Ct 1040 Form 2017

What is the Ct 1040 Form

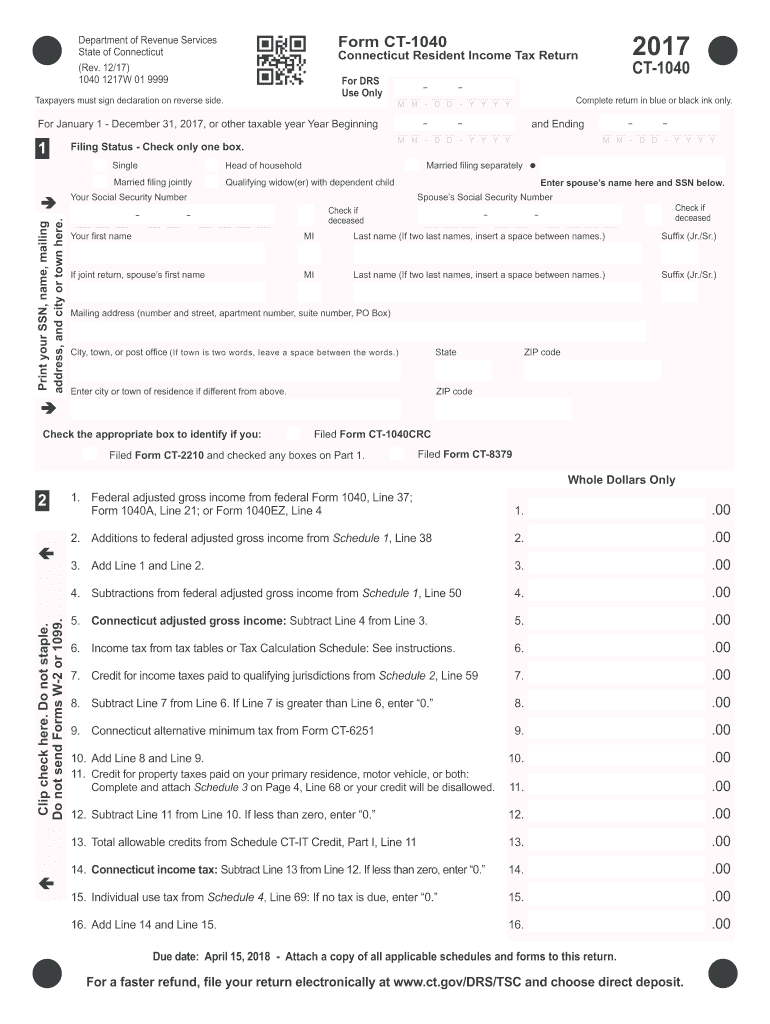

The Ct 1040 Form is a state income tax return form used by residents of Connecticut to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and need to comply with Connecticut tax laws. The information provided on the Ct 1040 Form is used by the Connecticut Department of Revenue Services to assess the amount of tax owed or the refund due to the taxpayer.

How to use the Ct 1040 Form

Using the Ct 1040 Form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with accurate information regarding your income, deductions, and credits. Ensure that all calculations are correct to avoid any discrepancies. After completing the form, review it for accuracy before submitting it to the state. The form can be filed electronically or mailed to the appropriate state office.

Steps to complete the Ct 1040 Form

Completing the Ct 1040 Form requires careful attention to detail. Follow these steps:

- Gather all relevant income documentation, such as W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Claim any eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form to certify that the information is true and complete.

- Submit the form by the filing deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Ct 1040 Form to avoid penalties. Typically, the deadline for filing state income tax returns in Connecticut is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available and the corresponding deadlines for submitting those requests.

Required Documents

To complete the Ct 1040 Form accurately, certain documents are necessary. These include:

- W-2 forms from employers showing annual earnings.

- 1099 forms for other income sources, such as freelance work or interest income.

- Documentation for any deductions or credits claimed, such as receipts for medical expenses or education costs.

- Previous year’s tax return for reference, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Ct 1040 Form can be submitted in several ways. Taxpayers can file electronically using approved tax software, which often provides a streamlined process for completing and submitting the form. Alternatively, individuals may choose to print the completed form and mail it to the Connecticut Department of Revenue Services. In some cases, in-person submissions may be possible at designated state offices, although this option may be limited.

Quick guide on how to complete ct 1040 2017 form

Your assistance manual on preparing your Ct 1040 Form

If you’re wondering how to create and dispatch your Ct 1040 Form, here are a few concise instructions on how to simplify tax submission.

To begin, you simply need to register your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, generate, and finalize your tax paperwork with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit to adjust responses when necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Ct 1040 Form in just minutes:

- Create your account and start editing PDFs in moments.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Ct 1040 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any inaccuracies.

- Save alterations, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can lead to return mistakes and delay refunds. Additionally, before e-filing your taxes, check the IRS website for submission guidelines in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040 2017 form

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

Create this form in 5 minutes!

How to create an eSignature for the ct 1040 2017 form

How to generate an eSignature for your Ct 1040 2017 Form in the online mode

How to make an electronic signature for the Ct 1040 2017 Form in Chrome

How to create an eSignature for signing the Ct 1040 2017 Form in Gmail

How to make an electronic signature for the Ct 1040 2017 Form right from your smart phone

How to make an electronic signature for the Ct 1040 2017 Form on iOS

How to make an electronic signature for the Ct 1040 2017 Form on Android

People also ask

-

What is the Ct 1040 Form and why do I need it?

The Ct 1040 Form is the primary tax form used by residents of Connecticut to report their income and calculate their state tax liability. It is essential for ensuring compliance with state tax laws and determining the correct amount of tax owed or refund due. By filing the Ct 1040 Form accurately, you can avoid penalties and ensure you are taking advantage of any applicable deductions.

-

How can airSlate SignNow help me with the Ct 1040 Form?

airSlate SignNow simplifies the process of preparing and signing your Ct 1040 Form by providing an easy-to-use platform for document management. You can securely upload, edit, and eSign your Ct 1040 Form in minutes, ensuring a hassle-free experience. Our solution streamlines workflows, making tax season less stressful and more efficient.

-

Is there a cost associated with using airSlate SignNow for the Ct 1040 Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit your needs, whether you are an individual or a business. Our plans are designed to be cost-effective, providing you with all the necessary features to manage your Ct 1040 Form and other documents without breaking the bank. Explore our website for detailed pricing information and choose the plan that works best for you.

-

What features does airSlate SignNow offer for managing the Ct 1040 Form?

airSlate SignNow provides robust features for managing the Ct 1040 Form, including document templates, electronic signatures, and real-time tracking. You can also collaborate with tax professionals seamlessly and ensure that all parties have access to the latest version of your Ct 1040 Form. This enhances efficiency and helps you stay organized during tax season.

-

Can I integrate airSlate SignNow with other tools for my Ct 1040 Form?

Absolutely! airSlate SignNow offers integrations with popular tools such as Google Drive, Dropbox, and CRM systems, allowing you to manage your Ct 1040 Form alongside other important documents. This seamless integration helps streamline your workflow and ensures that all your tax documents are easily accessible in one place.

-

Is airSlate SignNow secure for filing my Ct 1040 Form?

Yes, airSlate SignNow prioritizes the security of your documents, including the Ct 1040 Form. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can eSign and send your Ct 1040 Form confidently, knowing that your data is in safe hands.

-

How do I get started with airSlate SignNow for my Ct 1040 Form?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, and you can begin uploading and managing your Ct 1040 Form right away. Our intuitive interface guides you through the process of eSigning and sharing your form, making it accessible and user-friendly for everyone.

Get more for Ct 1040 Form

Find out other Ct 1040 Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online