Schedule C Tax Form 2015

What is the Schedule C Tax Form

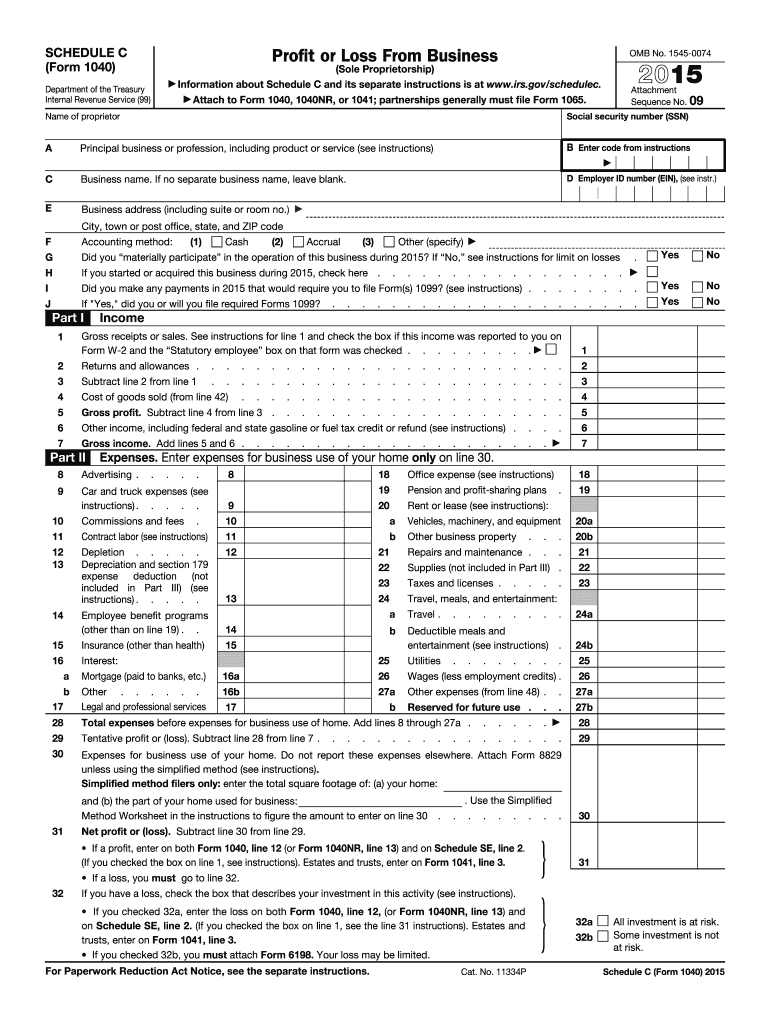

The Schedule C tax form, officially known as the 2015 IRS Schedule C, is used by sole proprietors to report income or loss from their business. This form is part of the individual income tax return process and is filed alongside Form 1040. It allows self-employed individuals to detail their business income, expenses, and ultimately calculate their net profit or loss for the tax year. Understanding the Schedule C is essential for accurately reporting earnings and ensuring compliance with IRS regulations.

Steps to complete the Schedule C Tax Form

Completing the 2015 Schedule C involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including income statements, receipts for expenses, and any prior year tax returns.

- Fill in business information: Provide details about your business, such as its name, address, and the type of business activity.

- Report income: List all sources of income related to your business, including gross receipts and any other income.

- Detail expenses: Itemize your business expenses, categorizing them into sections such as advertising, vehicle expenses, and supplies.

- Calculate net profit or loss: Subtract total expenses from total income to determine your net profit or loss, which will be reported on your Form 1040.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C form, which are crucial for ensuring compliance. These guidelines include:

- Accurate reporting: All income must be reported, and expenses should be directly related to the business operations.

- Recordkeeping: Maintain thorough records of all income and expenses, as the IRS may request documentation in case of an audit.

- Filing deadlines: The Schedule C must be submitted by the tax filing deadline, typically April 15, unless an extension is filed.

Legal use of the Schedule C Tax Form

The legal use of the Schedule C tax form is defined by IRS regulations. It is essential for self-employed individuals to accurately report their income and expenses to avoid legal issues. Misreporting can lead to penalties, interest on unpaid taxes, and potential audits. The Schedule C must be filled out truthfully and submitted in accordance with tax laws to maintain compliance and avoid legal repercussions.

Required Documents

To complete the 2015 Schedule C, several documents are required:

- Income records: This includes invoices, bank statements, and any other documents that verify income received.

- Expense receipts: Keep receipts for all business-related expenses, such as utilities, supplies, and travel costs.

- Previous tax returns: Having prior year returns can help ensure consistency and accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The 2015 Schedule C can be submitted in various ways:

- Online: Many taxpayers choose to file electronically through tax software that supports Form 1040 and Schedule C.

- Mail: You can print the completed form and send it to the appropriate IRS address based on your location.

- In-person: Some individuals may opt to file their taxes in person at a local IRS office or through a tax professional.

Quick guide on how to complete 2015 schedule c tax form

Complete Schedule C Tax Form effortlessly on any device

Digital document management has gained immense traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the correct format and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents swiftly without delays. Manage Schedule C Tax Form on any platform with airSlate SignNow mobile applications available for Android or iOS, and enhance any document-related process today.

The easiest method to modify and eSign Schedule C Tax Form seamlessly

- Obtain Schedule C Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule C Tax Form to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 schedule c tax form

Create this form in 5 minutes!

How to create an eSignature for the 2015 schedule c tax form

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the 2015 Schedule C form and why is it important?

The 2015 Schedule C form is a tax document used by sole proprietors to report income and expenses. It's essential for accurately reporting your business earnings and determining your taxable income. Properly filling out the 2015 Schedule C form can help you maximize your deductions and minimize errors.

-

How can airSlate SignNow help with preparing the 2015 Schedule C form?

airSlate SignNow provides an easy-to-use platform for electronically signing documents, including the 2015 Schedule C form. This ensures that you can complete your tax documentation efficiently, securely, and in compliance with legal standards. With our user-friendly interface, managing your tax forms becomes a streamlined process.

-

What features does airSlate SignNow offer that assist in completing the 2015 Schedule C form?

Our platform offers features such as eSigning, document templates, and cloud storage which are invaluable for managing documents like the 2015 Schedule C form. You can customize templates, ensuring all the necessary information is included, which simplifies the preparation of your tax returns. This all-in-one solution saves time and reduces stress during tax season.

-

Is there a cost associated with using airSlate SignNow for the 2015 Schedule C form?

Yes, using airSlate SignNow entails a subscription cost, but we offer various pricing plans to fit different business needs. The cost is relatively low compared to the potential savings on tax preparation and filing. Additionally, the platform’s efficiency can ultimately save you time and money in the long run.

-

Can I integrate airSlate SignNow with other accounting tools for the 2015 Schedule C form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to import and export data related to the 2015 Schedule C form. This integration helps ensure that all your financial information is organized and accessible, streamlining your overall tax preparation workflow.

-

What are the benefits of using airSlate SignNow for tax documentation like the 2015 Schedule C form?

Using airSlate SignNow for your 2015 Schedule C form simplifies the documentation process, enhances security with encrypted signatures, and allows for faster turnaround times. Our platform also provides audit trails and easy access to past documents, helping you maintain compliance with tax regulations. Overall, it makes tax season less stressful and more efficient.

-

How secure is airSlate SignNow when handling documents like the 2015 Schedule C form?

Security is a top priority for airSlate SignNow. We use industry-standard encryption and authentication measures to ensure that your documents, including the 2015 Schedule C form, are safe from unauthorized access. You can confidently use our platform knowing that your sensitive business information is protected.

Get more for Schedule C Tax Form

- Important check x the appropriate boxes below and complete the applicable sections form

- Information intake form for pida loan

- The medical assisting ma program is accredited by the commission on accreditation of allied health form

- Visa credit cardresponders emergency services credit form

- Replacement card formdocx

- Scholarship application proctor federal credit union form

- Omsnic individual new business application email disclaimer form

- Axis bank credit card auto debit deactivation form

Find out other Schedule C Tax Form

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure