Vermont Department of Taxes2023 Schedule IN117*231 Form

Understanding the Vermont 117 Tax Form

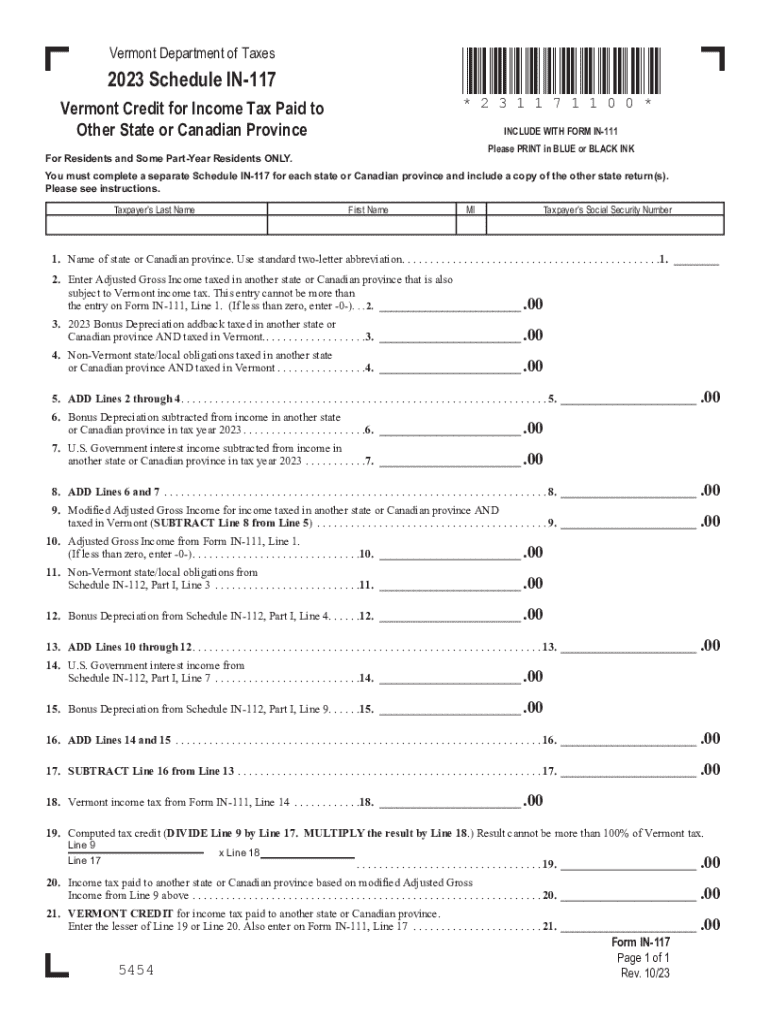

The Vermont 117 tax form, officially known as the Schedule IN117, is a critical document used by residents to report their income and calculate their tax obligations. This form is specifically designed for individuals who need to report income from various sources, including wages, business income, and other taxable earnings. Understanding the purpose and requirements of this form is essential for accurate tax filing and compliance with Vermont state tax laws.

Steps to Complete the Vermont 117 Tax Form

Completing the Vermont 117 tax form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your total income by adding all sources of income as indicated on your income statements.

- Calculate your deductions and credits, which can reduce your taxable income and overall tax liability.

- Complete the tax calculation section to determine the amount of tax owed or refund due.

- Review the form for accuracy and completeness before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Vermont 117 tax form. Typically, the deadline for submitting your tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, but it is important to understand that this does not extend the time to pay any taxes owed.

Required Documents for Vermont 117 Tax Filing

To successfully complete the Vermont 117 tax form, you will need several documents:

- W-2 forms from employers detailing your earned income.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or investment earnings.

- Documentation of any deductions or credits you plan to claim.

Form Submission Methods

The Vermont 117 tax form can be submitted in various ways, providing flexibility for taxpayers. You can file the form electronically through approved tax software, which often simplifies the process and speeds up the refund timeline. Alternatively, you may choose to print the completed form and mail it to the Vermont Department of Taxes. In-person submissions are also accepted at designated tax offices throughout the state.

Key Elements of the Vermont 117 Tax Form

The Vermont 117 tax form includes several key sections that are important for accurate reporting:

- Personal information section for taxpayer identification.

- Income reporting section to detail all sources of income.

- Deductions and credits section to claim any eligible tax benefits.

- Tax calculation section to determine final tax liability.

Eligibility Criteria for Filing the Vermont 117 Tax Form

Eligibility to file the Vermont 117 tax form generally includes residents of Vermont who have earned income during the tax year. Specific criteria may vary based on income level, filing status, and age. It is advisable to review the eligibility requirements outlined by the Vermont Department of Taxes to ensure compliance and proper filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vermont department of taxes2023 schedule in117231

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Vermont 117 tax and how does it affect my business?

The Vermont 117 tax is a tax form that businesses in Vermont must file to report certain financial activities. Understanding this tax is crucial for compliance and can help you avoid penalties. Using airSlate SignNow can streamline the document signing process related to Vermont 117 tax filings, making it easier for your business to stay organized.

-

How can airSlate SignNow help with Vermont 117 tax documentation?

airSlate SignNow provides an efficient platform for electronically signing and managing documents related to Vermont 117 tax. With its user-friendly interface, you can quickly prepare, send, and track your tax documents. This not only saves time but also ensures that your filings are accurate and timely.

-

What are the pricing options for airSlate SignNow when dealing with Vermont 117 tax?

airSlate SignNow offers various pricing plans that cater to different business needs, including those focused on Vermont 117 tax documentation. Each plan provides essential features for eSigning and document management at competitive rates. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for managing Vermont 117 tax documents?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage Vermont 117 tax documents. These integrations allow for automatic data transfer and streamlined workflows, enhancing your overall efficiency. This means you can focus more on your business and less on paperwork.

-

What features does airSlate SignNow offer for Vermont 117 tax compliance?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for Vermont 117 tax compliance. These tools help ensure that your documents are completed accurately and stored securely. Additionally, you can easily access your signed documents whenever needed.

-

Can airSlate SignNow help reduce the time spent on Vermont 117 tax filings?

Absolutely! By using airSlate SignNow, you can signNowly reduce the time spent on Vermont 117 tax filings. The platform allows for quick document preparation and eSigning, which accelerates the entire process. This efficiency means you can focus on other important aspects of your business.

-

Is airSlate SignNow secure for handling Vermont 117 tax documents?

Yes, airSlate SignNow prioritizes security, ensuring that all documents, including those related to Vermont 117 tax, are protected. The platform uses advanced encryption and complies with industry standards to safeguard your sensitive information. You can trust that your tax documents are in safe hands.

Get more for Vermont Department Of Taxes2023 Schedule IN117*231

- Business credit application utah form

- Authorization to release industrial accident division records utah form

- Individual credit application utah form

- Interrogatories to plaintiff for motor vehicle occurrence utah form

- Restoration services authorization denial utah form

- Interrogatories to defendant for motor vehicle accident utah form

- Llc notices resolutions and other operations forms package utah

- Utah disclosure 497427525 form

Find out other Vermont Department Of Taxes2023 Schedule IN117*231

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy