Connecticut Form CT 1040 Connecticut Resident Income Tax 2020

What is the Connecticut Form CT 1040 Connecticut Resident Income Tax

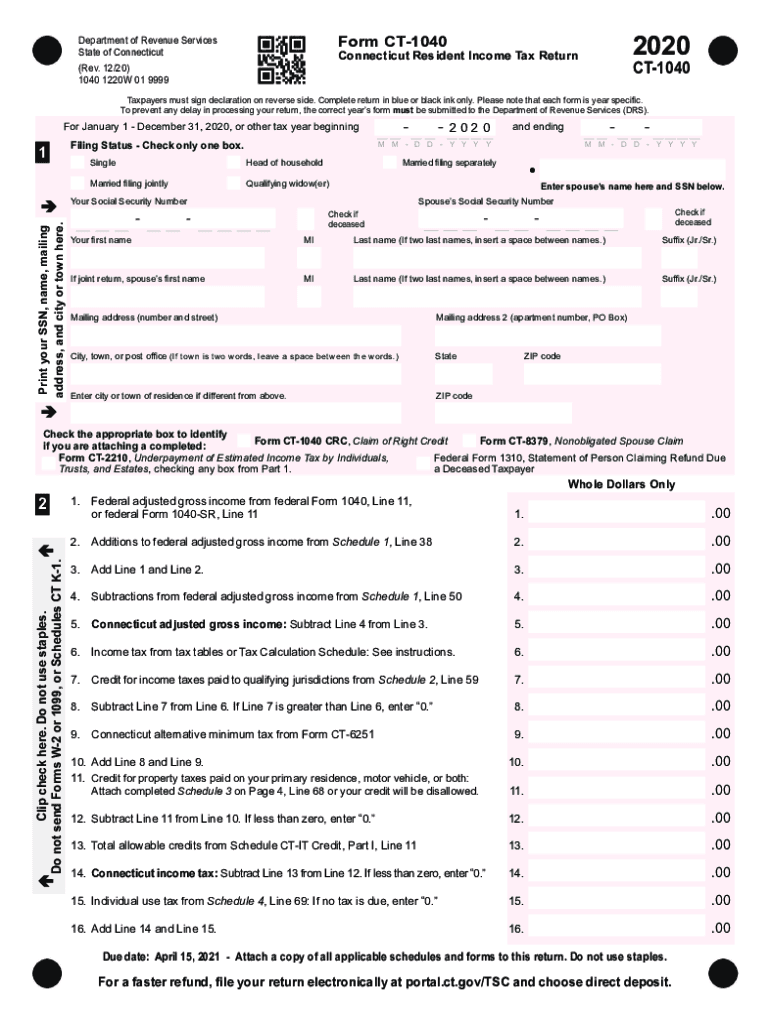

The Connecticut Form CT 1040 is the primary income tax return form for residents of Connecticut. It is used by individuals to report their income, calculate their tax liability, and determine any refunds or amounts owed to the state. This form is essential for residents who earn income within the state, including wages, salaries, and other sources of income. Understanding the purpose and requirements of the CT 1040 is crucial for ensuring compliance with state tax laws.

Steps to complete the Connecticut Form CT 1040 Connecticut Resident Income Tax

Completing the Connecticut Form CT 1040 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Begin filling out the form by entering your personal information, such as your name, address, and Social Security number.

- Report your total income by adding all sources of income, including wages, interest, and dividends.

- Calculate your deductions and credits, which can reduce your taxable income.

- Determine your tax liability using the tax tables provided in the form instructions.

- Review your calculations for accuracy and ensure all required fields are completed.

- Sign and date the form before submission.

Required Documents

To accurately complete the Connecticut Form CT 1040, several documents are necessary:

- W-2 forms from employers for reporting wages and salaries.

- 1099 forms for reporting other income sources, such as freelance work or interest income.

- Records of any deductions you plan to claim, such as mortgage interest or property taxes.

- Any additional documentation required for specific credits or adjustments.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Connecticut Form CT 1040 to avoid penalties:

- The standard filing deadline is April 15 for the previous tax year.

- If you require additional time, you can file for an extension, which typically grants an additional six months.

- Payments for any taxes owed are also due by April 15 to avoid interest and penalties.

Legal use of the Connecticut Form CT 1040 Connecticut Resident Income Tax

The Connecticut Form CT 1040 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must provide accurate information and comply with all relevant tax laws. E-signatures are accepted, provided they meet the requirements set forth by the state. Additionally, maintaining records of submitted forms and supporting documents is essential for legal compliance and future reference.

Form Submission Methods (Online / Mail / In-Person)

The Connecticut Form CT 1040 can be submitted through various methods:

- Online submission via the Connecticut Department of Revenue Services (DRS) website, which allows for faster processing and confirmation.

- Mailing a paper copy of the completed form to the designated address provided in the form instructions.

- In-person submission at local DRS offices, which may be beneficial for those needing assistance or clarification.

Quick guide on how to complete connecticut form ct 1040 connecticut resident income tax

Complete Connecticut Form CT 1040 Connecticut Resident Income Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly and without hassle. Handle Connecticut Form CT 1040 Connecticut Resident Income Tax on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest way to modify and electronically sign Connecticut Form CT 1040 Connecticut Resident Income Tax with ease

- Find Connecticut Form CT 1040 Connecticut Resident Income Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes merely seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Connecticut Form CT 1040 Connecticut Resident Income Tax and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticut form ct 1040 connecticut resident income tax

Create this form in 5 minutes!

How to create an eSignature for the connecticut form ct 1040 connecticut resident income tax

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What are CT DRS forms and why are they important?

CT DRS forms are essential documents used by businesses and individuals in Connecticut for various transactions, such as tax filings and legal agreements. Ensuring these forms are completed accurately can simplify compliance and reduce errors.

-

How does airSlate SignNow support CT DRS forms?

AirSlate SignNow provides a streamlined platform for eSigning and managing CT DRS forms efficiently. Our solution allows users to electronically fill out, sign, and send these forms, ensuring quick turnaround times and compliance with state regulations.

-

What are the pricing options for using airSlate SignNow for CT DRS forms?

AirSlate SignNow offers flexible pricing plans designed to meet the needs of different users. Whether you're a small business or a large enterprise, you can choose a plan that provides an affordable rate while enabling seamless handling of CT DRS forms.

-

Can I integrate airSlate SignNow with other software for managing CT DRS forms?

Yes, airSlate SignNow integrates seamlessly with popular software solutions, allowing users to manage their CT DRS forms alongside other business tools. This integration enhances workflow efficiency and helps maintain accurate records.

-

Is it easy to eSign CT DRS forms with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign CT DRS forms. The user-friendly interface ensures that anyone can quickly navigate the signing process, whether on desktop or mobile devices.

-

What are the main benefits of using airSlate SignNow for CT DRS forms?

Using airSlate SignNow for CT DRS forms provides numerous benefits, including enhanced speed, security, and accessibility. With our robust digital signature capabilities, you can sign documents securely from anywhere, improving overall productivity.

-

Are there templates available for CT DRS forms in airSlate SignNow?

Yes, airSlate SignNow offers a variety of customizable templates for CT DRS forms. These templates save time and ensure that all necessary fields are filled out correctly, helping you to comply with state requirements effortlessly.

Get more for Connecticut Form CT 1040 Connecticut Resident Income Tax

- Basic econometrics questions and answers pdf form

- Naac student survey form

- Gsrtc ticket download form

- Suffolk county pistol permit amendment form

- Form 1195 identity declaration form pdf

- Applicant medical history form

- Myers stevens claim form cifsf

- Fixed term residential tenancy agreement all parti form

Find out other Connecticut Form CT 1040 Connecticut Resident Income Tax

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy