Form Net Profit

What is the Form Net Profit

The Form Net Profit is a tax document used by businesses in Kentucky to report their net profit for a specific tax year. This form is essential for calculating the amount of tax owed to the state based on the income generated by the business. It is particularly relevant for various business types, including sole proprietorships, partnerships, and corporations. Understanding this form is crucial for compliance with state tax regulations.

Steps to complete the Form Net Profit

Completing the Form Net Profit involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, calculate your total income and deduct allowable business expenses to determine your net profit. Fill out the form by entering this information in the designated sections. Be sure to double-check your calculations and ensure that all required fields are completed. Finally, sign and date the form before submission.

Legal use of the Form Net Profit

The Form Net Profit must be used in accordance with Kentucky state tax laws. It serves as a legal document that reports the financial performance of a business for tax purposes. To be considered valid, the form must be completed accurately and submitted by the designated filing deadline. Failure to comply with these legal requirements may result in penalties or audits by the Kentucky Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Form Net Profit are crucial for maintaining compliance. Typically, the form is due on the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the form is due by April 15. It is important to stay informed about any changes to these deadlines, as late submissions may incur penalties or interest on unpaid taxes.

Required Documents

To complete the Form Net Profit, several documents are necessary. These include financial statements, such as profit and loss statements, balance sheets, and any relevant tax documents from previous years. Additionally, any supporting documentation for deductions claimed, such as receipts and invoices, should be organized and available for reference. Having these documents ready will streamline the completion process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Form Net Profit can be submitted through various methods. Businesses have the option to file online through the Kentucky Department of Revenue’s e-filing system, which offers a convenient and efficient way to submit tax forms. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

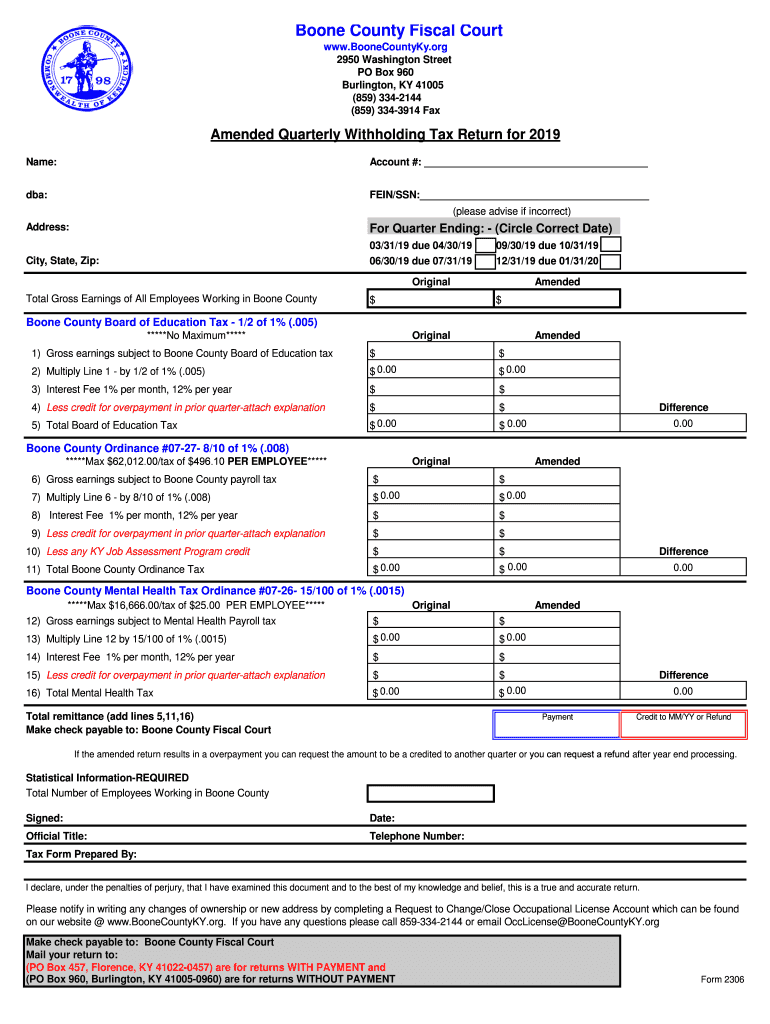

Quick guide on how to complete 2019 net profit tax return boone county ky

Complete Form Net Profit effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form Net Profit on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Form Net Profit with ease

- Locate Form Net Profit and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign Form Net Profit and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 net profit tax return boone county ky

How to generate an eSignature for your 2019 Net Profit Tax Return Boone County Ky in the online mode

How to generate an eSignature for your 2019 Net Profit Tax Return Boone County Ky in Google Chrome

How to create an electronic signature for signing the 2019 Net Profit Tax Return Boone County Ky in Gmail

How to make an electronic signature for the 2019 Net Profit Tax Return Boone County Ky from your smartphone

How to make an electronic signature for the 2019 Net Profit Tax Return Boone County Ky on iOS devices

How to create an eSignature for the 2019 Net Profit Tax Return Boone County Ky on Android OS

People also ask

-

What is ky net profit and how does it relate to airSlate SignNow?

Ky net profit refers to the financial gains made by your business after all expenses are deducted. Using airSlate SignNow can positively impact your ky net profit by streamlining document workflows, reducing administrative costs, and improving efficiency in obtaining signatures.

-

How can airSlate SignNow help increase my business's ky net profit?

By simplifying the eSigning process, airSlate SignNow helps you close deals faster and reduce delays, which can ultimately enhance your ky net profit. The platform's automation features can also lead to fewer errors and lower operational costs.

-

What are the pricing plans for airSlate SignNow and how do they affect my ky net profit?

airSlate SignNow offers various pricing plans tailored to different business needs. Choosing a plan that suits your business can help optimize costs, enhancing your ky net profit by minimizing expenses related to document management.

-

What features of airSlate SignNow can contribute to better ky net profit?

Key features such as customizable templates, multi-party signing, and secure storage contribute to increased efficiency. Utilizing these features can streamline your processes and thus improve your ky net profit.

-

Does airSlate SignNow integrate with other software to improve my ky net profit?

Yes, airSlate SignNow integrates seamlessly with various popular applications like Salesforce, Google Drive, and Zapier. These integrations can enhance your workflow, allowing you to optimize processes and positively affect your ky net profit.

-

How secure is airSlate SignNow, and how does that impact my ky net profit?

airSlate SignNow prioritizes security with features like encryption and audit trails. Ensuring document security can prevent costly data bsignNowes, ultimately protecting your ky net profit.

-

Can using airSlate SignNow improve customer satisfaction and affect ky net profit?

Absolutely! A user-friendly eSigning experience enhances customer satisfaction, leading to repeat business and referrals. This improved customer interaction can directly influence your ky net profit positively.

Get more for Form Net Profit

- Fiduciary tax department of revenue kentucky gov form

- Separation of liability reliefinternal revenue service form

- Department of revenue services state of connecticu form

- Registration forms sc department of revenue

- Annual return 4567 department of treasury formalu

- Form w 2 wage and tax statement

- Failure to file form ct 706 nt ext

- Department of revenue services state of connecticu 693992266 form

Find out other Form Net Profit

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile