Form 4466 Rev July

What is the Form 4466 Rev July

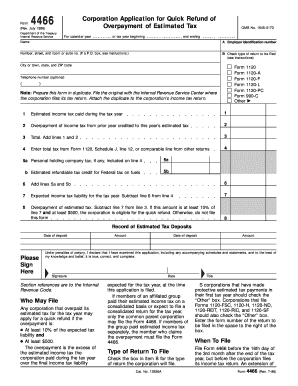

The Form 4466 Rev July is a tax form used by taxpayers in the United States to apply for a quick refund of an overpayment of income tax. This form is specifically designed for individuals and businesses that have paid more tax than they owe and are seeking a prompt refund. It is typically utilized when a taxpayer believes they have overpaid their estimated tax payments or withholding. By submitting this form, taxpayers can expedite the refund process, allowing them to receive their money back sooner.

How to obtain the Form 4466 Rev July

To obtain the Form 4466 Rev July, taxpayers can visit the official IRS website, where the form is available for download in PDF format. Additionally, the form can be requested by calling the IRS directly or visiting a local IRS office. It is important to ensure that the most current version of the form is used, as outdated forms may not be accepted.

Steps to complete the Form 4466 Rev July

Completing the Form 4466 Rev July involves several key steps:

- Begin by providing your personal information, including your name, address, and Social Security number or Employer Identification Number.

- Indicate the tax year for which you are claiming the refund.

- Calculate the total amount of overpayment and enter this figure on the form.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the appropriate IRS address, which can be found in the form instructions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 4466 Rev July. Taxpayers should ensure they meet the eligibility criteria, which typically include having filed a tax return for the year in question and having an overpayment of tax. The IRS also outlines the required documentation that may need to accompany the form, such as copies of previous tax returns or proof of payments made. Adhering to these guidelines helps prevent delays in processing the refund.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4466 Rev July are crucial for taxpayers to consider. Generally, the form must be submitted within a specific timeframe after the tax year ends. For most taxpayers, this means filing the form within three years from the due date of the return for the year in which the overpayment occurred. It is essential to keep track of these deadlines to ensure timely refunds.

Form Submission Methods

The Form 4466 Rev July can be submitted through various methods, including:

- Online submission through the IRS e-file system, if applicable.

- Mailing the completed form to the appropriate IRS address as indicated in the form instructions.

- In-person delivery at a local IRS office, which may provide immediate assistance and confirmation of receipt.

Eligibility Criteria

To be eligible to file the Form 4466 Rev July, taxpayers must meet certain criteria. This includes having an overpayment of income tax for the specific tax year and having filed a tax return for that year. Additionally, the taxpayer must not have any outstanding tax liabilities or other issues with the IRS that could affect their eligibility for a refund. Understanding these criteria is vital for a successful application.

Quick guide on how to complete form 4466 rev july

Accomplish [SKS] easily on any device

Digital document administration has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary instruments to produce, modify, and electronically sign your documents rapidly without inconveniences. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important parts of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which requires just seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose your preferred method of sending your form, via email, SMS, or invitation link, or download it to your PC.

Wave goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign [SKS] and guarantee excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4466 Rev July

Create this form in 5 minutes!

How to create an eSignature for the form 4466 rev july

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4466 Rev July and how does it work?

Form 4466 Rev July is a tax form that allows businesses to apply for a quick refund from the IRS. Using airSlate SignNow, you can electronically sign and send your completed Form 4466 Rev July, streamlining the process and ensuring your submission is secure and prompt.

-

How can I benefit from using airSlate SignNow for Form 4466 Rev July?

By utilizing airSlate SignNow, you can easily complete, sign, and send Form 4466 Rev July from any device. This eliminates delays and bottlenecks associated with traditional signing methods, helping you get your refunds faster.

-

What are the pricing options for airSlate SignNow when handling Form 4466 Rev July?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Each plan includes features that facilitate the management of documents like Form 4466 Rev July, ensuring you get value for your investment.

-

Are there any integration options available for Form 4466 Rev July?

Yes, airSlate SignNow integrates seamlessly with various popular applications, allowing you to easily manage Form 4466 Rev July alongside your other business processes. These integrations enhance efficiency and help maintain a smooth workflow.

-

Can I trust airSlate SignNow with my Form 4466 Rev July submissions?

Absolutely! airSlate SignNow employs top-notch security protocols to protect your data, including Form 4466 Rev July submissions. Your sensitive information is safeguarded, ensuring compliance and confidentiality.

-

What features does airSlate SignNow offer for completing Form 4466 Rev July?

airSlate SignNow provides a user-friendly interface, easy document management, and a variety of templates specifically for Form 4466 Rev July. These features simplify the completion and signing process, making it accessible for everyone.

-

Is airSlate SignNow suitable for large businesses filing Form 4466 Rev July?

Yes, airSlate SignNow is designed to scale with your business needs. Whether you're a small startup or a large corporation, our platform can effectively handle numerous Form 4466 Rev July filings without sacrificing performance.

Get more for Form 4466 Rev July

Find out other Form 4466 Rev July

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template