Foreign Person 2018

What is the Foreign Person

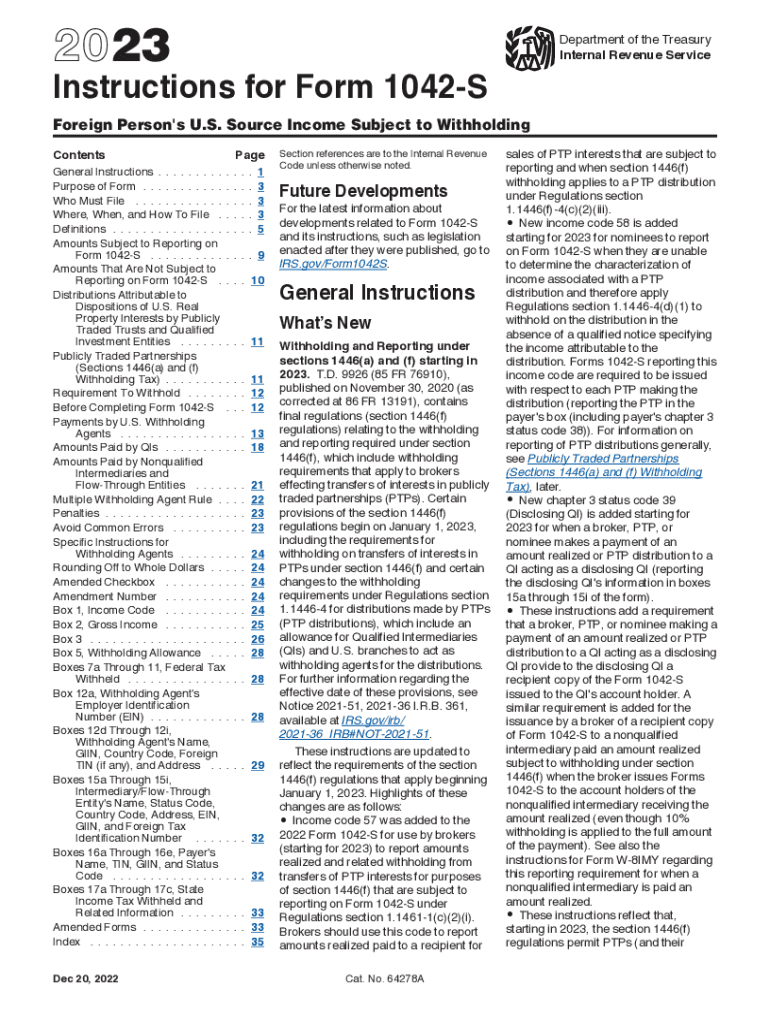

A foreign person, in the context of IRS Form 1042-S, refers to individuals or entities that are not considered U.S. persons for tax purposes. This includes non-resident aliens, foreign corporations, foreign partnerships, and foreign estates or trusts. Understanding the definition of a foreign person is crucial as it determines the applicability of withholding tax on income sourced from the United States.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting and withholding of income paid to foreign persons. These guidelines clarify the types of income that may be subject to withholding, such as interest, dividends, rents, and royalties. It is essential for payers to familiarize themselves with these regulations to ensure compliance and avoid potential penalties. The IRS also outlines the necessary documentation that must be collected from foreign persons to support the withholding tax rates applied.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 1042-S are crucial for compliance. Generally, the form must be filed by March fifteen of the year following the calendar year in which the income was paid. Additionally, payers must provide copies of the form to the recipients by the same date. Understanding these deadlines helps ensure timely submission and avoids penalties for late filing.

Required Documents

To properly complete IRS Form 1042-S, certain documents are required. Payers must collect Form W-8 from foreign persons to certify their foreign status and claim any applicable tax treaty benefits. Additionally, documentation supporting the income type and amount paid is necessary for accurate reporting. Keeping thorough records ensures compliance and facilitates the completion of the form.

Form Submission Methods

IRS Form 1042-S can be submitted through various methods. Payers have the option to file the form electronically using the IRS e-file system or submit a paper version by mail. Electronic filing is often preferred due to its efficiency and immediate confirmation of receipt. Understanding the submission methods available helps payers choose the best option for their needs.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding Form 1042-S can result in significant penalties. These may include fines for late filing, failure to furnish correct payee statements, and underreporting of income. It is important for payers to understand these potential consequences to maintain compliance and avoid unnecessary financial burdens.

Quick guide on how to complete foreign person

Effortlessly Prepare Foreign Person on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to design, amend, and electronically sign your documents quickly and without delay. Manage Foreign Person on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Foreign Person seamlessly

- Obtain Foreign Person and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Foreign Person and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct foreign person

Create this form in 5 minutes!

How to create an eSignature for the foreign person

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 1042 s instructions for using airSlate SignNow?

The 1042 s instructions outline the reporting requirements for U.S. taxpayers receiving income from foreign sources. With airSlate SignNow, you can easily prepare and eSign these documents digitally, streamlining the process and ensuring accuracy in compliance with the IRS guidelines.

-

How can airSlate SignNow help me understand 1042 s instructions?

airSlate SignNow provides resources and templates to help you navigate the 1042 s instructions efficiently. Our platform offers step-by-step guidance, ensuring you are equipped to fill out the necessary forms accurately and eSign them securely.

-

What features does airSlate SignNow offer for the 1042 s instructions?

airSlate SignNow features customizable templates, eSignature capabilities, and automated workflows that are ideal for managing 1042 s instructions. These features help simplify the documentation process and enhance collaboration among multiple signers.

-

Is there a cost associated with using airSlate SignNow for 1042 s instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to essential features for managing 1042 s instructions, ensuring you can choose a solution that fits your budget while ensuring compliance.

-

Can I integrate airSlate SignNow with other applications for handling 1042 s instructions?

Absolutely! airSlate SignNow integrates seamlessly with several popular applications, allowing you to manage your 1042 s instructions alongside other business processes. This integration enhances efficiency and helps streamline your documentation workflow.

-

What benefits does airSlate SignNow provide for managing 1042 s instructions?

The primary benefits of using airSlate SignNow for your 1042 s instructions include increased efficiency, enhanced security, and reduced paper usage. By digitizing the eSigning process, you can save time and reduce errors, ensuring compliance and maintaining a professional edge.

-

How secure is airSlate SignNow when handling documents related to 1042 s instructions?

airSlate SignNow employs high-level security measures, including encryption and secure authentication, to protect documents related to 1042 s instructions. Your sensitive data is safeguarded, providing peace of mind throughout the document signing process.

Get more for Foreign Person

- Sample of a choir form

- Printable ca 17 form

- Usps power of attorney 5620855 form

- Cpsu claim form

- Meldezettel form

- Job fair form

- Financeadministration section chief type 2 fsc2 financeadministration section chief type 1 fsc1 fsc2 fsc1 position task book form

- Advertisement consent form eplanning scotland

Find out other Foreign Person

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later