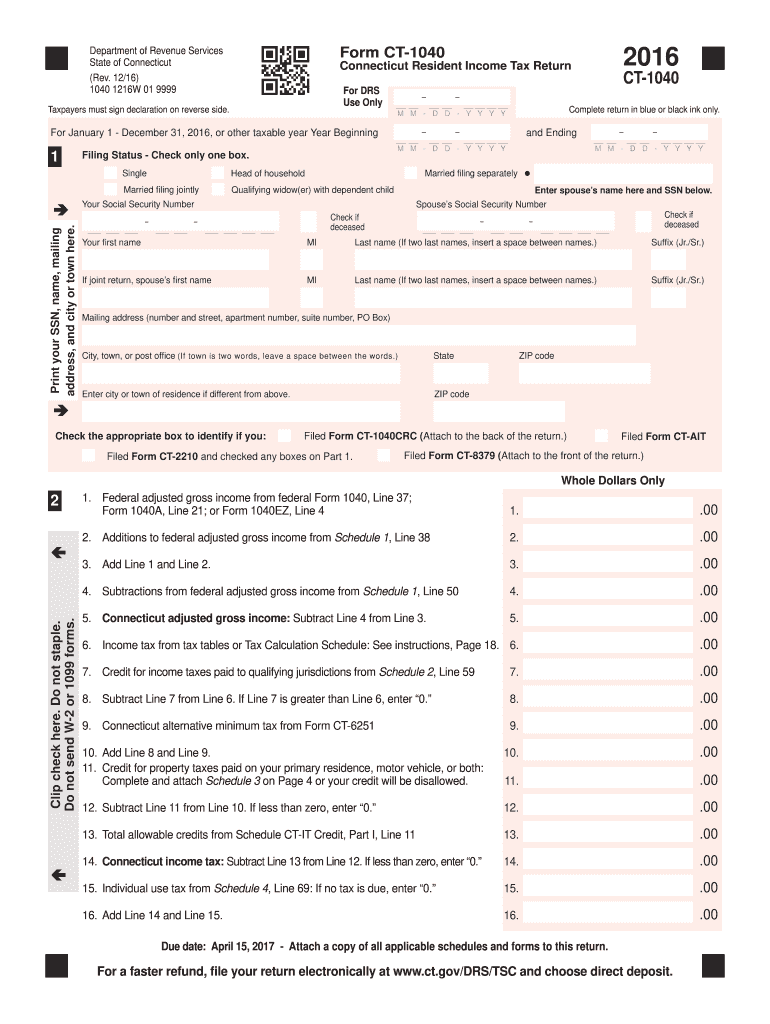

Ct 1040 Form 2016

What is the Ct 1040 Form

The Ct 1040 Form is the official state income tax return used by residents of Connecticut to report their income and calculate their state tax liability. It is similar to the federal Form 1040 but tailored to meet state-specific requirements. This form is essential for individuals and couples filing their annual income taxes in Connecticut, ensuring compliance with state tax laws.

How to use the Ct 1040 Form

To effectively use the Ct 1040 Form, taxpayers need to gather all necessary financial documents, such as W-2s, 1099s, and any other income statements. The form requires detailed information regarding income, deductions, and credits. Taxpayers should fill out the form accurately, ensuring that all calculations are correct. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Ct 1040 Form

Completing the Ct 1040 Form involves several key steps:

- Gather all relevant financial documents, including income statements and prior year tax returns.

- Fill out personal information, including name, address, and Social Security number.

- Report income from all sources, ensuring to include any taxable income.

- Claim applicable deductions and credits to reduce taxable income.

- Calculate total tax liability and any refund due or amount owed.

- Review the completed form for accuracy before submission.

Legal use of the Ct 1040 Form

The Ct 1040 Form must be used in accordance with Connecticut state tax laws. It is legally binding once signed and submitted, and taxpayers are responsible for the accuracy of the information provided. Filing this form is essential for compliance with state tax regulations, and failure to do so can result in penalties or legal consequences.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines when filing the Ct 1040 Form. Typically, the form must be filed by April fifteenth of each year, aligning with federal tax deadlines. Extensions may be available, but they must be requested prior to the original deadline. It is crucial to stay informed about any changes to deadlines announced by the Connecticut Department of Revenue Services.

Form Submission Methods (Online / Mail / In-Person)

The Ct 1040 Form can be submitted through various methods to accommodate taxpayer preferences:

- Online: Taxpayers can file electronically through approved e-filing services, which often provide guided assistance.

- Mail: Completed forms can be printed and mailed to the appropriate state tax office, ensuring proper postage is applied.

- In-Person: Some taxpayers may choose to file in person at designated state tax offices, where assistance may be available.

Quick guide on how to complete ct 1040 2016 form

Your assistance manual on how to prepare your Ct 1040 Form

If you’re curious about how to create and submit your Ct 1040 Form, here are some concise instructions on how to simplify tax processing.

To begin, you only need to set up your airSlate SignNow profile to revolutionize the way you handle documents online. airSlate SignNow is a highly user-friendly and robust document solution that allows you to alter, create, and finalize your tax documents with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and revisit to modify information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Ct 1040 Form in just minutes:

- Establish your account and begin working on PDFs in a matter of minutes.

- Utilize our catalog to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Ct 1040 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that filing on paper can lead to mistakes and slow down refunds. Naturally, before e-filing your taxes, check the IRS website for the declaration rules in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040 2016 form

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Can I file a claim with TurboTax for filing the wrong form for me? Instead of filling the 1040NR form in 2015 and 2016, TurboTax filled 1040 for me instead. Now I need to file for an amendment, which will cost $1200.

Sure you can. Pretty much any one can sue for anything. You have a snowballs chance in hell of winning though. Go back and read the disclaimer-terms of use that you just accepted without reading on installing it.You’ll notice that they bear NO responsibility for incorrect taxes.Besides it was your failure to pick the correct product. Turbo tax does not and has NEVER produced a 1040NR product.As my old Computer Science professors used to say. GIGO - Garbage In Garbage Out.

Create this form in 5 minutes!

How to create an eSignature for the ct 1040 2016 form

How to make an eSignature for the Ct 1040 2016 Form online

How to create an electronic signature for your Ct 1040 2016 Form in Google Chrome

How to make an eSignature for putting it on the Ct 1040 2016 Form in Gmail

How to make an electronic signature for the Ct 1040 2016 Form right from your smartphone

How to make an eSignature for the Ct 1040 2016 Form on iOS devices

How to make an electronic signature for the Ct 1040 2016 Form on Android

People also ask

-

What is the Ct 1040 Form?

The Ct 1040 Form is a tax form used by residents of Connecticut to report their income and calculate the state income tax owed. This form is essential for individuals filing their state taxes, and completing it accurately is crucial for compliance. airSlate SignNow provides an easy way to eSign the Ct 1040 Form to streamline your filing process.

-

How much does it cost to use airSlate SignNow for the Ct 1040 Form?

airSlate SignNow offers a variety of pricing plans designed to fit different needs and budgets, starting at a competitive rate for individual users. Our pricing includes access to features that allow for efficient eSigning of forms like the Ct 1040 Form. You can easily choose a plan that suits your requirements for document management.

-

What features does airSlate SignNow offer for the Ct 1040 Form?

airSlate SignNow includes features such as templates, cloud storage, and customizable signing workflows for the Ct 1040 Form. These capabilities allow you to manage your documents with ease, ensuring you can complete and eSign your forms without hassle. Additionally, our platform simplifies collaboration between multiple parties involved in the signing process.

-

How can airSlate SignNow improve the filing process for the Ct 1040 Form?

Using airSlate SignNow for the Ct 1040 Form can signNowly streamline your filing process. Our platform offers a user-friendly interface that allows for quick eSigning and document sharing. This not only saves time but also minimizes errors and ensures that your documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other applications for filing the Ct 1040 Form?

Yes, airSlate SignNow integrates seamlessly with various applications and tools often used for tax preparation and document management. This allows you to easily import data and expedite the process of completing your Ct 1040 Form. Integrations help enhance your workflow by connecting to accounting software and CRM systems.

-

Is airSlate SignNow secure for signing the Ct 1040 Form?

Absolutely! airSlate SignNow prioritizes security with advanced encryption protocols to protect your data while you eSign the Ct 1040 Form. Your information is safeguarded, ensuring that your documents remain confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for business taxes including the Ct 1040 Form?

Using airSlate SignNow for business taxes, including the Ct 1040 Form, offers several benefits such as increased efficiency, reduced processing times, and a smoother workflow. Our solution allows businesses to handle multiple signatures and approvals quickly, enhancing productivity. Moreover, the ease of use encourages compliance and accuracy in your tax filings.

Get more for Ct 1040 Form

Find out other Ct 1040 Form

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later