Ct Tax 2021

What is the CT Tax?

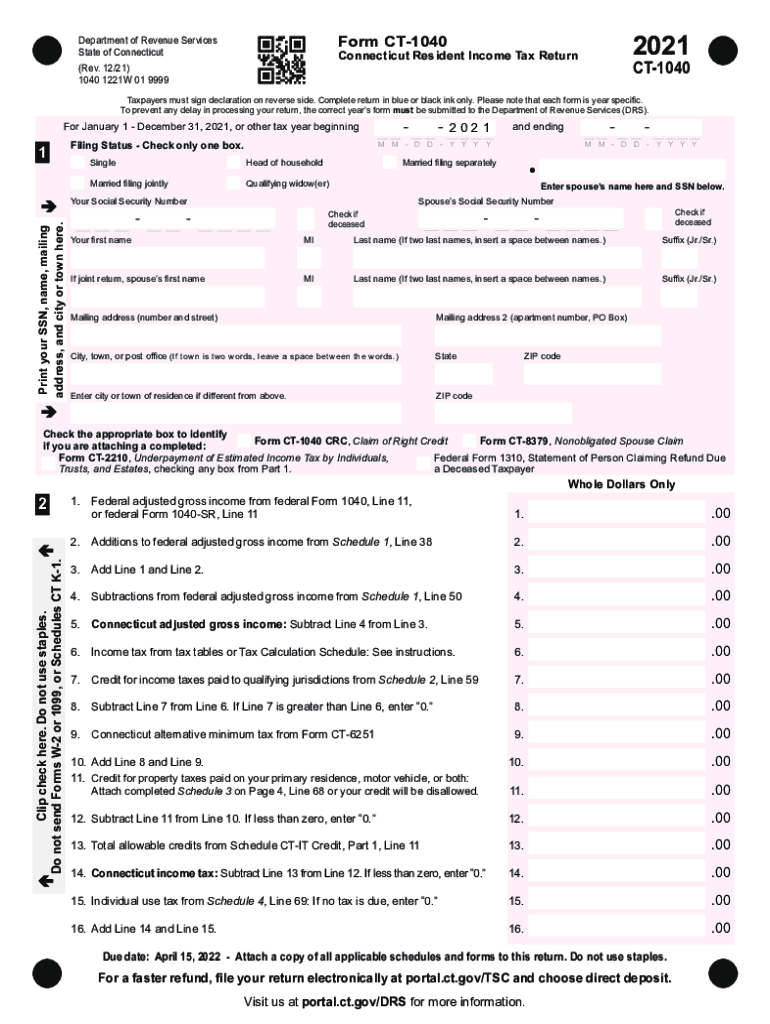

The Connecticut tax, often referred to as the 2019 CT tax, is a state income tax levied on individuals and businesses operating within Connecticut. This tax is calculated based on the taxpayer's income and is essential for funding state services and infrastructure. The tax applies to various income types, including wages, salaries, and investment income. Understanding the specifics of the CT tax is crucial for residents and businesses to ensure compliance and optimize their tax liabilities.

Steps to Complete the CT Tax

Completing the 2019 CT tax involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099 forms, and any other income statements. Next, determine your filing status, which can impact your tax rate and deductions. After that, calculate your total income and applicable deductions. Use the appropriate tax tables or software to determine your tax liability. Finally, review your completed form for accuracy before submitting it to the Connecticut Department of Revenue Services.

Legal Use of the CT Tax

The legal framework surrounding the CT tax mandates that all residents and businesses report their income accurately and pay the appropriate tax amount. Compliance with state tax laws is essential to avoid penalties and legal repercussions. Electronic filing methods, such as using e-signature solutions, can enhance the legal validity of your submissions. It is important to maintain records of your tax filings and any correspondence with tax authorities for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the 2019 CT tax are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the deadline for individual income tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may need to consider estimated tax payment deadlines throughout the year to ensure they meet their obligations in a timely manner.

Required Documents

When preparing to file the 2019 CT tax, certain documents are essential for accurate reporting. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income, such as rental or investment income

- Documentation for deductions, including mortgage interest statements and property tax receipts

- Previous year’s tax return for reference

Having these documents organized will facilitate a smoother filing process.

Form Submission Methods

Taxpayers have several options for submitting the 2019 CT tax. The most common methods include:

- Online filing through the Connecticut Department of Revenue Services website

- Mailing a paper return to the appropriate address provided by the state

- In-person submission at designated state offices

Each method has its own advantages, such as the speed of online filing versus the traditional approach of mailing a paper return.

Penalties for Non-Compliance

Failing to comply with the 2019 CT tax requirements can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for severe cases of tax evasion. It is important for taxpayers to understand their obligations and file on time to avoid these consequences. Regularly reviewing tax regulations can help ensure compliance and mitigate risks associated with non-compliance.

Quick guide on how to complete 2019 ct tax

Effortlessly Prepare Ct Tax on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, enabling you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents rapidly without any holdups. Manage Ct Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Ct Tax Effortlessly

- Obtain Ct Tax and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and eSign Ct Tax and guarantee excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 ct tax

Create this form in 5 minutes!

People also ask

-

What is the significance of the 2019 CT tax for my business?

The 2019 CT tax impacts how businesses file their taxes, including various deductions and credits available. Understanding this tax ensures that you comply with state regulations and can maximize savings. airSlate SignNow provides tools to help streamline document management related to the 2019 CT tax, ensuring you stay organized and compliant.

-

How can airSlate SignNow help with 2019 CT tax documentation?

airSlate SignNow simplifies the process of gathering and signing necessary documents related to the 2019 CT tax. With its user-friendly interface, users can easily send and eSign tax forms, making the filing process more efficient. This ensures that your tax documentation is timely and organized.

-

Are there integrations available for managing 2019 CT tax documents?

Yes, airSlate SignNow integrates with various accounting software that can manage 2019 CT tax documents, thus providing a comprehensive approach to tax management. This integration allows for seamless data transfer, ensuring that your tax records are up-to-date and easily accessible. By using these integrations, you can also save time on data entry and improve accuracy.

-

What features does airSlate SignNow offer to ease the process of handling 2019 CT tax forms?

airSlate SignNow offers features such as customizable templates, automatic reminders, and a secure signing process specifically designed for tax forms, including those for the 2019 CT tax. These features help users manage their tax documentation effectively, ensuring they meet deadlines. Additionally, the platform provides encryption and compliance measures to protect sensitive information.

-

Can I track my 2019 CT tax documents with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow businesses to monitor the status of their 2019 CT tax documents in real-time. This means you can see when a document has been sent, viewed, and signed, giving you peace of mind that your tax forms are being handled promptly. This level of transparency helps in managing deadlines and follow-ups.

-

How cost-effective is airSlate SignNow for businesses managing 2019 CT tax documents?

airSlate SignNow is designed to be a cost-effective solution for businesses handling their 2019 CT tax documents. With flexible pricing plans, companies can choose the option that fits their needs without breaking the bank. The savings achieved by streamlining document management often outweigh the subscription costs, making it a smart investment for tax season.

-

What benefits can I expect when using airSlate SignNow for 2019 CT tax preparation?

Using airSlate SignNow for your 2019 CT tax preparation offers numerous benefits such as time savings, improved accuracy, and enhanced security for your documents. The streamlined workflow allows your team to focus on what really matters—growing the business while ensuring compliance. Additionally, the ease of eSigning helps in reducing paperwork hassle.

Get more for Ct Tax

- Employment employee personnel file package hawaii form

- Hawaii assignment form

- Assignment of lease package hawaii form

- Lease purchase agreements package hawaii form

- Satisfaction cancellation or release of mortgage package hawaii form

- Premarital agreements package hawaii form

- Painting contractor package hawaii form

- Framing contractor package hawaii form

Find out other Ct Tax

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now