporations to comply with state tax regulations and to ensure accurate reporting of their income and tax liabilities. The CT-222 is specifically designed for certain types of corporations, including those that are classified as S corporations or those that meet specific criteria set by the New York State Department of Taxation and Finance.

How to Obtain the NY Form CT-222

To obtain the NY Form CT-222, businesses can visit the New York State Department of Taxation and Finance website. The form is available for download in PDF format, allowing users to print and fill it out manually. Additionally, businesses may be able to request a physical copy through their tax professional or accountant. It is important to ensure that you are using the most recent version of the form to comply with current tax laws.

Steps to Complete the NY Form CT-222

Completing the NY Form CT-222 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill in the business identification information, including the corporation's name, address, and employer identification number (EIN).

- Report the total income and deductions as required by the form.

- Calculate the franchise tax due based on the provided tax rates.

- Sign and date the form, ensuring that it is completed accurately.

Legal Use of the NY Form CT-222

The NY Form CT-222 must be used in accordance with New York state tax laws. It is legally binding once signed and submitted, meaning that any inaccuracies or omissions can lead to penalties or audits. Businesses are encouraged to consult with tax professionals to ensure compliance with all legal requirements and to understand the implications of the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the NY Form CT-222 typically align with the corporation's fiscal year-end. Corporations must file the form by the fifteenth day of the fourth month following the end of their tax year. It is crucial for businesses to be aware of these deadlines to avoid late filing penalties and interest on unpaid taxes. Additionally, extensions may be available, but they must be requested in advance.

Form Submission Methods

The NY Form CT-222 can be submitted through various methods, including:

- Online submission via the New York State Department of Taxation and Finance e-file system.

- Mailing a completed paper form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can enhance the efficiency of the filing process and ensure timely compliance with state tax regulations.

Quick guide on how to complete ct 222 new york 2018 2019 form

Your assistance manual on how to prepare your Ny Form Ct 222

If you’re wondering how to generate and dispatch your Ny Form Ct 222, here are some straightforward instructions on how to simplify tax submission signNowly.

To begin, you simply need to set up your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to modify, create, and finalize your tax files effortlessly. With its editor, you can alternate between text, check boxes, and electronic signatures and revisit to amend responses as necessary. Enhance your tax organization with superior PDF editing, electronic signing, and user-friendly sharing capabilities.

Follow the instructions below to complete your Ny Form Ct 222 in no time:

- Create your account and start editing PDFs in moments.

- Utilize our directory to find any IRS tax document; browse through variations and schedules.

- Click Obtain form to access your Ny Form Ct 222 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if necessary).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that paper filing can increase return errors and delay refunds. Additionally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 222 new york 2018 2019 form

FAQs

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

How will the students who are graduating before August 2019 be able to apply for SSC CGL 2018? Could new forms be filled if the exam is cancelled?

No it cannot happen.Recrutiment once closed for applying will not be open again. It has never happened in my experience of 4 years.You should keep yourfocus on preparation as opportunity may come anytime.Best of hardwork.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the ct 222 new york 2018 2019 form

How to create an electronic signature for your Ct 222 New York 2018 2019 Form online

How to generate an electronic signature for the Ct 222 New York 2018 2019 Form in Chrome

How to generate an electronic signature for signing the Ct 222 New York 2018 2019 Form in Gmail

How to create an electronic signature for the Ct 222 New York 2018 2019 Form from your smartphone

How to create an eSignature for the Ct 222 New York 2018 2019 Form on iOS

How to generate an electronic signature for the Ct 222 New York 2018 2019 Form on Android devices

People also ask

-

What is the NY form CT 222 and why is it important?

The NY form CT 222 is a crucial document for businesses that need to report tax information in New York. It ensures compliance with state tax regulations and helps avoid penalties. Utilizing airSlate SignNow can streamline the process of completing and submitting the NY form CT 222 efficiently.

-

How can airSlate SignNow assist with the NY form CT 222?

airSlate SignNow simplifies the process of eSigning and managing the NY form CT 222. You can easily fill out, sign, and send the form electronically, ensuring that you meet all deadlines. This digital solution enhances your workflow and ensures that your documents are securely handled.

-

What features does airSlate SignNow offer for handling the NY form CT 222?

airSlate SignNow provides several features tailored for the NY form CT 222, including customizable templates, secure eSigning, and document tracking. You can manage all aspects of the form within a user-friendly interface, making it accessible for everyone in your business. Moreover, the integration with various applications increases its functionality.

-

Is airSlate SignNow affordable for managing the NY form CT 222?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for businesses of all sizes. With transparent pricing and no hidden fees, users can efficiently manage the NY form CT 222 without breaking the bank. Additionally, the time saved through automation can lead to indirect cost savings.

-

Can I integrate airSlate SignNow with other software for the NY form CT 222?

Absolutely! airSlate SignNow supports integration with numerous applications, enabling seamless management of the NY form CT 222 alongside your existing software stack. This capability allows for enhanced productivity and collaboration, making it easier to complete the document.

-

What are the benefits of eSigning the NY form CT 222 with airSlate SignNow?

eSigning the NY form CT 222 with airSlate SignNow offers considerable benefits, including increased security, reduced processing time, and better compliance. Digital signatures are legally binding and provide quick document turnaround. This convenience allows businesses to focus more on their core activities rather than administrative tasks.

-

How do I start using airSlate SignNow for the NY form CT 222?

To begin using airSlate SignNow for the NY form CT 222, simply sign up for an account on our website. Once registered, you can easily access templates for the form, fill them out, and start the eSigning process. Our intuitive platform ensures that you can get started with minimal hassle.

Get more for Ny Form Ct 222

- Ps form 4589

- Cpat online form

- What you should know about eiv form

- Breakers bookman road elementary after school program richland2 form

- Contact member servicesaiken electric cooperative inc form

- Equestrian release and waiver of liability middleton hunt form

- St mary our lady of the annunciation parish home form

- Homeslam snow removal livonia mi snow removal service form

Find out other Ny Form Ct 222

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure