Estimated Tax Payments What They Are and Who Needs 2019

Understanding Estimated Tax Payments

Estimated tax payments are advance payments made to the Internal Revenue Service (IRS) for taxes owed on income that is not subject to withholding. This includes income from self-employment, interest, dividends, and rental income. Individuals who expect to owe tax of $1,000 or more when filing their return must make these payments. It is crucial for taxpayers to understand their obligations to avoid penalties.

Steps to Complete Estimated Tax Payments

To complete estimated tax payments, follow these steps:

- Calculate your expected tax liability for the year, considering all sources of income.

- Determine the amount of tax you have already paid through withholding or previous estimated payments.

- Subtract your total payments from your expected tax liability to find the amount you need to pay.

- Divide this amount by the number of payment periods remaining in the year, typically four.

- Submit your payment using the IRS's online payment system, or by mailing a check with the appropriate form.

IRS Guidelines for Estimated Tax Payments

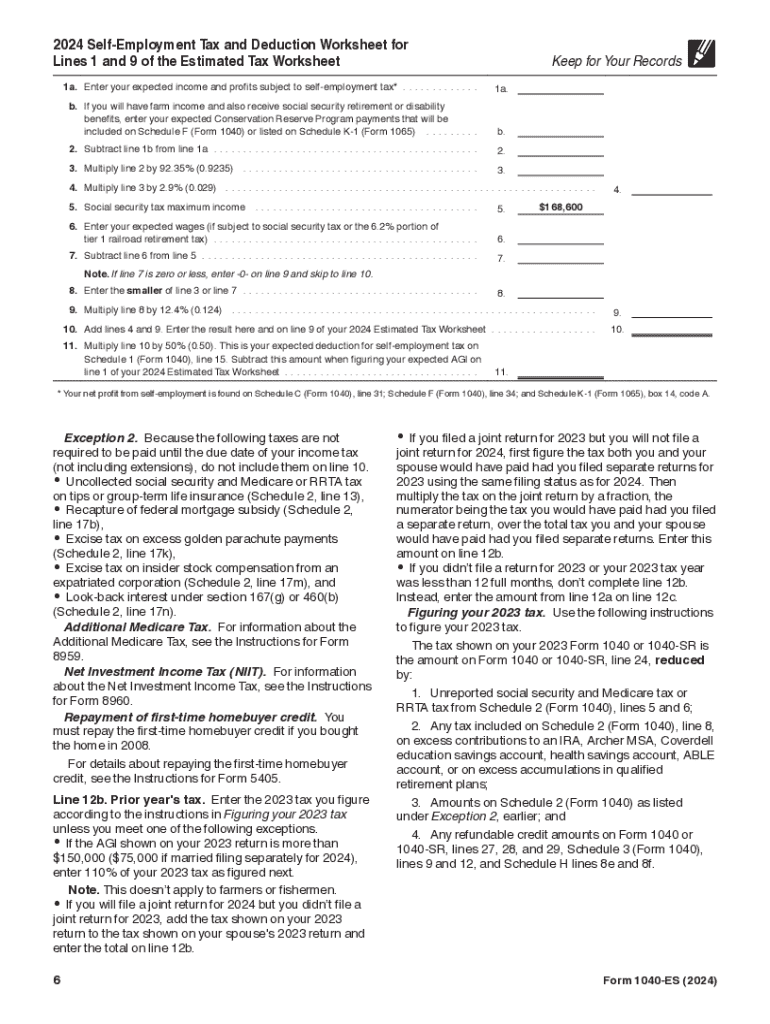

The IRS provides specific guidelines for making estimated tax payments. Taxpayers must use Form 1040-ES to calculate and report their estimated taxes. Payments are generally due quarterly, with deadlines typically falling in April, June, September, and January of the following year. It is important to adhere to these deadlines to avoid interest and penalties.

Required Documents for Estimated Tax Payments

When preparing to make estimated tax payments, gather the following documents:

- Your previous year's tax return, which provides a basis for estimating your current tax liability.

- Any income statements, such as 1099 forms, that report income not subject to withholding.

- Records of any deductions or credits you plan to claim, as these will affect your overall tax liability.

Filing Deadlines for Estimated Tax Payments

Filing deadlines for estimated tax payments are crucial for compliance. The typical due dates are:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Taxpayers should mark these dates on their calendars to ensure timely payments.

Penalties for Non-Compliance

Failing to make estimated tax payments can result in penalties. The IRS may charge interest on any unpaid tax, and a penalty may apply if the total payments made are less than 90% of the current year's tax liability or less than 100% of the previous year's tax liability. Understanding these penalties can help taxpayers stay compliant and avoid unexpected costs.

Quick guide on how to complete estimated tax payments what they are and who needs

Prepare Estimated Tax Payments What They Are And Who Needs effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as a superb environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly without any delays. Manage Estimated Tax Payments What They Are And Who Needs across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and electronically sign Estimated Tax Payments What They Are And Who Needs without hassle

- Find Estimated Tax Payments What They Are And Who Needs and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the frustration of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Estimated Tax Payments What They Are And Who Needs and ensure smooth communication at each step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct estimated tax payments what they are and who needs

Create this form in 5 minutes!

How to create an eSignature for the estimated tax payments what they are and who needs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help with forms?

airSlate SignNow is a powerful tool that enables businesses to create, send, and eSign forms effortlessly. With its user-friendly interface, you can streamline your document workflows and ensure that your forms are completed quickly and securely. This solution is designed to enhance productivity and reduce the time spent on paperwork.

-

How much does airSlate SignNow cost for form management?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. You can choose from various subscription options that provide access to essential features for managing forms. This cost-effective solution ensures that you get the best value while optimizing your document processes.

-

What features does airSlate SignNow offer for creating forms?

airSlate SignNow provides a range of features for creating forms, including customizable templates, drag-and-drop functionality, and the ability to add fields for signatures, dates, and text. These features make it easy to design forms that suit your specific requirements. Additionally, you can automate workflows to enhance efficiency.

-

Can I integrate airSlate SignNow with other applications for form management?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage your forms alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, you can connect airSlate SignNow to streamline your workflows. This integration capability enhances the overall efficiency of your form processes.

-

What are the benefits of using airSlate SignNow for forms?

Using airSlate SignNow for forms provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. By digitizing your forms, you can eliminate the hassle of paper-based processes and ensure that documents are signed and returned promptly. This leads to faster turnaround times and improved customer satisfaction.

-

Is it easy to eSign forms with airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process, allowing users to sign forms electronically with just a few clicks. The platform is designed to be intuitive, ensuring that both senders and signers can navigate the process without any technical difficulties. This ease of use contributes to a smoother experience for all parties involved.

-

How secure is airSlate SignNow when handling forms?

airSlate SignNow prioritizes security when handling forms, employing advanced encryption and compliance with industry standards. Your documents are protected throughout the signing process, ensuring that sensitive information remains confidential. This commitment to security helps build trust with your clients and partners.

Get more for Estimated Tax Payments What They Are And Who Needs

- Letter from landlord to tenant returning security deposit less deductions maine form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return maine form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return maine form

- Letter from tenant to landlord containing request for permission to sublease maine form

- Maine landlord tenant form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent maine form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable maine form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration maine form

Find out other Estimated Tax Payments What They Are And Who Needs

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy