Ct 222 New York Form 2015

What is the Ct 222 New York Form

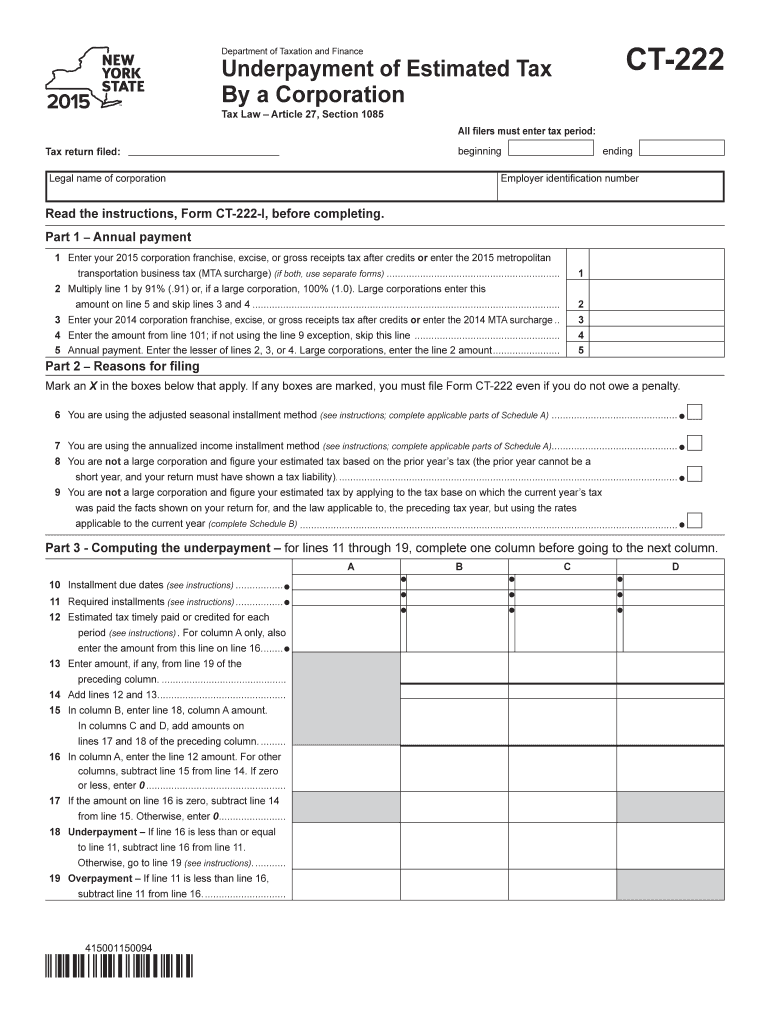

The Ct 222 New York Form is a specific tax document used by businesses to report certain financial information to the state of New York. This form is essential for ensuring compliance with state tax regulations. It is primarily utilized by corporations and partnerships to report income, deductions, and credits for tax purposes. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and maintaining good standing with the state authorities.

How to use the Ct 222 New York Form

Using the Ct 222 New York Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information related to your business operations. This may include profit and loss statements, balance sheets, and previous tax returns. Next, fill out the form accurately, ensuring all fields are completed with the correct information. After completing the form, review it for any errors before signing and submitting it to the appropriate state agency. Utilizing digital tools can streamline this process, allowing for easier corrections and secure submission.

Steps to complete the Ct 222 New York Form

Completing the Ct 222 New York Form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary financial documents, including income statements and expense records.

- Access the Ct 222 New York Form through the official state website or a trusted eSignature platform.

- Fill in the required fields, ensuring accuracy in all financial reporting.

- Review the form for completeness and correctness.

- Sign the form electronically or by hand, as required.

- Submit the form electronically or by mail to the designated state department.

Legal use of the Ct 222 New York Form

The Ct 222 New York Form has specific legal implications for businesses operating in the state. It is crucial for ensuring compliance with state tax laws, which can help avoid penalties and legal issues. The form must be completed accurately and submitted by the designated deadlines to maintain good standing with state authorities. Additionally, businesses should retain copies of submitted forms and any supporting documentation for their records, as they may be required for future audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 222 New York Form are critical for compliance. Typically, the form must be submitted by the due date of the business's tax return. For most corporations, this is the fifteenth day of the third month following the end of the fiscal year. It is essential to stay updated on any changes to these deadlines, as they can vary based on specific circumstances or legislative changes. Marking these dates on a calendar can help ensure timely submission and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ct 222 New York Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses opt for electronic filing through state-approved platforms, which can expedite processing and reduce errors.

- Mail Submission: The form can be printed and mailed to the appropriate state department. Ensure to use the correct address and include any required documentation.

- In-Person Submission: Some businesses may choose to submit the form in person at designated state offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete ct 222 new york 2015 form

Your assistance manual on how to prepare your Ct 222 New York Form

If you’re looking to understand how to create and submit your Ct 222 New York Form, here are a few straightforward instructions on how to streamline tax submission.

To begin, you need to set up your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is a highly user-friendly and efficient document solution that allows you to modify, create, and finalize your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to revise entries as necessary. Make your tax organization simpler with advanced PDF modification, eSigning, and convenient sharing options.

Follow the instructions below to finalize your Ct 222 New York Form in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Ct 222 New York Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delay refunds. Moreover, before e-filing your taxes, review the IRS website for declaration guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 222 new york 2015 form

FAQs

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Which forms do I need to fill in order to file New York state taxes?

You must determine your New York State residency status. You need to answer these questions:Did you live in an on-campus apartment or an apartment or house off-campus in New York State in 2012?Did you maintain, or rent, the on-campus apartment or off-campus residence for at least 11 months in 2012?Were you physically present in New York State for at least 183 days in 2012?If the answers to all three questions are "Yes", and you were not a full-time undergraduate student (which as an F-1 OPT I assume you were not), you are a New York State resident for tax purposes. Otherwise you are a nonresident.You file Form IT-201, http://www.tax.ny.gov/pdf/curren..., if you are a resident of New York State, Form IT-203, http://www.tax.ny.gov/pdf/curren..., if you are not.

-

How long does it take to get from New York City, NY to Greenwich, CT?

Metro North is the best bet heading into the city. Takes around 42 mins.Greenwich has 4 train stations;Old Greenwich StationRiverside StationCos Cob StationCentral Greenwich StationThe residents of the west side of town consider Portchester, NY Station to be the unofficial 5th.Here’s a quick map…

-

What are some must sees or dos when in New York City to fill out a two day itinerary?

Get yourself Metrocards. They work in the Subways and on the buses. Each ride is about $2.75. However, you can transfer from bus to subway, bus to bus, Subway to Subway, or Subway to bus for free.When I take people around for two days, I typically start with the Statue of Liberty. First boat goes out at 8:30 a m. Do not talk to sidewalk ticket agents. At best, they will sell you the $19 ticket for $25, with a commission. At worst, thousands last year paid for boat trips that did not go to the Statue of Liberty, after being told by street ticket agents that it would.From the statue, it's a short walk to either the financial district or World Trade Center Memorial. (We don't call it Ground Zero anymore.)After that, I walk over the Brooklyn Bridge to Brooklyn Heights, with its beautiful 150-year-old houses, including those that housed Arthur Miller, Norman Mailer, Truman Capote and WH Auden. Stop at the Brooklyn Heights Promenade with a 15 km or 10 Mile view of the city and the harbor.This takes us to lunch the first day.Contact me if you want to learn the rest of this two-day itinerary. I'm always looking for another day of work!

Create this form in 5 minutes!

How to create an eSignature for the ct 222 new york 2015 form

How to generate an eSignature for the Ct 222 New York 2015 Form in the online mode

How to make an electronic signature for the Ct 222 New York 2015 Form in Google Chrome

How to generate an eSignature for signing the Ct 222 New York 2015 Form in Gmail

How to generate an eSignature for the Ct 222 New York 2015 Form from your smart phone

How to create an electronic signature for the Ct 222 New York 2015 Form on iOS devices

How to generate an electronic signature for the Ct 222 New York 2015 Form on Android

People also ask

-

What is the Ct 222 New York Form?

The Ct 222 New York Form is a specific tax document required for certain businesses operating in New York. It facilitates the reporting of income and provides essential information to the state for tax purposes. Understanding this form is crucial for compliance and to avoid potential penalties.

-

How does airSlate SignNow help with the Ct 222 New York Form?

airSlate SignNow helps streamline the process of completing and eSigning the Ct 222 New York Form, making it easier for businesses to manage their documentation. With features like templates and integrations, users can fill out necessary fields quickly and accurately. This eliminates paperwork hassles and accelerates submission.

-

What are the pricing plans for airSlate SignNow in relation to the Ct 222 New York Form?

airSlate SignNow offers various pricing plans that cater to different business needs when handling documents like the Ct 222 New York Form. The cost-effective solutions ensure that businesses can efficiently manage their eSigning and document workflows without overspending. Plans are flexible, allowing clients to choose what fits best.

-

Can I store the completed Ct 222 New York Form with airSlate SignNow?

Yes, you can securely store your completed Ct 222 New York Form using airSlate SignNow. The platform provides a cloud storage solution that ensures easy access and retrieval of important documents. This feature is part of our commitment to making document management seamless and organized.

-

What features does airSlate SignNow offer for the Ct 222 New York Form?

airSlate SignNow offers a variety of features specifically tailored for managing the Ct 222 New York Form. Key functionalities include customizable templates, automated workflows, and integration capabilities with other software. These tools enhance efficiency and streamline the eSigning process.

-

Is airSlate SignNow compliant with New York regulations for the Ct 222 New York Form?

Yes, airSlate SignNow is designed to be compliant with New York regulations for documents like the Ct 222 New York Form. Our platform follows industry standards for electronic signatures and document management, ensuring your submissions meet legal requirements. This compliance adds peace of mind for businesses navigating regulatory landscapes.

-

How can I integrate airSlate SignNow with other software to manage the Ct 222 New York Form?

airSlate SignNow easily integrates with various software applications, allowing users to manage the Ct 222 New York Form alongside their existing tools. Whether you're using CRM systems, cloud storage solutions, or workflow automation platforms, integration ensures a smooth workflow. This capability enhances productivity and reduces manual errors.

Get more for Ct 222 New York Form

- Gold award final report girl scouts of connecticut gsofct form

- Dd form 2326 24425053

- Scca 235e form

- Iamps 07033403 form

- Medical records 280822721 form

- Application for chronic condition or critical care residential customer status form

- Ejgh outpatient lab order form

- Fillable online authentications cover letter for website form

Find out other Ct 222 New York Form

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer