Example GST Withholding Notice 00150808;4 DOCX 00150808 Form

Understanding the GST Withholding Notice

The GST withholding notice is an important document used in the context of tax compliance in the United States. It serves as a formal communication regarding the withholding of goods and services tax (GST) from payments made to vendors or service providers. This notice ensures that the appropriate amount of tax is withheld and remitted to the government, thereby helping businesses stay compliant with tax regulations.

How to Complete the GST Withholding Notice

Completing the GST withholding notice involves several key steps. First, gather all necessary information about the transaction, including the names and addresses of the parties involved, the amount subject to withholding, and the applicable tax rate. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays or penalties. Finally, review the completed notice for accuracy before submission.

Obtaining the GST Withholding Notice

To obtain the GST withholding notice, businesses can typically download the form from the official IRS website or request it through their tax professional. It is essential to ensure that you are using the most current version of the form to comply with current regulations. If assistance is needed, consulting a tax advisor can provide clarity on obtaining and completing the notice.

Legal Considerations for the GST Withholding Notice

The legal use of the GST withholding notice is crucial for compliance with federal tax laws. Businesses must ensure that they understand the legal implications of withholding taxes, including the responsibility to remit withheld amounts to the IRS. Failure to comply with these regulations can result in penalties, interest, and potential legal action. Therefore, it is advisable to stay informed about any changes in tax laws that may affect the withholding process.

Filing Deadlines for the GST Withholding Notice

Filing deadlines for the GST withholding notice are critical to avoid penalties. Generally, businesses must submit the notice according to the schedule set by the IRS, which may vary based on the type of transaction and the amount withheld. Keeping track of these deadlines ensures that businesses remain compliant and avoid unnecessary fines. It is beneficial to mark these dates on a calendar to ensure timely submission.

Penalties for Non-Compliance with GST Withholding

Non-compliance with GST withholding regulations can lead to significant penalties. Businesses may face fines for failing to withhold the correct amount or for not submitting the notice on time. Additionally, interest may accrue on any unpaid taxes, increasing the overall liability. Understanding these penalties emphasizes the importance of accurate and timely filing of the GST withholding notice.

Examples of GST Withholding Notice Usage

Examples of using the GST withholding notice can vary across different business scenarios. For instance, a contractor providing services to a government agency may be required to submit this notice to ensure that the appropriate tax is withheld from their payments. Similarly, businesses engaging in large transactions with foreign vendors may also need to utilize the notice to comply with tax regulations. These examples illustrate the practical application of the form in various contexts.

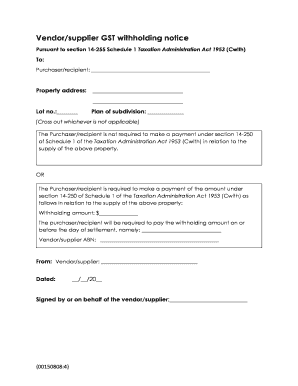

Quick guide on how to complete example gst withholding notice 001508084 docx 00150808

Complete Example GST Withholding Notice 00150808;4 DOCX 00150808 effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without obstacles. Manage Example GST Withholding Notice 00150808;4 DOCX 00150808 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Example GST Withholding Notice 00150808;4 DOCX 00150808 with ease

- Find Example GST Withholding Notice 00150808;4 DOCX 00150808 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent areas of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about missing or misplaced documents, laborious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Alter and eSign Example GST Withholding Notice 00150808;4 DOCX 00150808 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the example gst withholding notice 001508084 docx 00150808

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is GST withholding and how does it affect my business?

GST withholding refers to the practice where businesses are required to withhold a portion of GST from payments made to suppliers. This can impact cash flow and accounting practices. Understanding GST withholding is crucial for compliance and effective financial management.

-

How can airSlate SignNow help with GST withholding documentation?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning documents related to GST withholding. Our solution ensures that all necessary documentation is easily accessible and securely stored, simplifying compliance and record-keeping.

-

What are the pricing options for airSlate SignNow regarding GST withholding features?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Each plan includes features that support GST withholding documentation, ensuring you have the tools needed for compliance without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software for GST withholding?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions. This integration allows for efficient management of GST withholding processes, ensuring that your financial records are accurate and up-to-date.

-

What benefits does airSlate SignNow provide for managing GST withholding?

Using airSlate SignNow for GST withholding management offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the entire process, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling GST withholding documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your GST withholding documents. With encryption and secure access controls, you can trust that your sensitive information is safe and compliant with regulations.

-

How does airSlate SignNow ensure compliance with GST withholding regulations?

airSlate SignNow is designed to help businesses stay compliant with GST withholding regulations. Our platform provides templates and guidance to ensure that all necessary information is included in your documents, minimizing the risk of errors.

Get more for Example GST Withholding Notice 00150808;4 DOCX 00150808

- Instructions for form nyc 202 unincorporated business tax

- Instructions for form it 213 ampquotclaim for empire state child

- State of connecticut department of revenue services form

- Form it 2 summary of w 2 statements new york state

- Form ct 945 2012 connecticut annual reconciliation of

- Summary of federal form 1099 r statements department of

- Pdf form st 140 individual purchasers annual report of sales and

- Ct 6559 submitter report for form w 2 cd filing

Find out other Example GST Withholding Notice 00150808;4 DOCX 00150808

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure