File and Pay Form CT1040 Electronically Using MyconneCT at Portal 2023

What is the File And Pay Form CT1040 Electronically Using MyconneCT At Portal

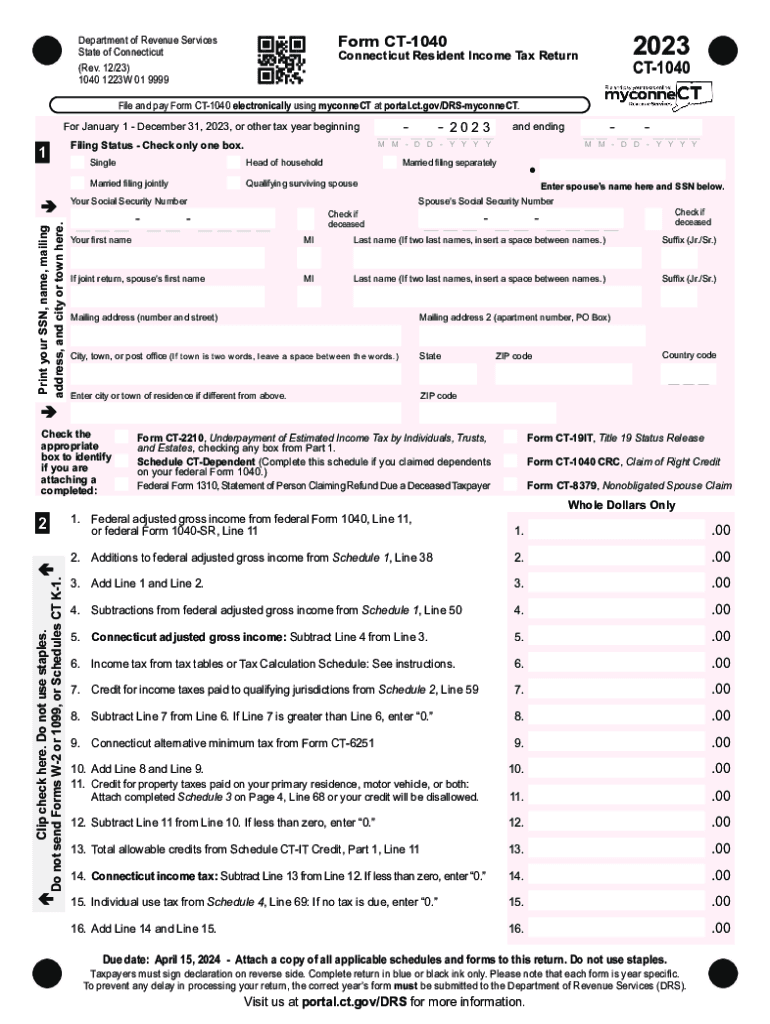

The File and Pay Form CT1040 is the primary tax form used by residents of Connecticut to report their income tax for the year 2015. This form allows taxpayers to declare their income, claim deductions, and calculate the amount of tax owed or the refund due. By using the MyconneCT portal, taxpayers can file and pay their taxes electronically, streamlining the process and ensuring timely submission. This method is especially beneficial for those who prefer digital solutions for managing their tax obligations.

Steps to complete the File And Pay Form CT1040 Electronically Using MyconneCT At Portal

To complete the File and Pay Form CT1040 electronically via MyconneCT, follow these steps:

- Visit the MyconneCT portal and create an account if you do not have one.

- Log in to your account and navigate to the tax filing section.

- Select the option to file Form CT1040 for the year 2015.

- Enter your personal information, including your Social Security number, address, and filing status.

- Input your income details, including wages, interest, and other sources of income.

- Claim any applicable deductions and credits to reduce your taxable income.

- Review the information for accuracy and submit the form electronically.

- Make your payment through the portal using a bank account or credit card.

Required Documents

When filing the 2015 CT tax, it is essential to gather all necessary documents to ensure accurate reporting. Required documents include:

- W-2 forms from all employers for the year 2015.

- 1099 forms for any additional income received.

- Records of any deductions, such as mortgage interest statements or student loan interest.

- Proof of any tax credits you intend to claim.

Filing Deadlines / Important Dates

For the 2015 CT tax filing, it is crucial to adhere to the deadlines to avoid penalties. The key dates include:

- April 15, 2016: Deadline for filing Form CT1040 for the 2015 tax year.

- October 15, 2016: Extended deadline for those who filed for an extension.

Legal use of the File And Pay Form CT1040 Electronically Using MyconneCT At Portal

The electronic filing of Form CT1040 through MyconneCT is legally recognized by the Connecticut Department of Revenue Services. Taxpayers must ensure that they comply with all state regulations when using this method. Electronic submissions are secure and provide a confirmation of receipt, which serves as proof of filing. It is important to maintain records of all submitted documents and payments for future reference.

Penalties for Non-Compliance

Failure to file the 2015 CT tax return on time or pay the taxes owed can result in significant penalties. Common penalties include:

- A late filing penalty, which is typically a percentage of the unpaid tax for each month the return is late.

- Interest on any unpaid tax, which accrues from the due date until the tax is paid in full.

- Additional penalties for failure to pay, which can further increase the total amount owed.

Quick guide on how to complete file and pay form ct1040 electronically using myconnect at portal

Complete File And Pay Form CT1040 Electronically Using MyconneCT At Portal with ease on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage File And Pay Form CT1040 Electronically Using MyconneCT At Portal on any gadget using airSlate SignNow's Android or iOS applications and simplify your document-centric tasks today.

The easiest way to modify and eSign File And Pay Form CT1040 Electronically Using MyconneCT At Portal effortlessly

- Locate File And Pay Form CT1040 Electronically Using MyconneCT At Portal and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent parts of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Modify and eSign File And Pay Form CT1040 Electronically Using MyconneCT At Portal and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct file and pay form ct1040 electronically using myconnect at portal

Create this form in 5 minutes!

How to create an eSignature for the file and pay form ct1040 electronically using myconnect at portal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ct tax 2022?

airSlate SignNow is a powerful eSignature solution that simplifies document management tasks. When preparing your ct tax 2022 documents, you can easily create, sign, and send forms electronically, ensuring compliance and efficiency in your tax-related processes.

-

How can airSlate SignNow help with preparing ct tax 2022 forms?

With airSlate SignNow, you can quickly prepare ct tax 2022 forms by utilizing templates and automation features. This streamlines the completion process, allowing you to focus on accurate filings rather than manual paperwork.

-

Is airSlate SignNow cost-effective for businesses handling ct tax 2022?

Yes, airSlate SignNow offers a cost-effective solution that is ideal for businesses managing ct tax 2022 documents. Our competitive pricing plans are designed to accommodate various business sizes, providing good value for signing and managing critical tax documents together.

-

What features does airSlate SignNow offer for ct tax 2022 document management?

airSlate SignNow includes features like templates, real-time tracking, and secure cloud storage, which are essential for handling ct tax 2022 effectively. These tools ensure that your documents are organized, easily accessible, and legally compliant.

-

Can I integrate airSlate SignNow with other platforms for ct tax 2022?

Yes, airSlate SignNow seamlessly integrates with various platforms such as Google Drive, Dropbox, and CRM systems, which can be beneficial for managing ct tax 2022 documents. This ensures that all your data is centralized and enhances the efficiency of your workflow.

-

How secure is airSlate SignNow when dealing with ct tax 2022 documents?

Security is a top priority at airSlate SignNow, especially for sensitive ct tax 2022 documents. We utilize advanced encryption, secure access controls, and regular security audits to protect your data and ensure compliance with legal standards.

-

What are the benefits of using airSlate SignNow for my ct tax 2022 filings?

Using airSlate SignNow for your ct tax 2022 filings allows for increased efficiency, enhanced accuracy, and reduced turnaround times. You'll benefit from automated workflows that help you manage signatures and approvals quickly and effectively.

Get more for File And Pay Form CT1040 Electronically Using MyconneCT At Portal

Find out other File And Pay Form CT1040 Electronically Using MyconneCT At Portal

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation