CT 1040, Connecticut Resident Income Tax Return It's Your 2020

What is the CT 1040, Connecticut Resident Income Tax Return

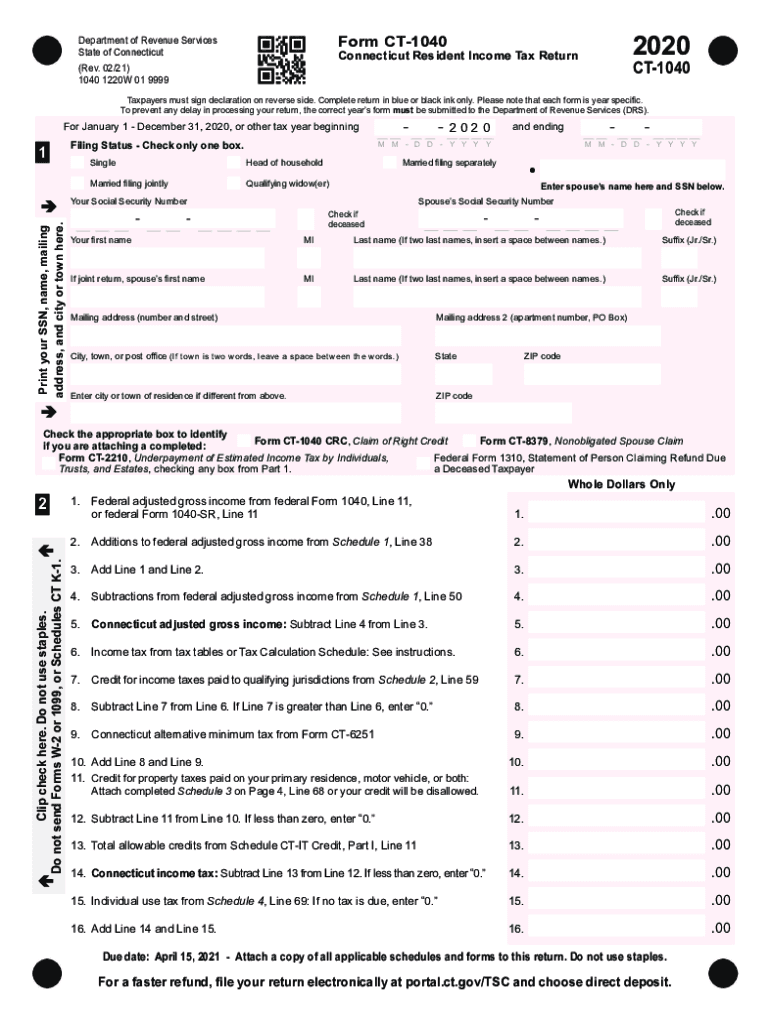

The CT 1040 is the official income tax return form for residents of Connecticut. It is used to report income, calculate tax liability, and claim any applicable credits or deductions. This form is essential for individuals who reside in Connecticut and earn income, whether from wages, self-employment, or other sources. Understanding the CT 1040 is crucial for ensuring compliance with state tax laws and for accurately reporting financial information to the Connecticut Department of Revenue Services.

Steps to Complete the CT 1040

Completing the CT 1040 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2 forms, 1099s, and any records of other income. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your total income, followed by adjustments, deductions, and credits that apply to your situation. Finally, calculate your tax due or refund and sign the form before submitting it. Each section must be completed carefully to avoid errors that could lead to penalties or delays.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the CT 1040. Typically, the deadline for submitting your Connecticut state tax return is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, if you require more time, you can file for an extension, but it is important to pay any estimated taxes owed by the original deadline to avoid penalties. Keeping track of these dates helps ensure timely compliance with state tax obligations.

Required Documents

When preparing to file the CT 1040, certain documents are necessary to provide accurate information. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income sources

- Documentation for deductions and credits, such as mortgage interest statements or proof of charitable contributions

- Previous year’s tax return for reference

Having all these documents ready will streamline the process of completing your tax return.

Legal Use of the CT 1040

The CT 1040 serves as a legally binding document when filed correctly. It must be signed by the taxpayer to affirm that the information provided is accurate and complete. In the context of electronic submissions, using a reliable eSignature solution ensures that the filing meets legal standards. Compliance with state tax regulations is essential, as inaccuracies or omissions can lead to legal repercussions, including penalties or audits.

Eligibility Criteria

Eligibility to file the CT 1040 generally includes any individual who is a resident of Connecticut and has earned income during the tax year. This includes full-time and part-time residents, as well as those who may have moved to the state during the year. Certain exemptions may apply, such as for individuals with very low income or specific categories of taxpayers like students or retirees. Understanding your eligibility ensures that you file the correct form and comply with state tax laws.

Quick guide on how to complete ct 1040 connecticut resident income tax return its your

Prepare CT 1040, Connecticut Resident Income Tax Return It's Your effortlessly on any device

The management of online documents has gained traction among enterprises and individuals alike. It serves as a superb environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the needed form and safely preserve it on the web. airSlate SignNow provides all the resources necessary to create, alter, and electronically sign your documents promptly without any hold-ups. Manage CT 1040, Connecticut Resident Income Tax Return It's Your on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign CT 1040, Connecticut Resident Income Tax Return It's Your with ease

- Locate CT 1040, Connecticut Resident Income Tax Return It's Your and select Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize essential parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as an ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign CT 1040, Connecticut Resident Income Tax Return It's Your and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040 connecticut resident income tax return its your

Create this form in 5 minutes!

How to create an eSignature for the ct 1040 connecticut resident income tax return its your

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a 1040ct and how does it relate to airSlate SignNow?

The 1040ct is a specific form used for Connecticut tax purposes. With airSlate SignNow, you can easily send and eSign your 1040ct documents, ensuring compliance and timely submission to the state. Our platform streamlines the process, making it simple to manage your tax needs.

-

How much does it cost to use airSlate SignNow for filing a 1040ct?

airSlate SignNow offers competitive pricing plans that are tailored to meet different user needs. The cost for using our services to file a 1040ct is highly affordable compared to traditional methods, allowing you to manage your documents without breaking the bank.

-

What features does airSlate SignNow offer for 1040ct document management?

Our platform includes features such as eSignature capabilities, document templates, and secure storage options specifically designed for managing 1040ct files. These tools help enhance efficiency and ensure that your documents are legally binding and compliant.

-

Is airSlate SignNow easy to use for beginners filing a 1040ct?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for beginners. The intuitive interface guides you through the steps needed to efficiently complete and eSign your 1040ct, helping you save time and avoid complications.

-

Can I integrate airSlate SignNow with other software for filing a 1040ct?

Absolutely! airSlate SignNow allows seamless integration with various applications, enhancing your workflow for filing a 1040ct. This means you can connect with accounting software, CRM systems, and other tools to streamline your document management process.

-

What are the benefits of using airSlate SignNow for my 1040ct?

By using airSlate SignNow for your 1040ct, you gain benefits like faster processing times, improved accuracy, and reduced paperwork. Our platform also enhances collaboration among teams, allowing for efficient communication and document sharing.

-

Is the data I upload for my 1040ct secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We employ advanced encryption protocols and security measures to ensure that your sensitive information related to your 1040ct is safely protected during the entire signing and storing process.

Get more for CT 1040, Connecticut Resident Income Tax Return It's Your

- Alaska mechanics form

- Alaska construction or mechanics lien package corporation alaska form

- Storage business package alaska form

- Child care services package alaska form

- Special or limited power of attorney for real estate sales transaction by seller alaska form

- Special or limited power of attorney for real estate purchase transaction by purchaser alaska form

- Limited power of attorney where you specify powers with sample powers included alaska form

- Limited power of attorney for stock transactions and corporate powers alaska form

Find out other CT 1040, Connecticut Resident Income Tax Return It's Your

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form