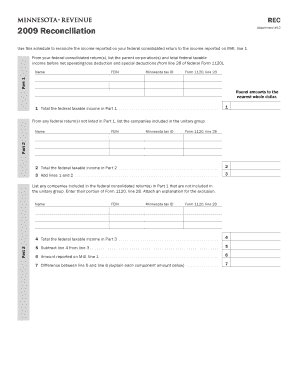

REC Reconciliation Attachment #12 Use This Schedule to Reconcile the Income Reported on Your Federal Consolidated Return to the Form

Understanding the REC Reconciliation Attachment #12

The REC Reconciliation Attachment #12 is a crucial document for reconciling the income reported on your federal consolidated return with the income reported on M4I, Line 1. This form is specifically designed to ensure that all income figures align correctly, which is essential for accurate tax reporting. It serves as a tool for tax professionals and businesses to verify that the income reported to the IRS matches what is reported at the state level, thus maintaining compliance with federal and state tax regulations.

How to Use the REC Reconciliation Attachment #12

Using the REC Reconciliation Attachment #12 involves a systematic approach. First, gather your federal consolidated return and the M4I form. Next, identify the income figures reported on both documents. The attachment provides a structured schedule where you can input these figures. Carefully compare each line item to ensure accuracy. If discrepancies arise, document the reasons for the differences in the designated sections of the attachment. This process not only aids in compliance but also helps in identifying potential errors before submission.

Steps to Complete the REC Reconciliation Attachment #12

Completing the REC Reconciliation Attachment #12 involves several key steps:

- Collect your federal consolidated return and M4I, Line 1 documentation.

- Fill in the income figures from your federal return on the attachment.

- Enter the corresponding income figures from M4I, Line 1.

- Review each entry for accuracy and consistency.

- Document any discrepancies, providing explanations as needed.

- Finalize the attachment by ensuring all required signatures are included.

Key Elements of the REC Reconciliation Attachment #12

The key elements of the REC Reconciliation Attachment #12 include:

- Income Reporting: Sections dedicated to reporting income from both federal and state documents.

- Discrepancy Documentation: Areas to explain any differences between reported figures.

- Signature Lines: Required signatures to validate the reconciliation process.

- Instructions: Clear guidelines for completing each section of the form.

IRS Guidelines for the REC Reconciliation Attachment #12

The IRS provides specific guidelines for using the REC Reconciliation Attachment #12. These guidelines emphasize the importance of accuracy in reporting income and the need for proper documentation of any discrepancies. Taxpayers are encouraged to maintain thorough records that support the figures reported on both the federal consolidated return and the M4I form. Following IRS guidelines helps prevent penalties and ensures compliance with tax laws.

Obtaining the REC Reconciliation Attachment #12

The REC Reconciliation Attachment #12 can typically be obtained through state tax authority websites or by contacting your tax professional. Many states provide downloadable forms on their official websites, ensuring that taxpayers have easy access to the necessary documentation for reconciliation. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Quick guide on how to complete rec reconciliation attachment 12 use this schedule to reconcile the income reported on your federal consolidated return to the

Easily prepare [SKS] on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hurdles. Manage [SKS] on any device using airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

Effortlessly modify and eSign [SKS]

- Find [SKS] and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this function.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your chosen device. Modify and electronically sign [SKS] to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rec reconciliation attachment 12 use this schedule to reconcile the income reported on your federal consolidated return to the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the REC Reconciliation Attachment #12 and how does it work?

The REC Reconciliation Attachment #12 Use This Schedule To Reconcile The Income Reported On Your Federal Consolidated Return To The Income Reported On M4I, Line 1 is a crucial tool for ensuring accurate income reporting. It helps businesses align their federal consolidated return with state income reports, minimizing discrepancies. By using this schedule, you can streamline your reconciliation process and maintain compliance with tax regulations.

-

How can airSlate SignNow assist with the REC Reconciliation Attachment #12?

airSlate SignNow provides a user-friendly platform that simplifies the process of preparing and submitting the REC Reconciliation Attachment #12. With our eSigning capabilities, you can easily send and sign documents related to your income reconciliation. This ensures that your submissions are timely and accurate, enhancing your overall compliance efforts.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for small businesses and larger enterprises. Each plan includes access to features that support the REC Reconciliation Attachment #12 Use This Schedule To Reconcile The Income Reported On Your Federal Consolidated Return To The Income Reported On M4I, Line 1. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features designed to enhance document management, such as customizable templates, automated workflows, and secure cloud storage. These features are particularly beneficial when working with the REC Reconciliation Attachment #12, as they streamline the process of gathering and organizing necessary documents. This efficiency can save time and reduce errors in your reconciliation efforts.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers seamless integrations with various software tools, including accounting and tax preparation software. This allows you to easily incorporate the REC Reconciliation Attachment #12 Use This Schedule To Reconcile The Income Reported On Your Federal Consolidated Return To The Income Reported On M4I, Line 1 into your existing workflows. Integrations enhance productivity and ensure that all your data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for tax reconciliation?

Using airSlate SignNow for tax reconciliation, including the REC Reconciliation Attachment #12, provides numerous benefits such as increased accuracy, reduced processing time, and enhanced compliance. Our platform simplifies the eSigning process, making it easier to obtain necessary approvals. Additionally, the secure storage of documents ensures that your sensitive information is protected.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from startups to large corporations. Regardless of your business's scale, you can effectively utilize the REC Reconciliation Attachment #12 Use This Schedule To Reconcile The Income Reported On Your Federal Consolidated Return To The Income Reported On M4I, Line 1 within our platform. Our flexible features and pricing plans make it accessible for everyone.

Get more for REC Reconciliation Attachment #12 Use This Schedule To Reconcile The Income Reported On Your Federal Consolidated Return To The

Find out other REC Reconciliation Attachment #12 Use This Schedule To Reconcile The Income Reported On Your Federal Consolidated Return To The

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple