Form CT 222 Underpayment of Estimated Tax by a Corporation Tax Year 2021

What is the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

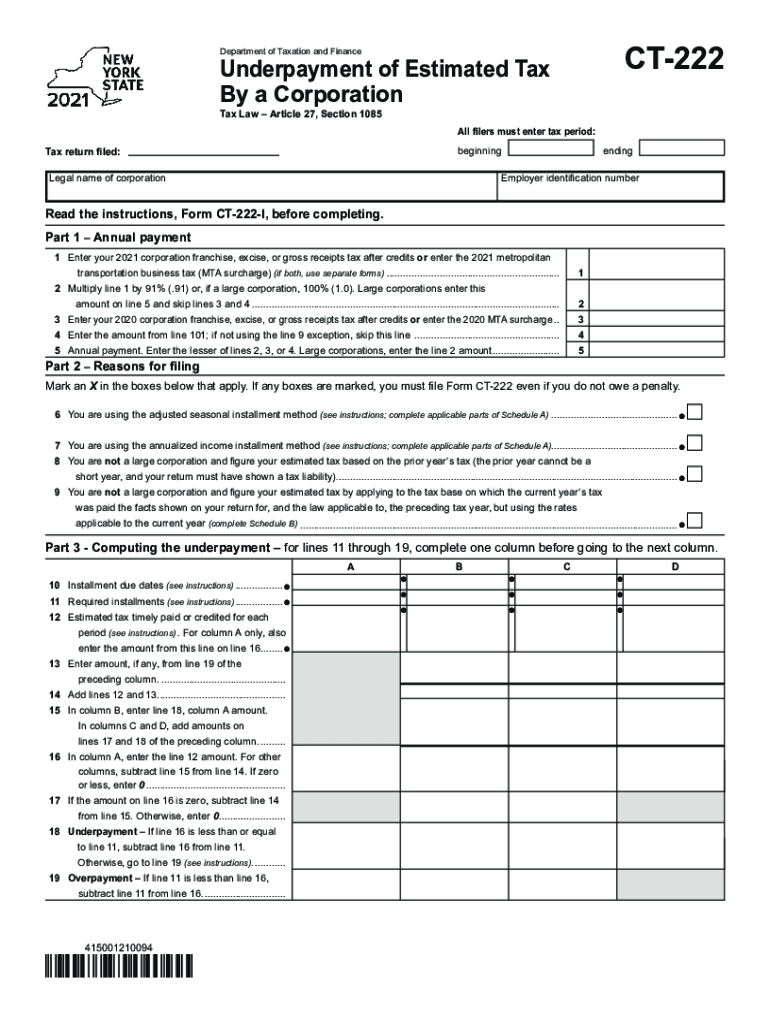

The Form CT 222 is specifically designed for corporations in the United States to report underpayment of estimated tax. This form is essential for businesses that do not meet the required estimated tax payment thresholds throughout the tax year. The purpose of the CT 222 is to calculate any penalties that may apply due to insufficient tax payments made during the year. Understanding the form's requirements is crucial for compliance with state tax regulations.

How to use the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

Using the Form CT 222 involves several key steps. First, corporations must determine their total tax liability for the year. Next, they need to calculate the estimated tax payments made throughout the year. By comparing these amounts, businesses can identify any underpayment. The form requires specific financial details, including income, deductions, and credits, to accurately assess the penalty for underpayment. Completing the form correctly ensures that corporations remain compliant with tax obligations.

Steps to complete the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

Completing the Form CT 222 involves a systematic approach:

- Gather financial records, including income statements and previous tax returns.

- Calculate the total tax liability for the current tax year.

- Determine the estimated tax payments made during the year.

- Compare the total tax liability with the estimated payments to identify any underpayment.

- Fill out the form, ensuring all calculations are accurate and supported by documentation.

- Submit the completed form by the specified deadline to avoid additional penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 222 are critical for compliance. Typically, the form must be submitted by the due date of the corporation's tax return. For most corporations, this is the fifteenth day of the fourth month following the end of the tax year. It is important to stay informed about any changes to tax deadlines that may occur, as these can vary based on specific circumstances, such as extensions or changes in tax law.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form CT 222 can result in significant penalties. Corporations may face financial penalties based on the amount of underpayment, which can accumulate over time. Additionally, non-compliance may lead to increased scrutiny from tax authorities, resulting in audits or further legal implications. It is essential for businesses to understand these penalties to avoid unnecessary financial burdens.

Legal use of the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

The Form CT 222 is legally recognized as a valid document for reporting underpayment of estimated tax by corporations. To ensure its legal standing, the form must be completed accurately and submitted on time. Compliance with state tax regulations is crucial for maintaining the legal integrity of the form. Corporations should keep records of all submissions and communications regarding the form to protect against potential disputes or audits.

Quick guide on how to complete form ct 222 underpayment of estimated tax by a corporation tax year 2021

Complete Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to modify and eSign Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year effortlessly

- Locate Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Modify and eSign Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 222 underpayment of estimated tax by a corporation tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form ct 222 underpayment of estimated tax by a corporation tax year 2021

How to create an e-signature for a PDF file in the online mode

How to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What are ct 222 instructions in the context of airSlate SignNow?

The ct 222 instructions refer to the guidelines that users need to follow for utilizing the eSignature features of airSlate SignNow. Understanding these instructions helps ensure that your documents are signed and processed correctly, facilitating smooth transactions and compliance.

-

How can I access ct 222 instructions within airSlate SignNow?

You can easily access ct 222 instructions by visiting the help section of the airSlate SignNow platform. There, you will find comprehensive guides and tutorials that outline the steps needed to effectively use our eSigning capabilities.

-

Are there any costs associated with following ct 222 instructions?

No, accessing the ct 222 instructions on the airSlate SignNow platform is free of charge. You can benefit from these instructions without any additional costs, ensuring you can utilize our services effectively within your budget.

-

What features can I utilize by following ct 222 instructions?

By adhering to the ct 222 instructions, you can utilize various features within airSlate SignNow such as electronic signatures, document tracking, and automated workflows. These features are designed to enhance your document management processes and improve overall efficiency.

-

How do ct 222 instructions help in improving workflow efficiency?

Ct 222 instructions provide a clear framework for leveraging airSlate SignNow's features, which can streamline your document signing processes. By following these instructions, you can minimize delays and errors, leading to increased productivity and faster turnaround times.

-

What integrations are available with airSlate SignNow that align with ct 222 instructions?

airSlate SignNow offers several integrations with CRM systems, cloud storage, and other business tools that complement the ct 222 instructions. By leveraging these integrations, you can enhance your workflow and ensure seamless data transfer between platforms.

-

Can I use airSlate SignNow for specific industries with ct 222 instructions?

Yes, airSlate SignNow and the ct 222 instructions are designed to meet the needs of various industries, including real estate, healthcare, and finance. The platform is customizable to accommodate specific compliance and operational requirements within those fields.

Get more for Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

Find out other Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed