Form 1099 MISC IRS Tax Forms 2022-2026

Understanding the 1099-C Cancellation of Debt

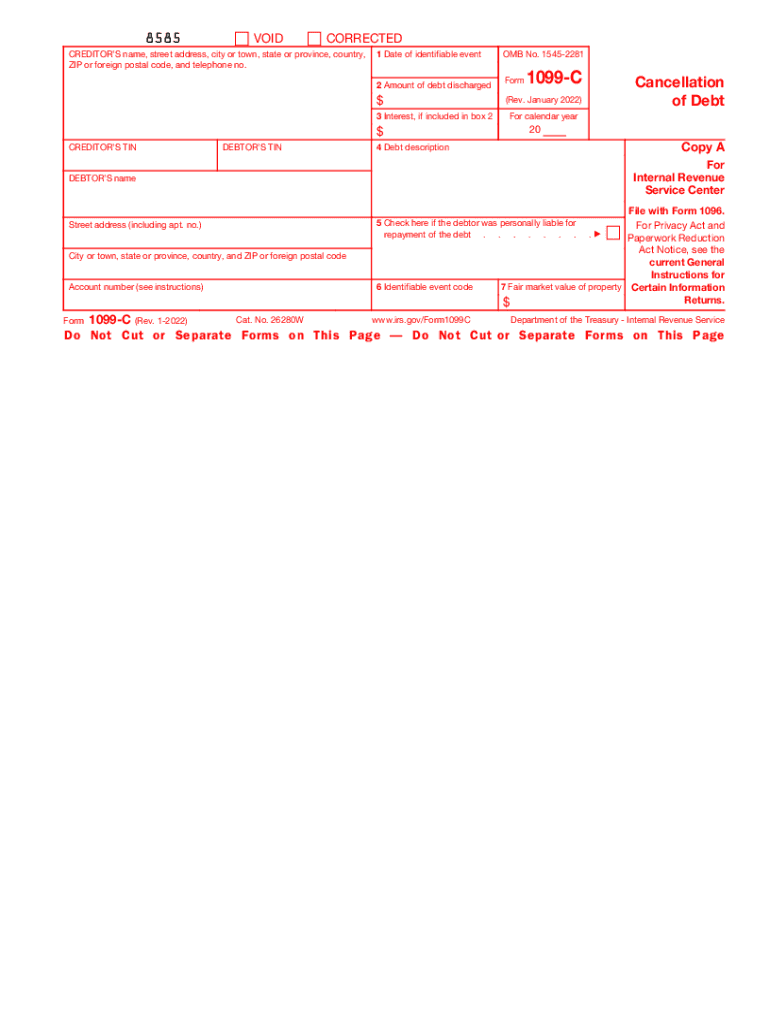

The 1099-C form, known as the Cancellation of Debt, is a crucial document issued by lenders when a debt of $600 or more is forgiven or canceled. This form is essential for tax purposes, as the IRS considers canceled debt as taxable income. If you receive a 1099-C, you must report this amount on your tax return, which can significantly impact your overall tax liability. Understanding how this form works is vital for managing your finances effectively.

Steps to Complete the 1099-C Form

Completing the 1099-C form involves several key steps:

- Gather necessary information, including the debtor's name, address, and taxpayer identification number (TIN).

- Identify the creditor's details, including their name, address, and TIN.

- Provide the date of cancellation and the amount of debt canceled.

- Complete the form accurately to ensure compliance with IRS requirements.

Once completed, ensure that the form is sent to the IRS and a copy is provided to the debtor for their records.

Legal Use of the 1099-C Form

The 1099-C form serves a legal purpose in documenting the cancellation of debt. It is essential for both creditors and debtors to understand the implications of this form. For creditors, issuing a 1099-C protects them from potential tax liabilities associated with forgiven debts. For debtors, receiving this form can affect their tax returns, making it crucial to handle it correctly. Legal compliance ensures that both parties are protected in the event of an audit or dispute.

IRS Guidelines for Reporting Canceled Debt

The IRS has established specific guidelines for reporting canceled debt. Taxpayers must include the amount reported on the 1099-C as income on their tax returns. However, there are exceptions where certain types of canceled debts may not be taxable, such as debts discharged in bankruptcy or qualified principal residence indebtedness. Understanding these guidelines can help taxpayers navigate their tax obligations effectively and avoid unnecessary penalties.

Filing Deadlines for the 1099-C Form

Filing deadlines for the 1099-C form are essential to avoid penalties. Creditors must file the form with the IRS by the end of February if filing by paper or by the end of March if filing electronically. Additionally, creditors must provide a copy to the debtor by January 31. Adhering to these deadlines ensures compliance and helps maintain accurate tax records.

Penalties for Non-Compliance

Failure to comply with the IRS requirements regarding the 1099-C form can result in significant penalties. Creditors may face fines for not filing the form on time or for failing to provide necessary information. Debtors who do not report the canceled debt may also incur penalties, including interest on unpaid taxes. Understanding these potential consequences emphasizes the importance of accurate and timely filing.

Quick guide on how to complete 2020 form 1099 misc irs tax forms

Complete Form 1099 MISC IRS Tax Forms effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form 1099 MISC IRS Tax Forms on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Form 1099 MISC IRS Tax Forms with ease

- Locate Form 1099 MISC IRS Tax Forms and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or an invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or mistakes that require printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1099 MISC IRS Tax Forms and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1099 misc irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the cancellation of debt credit card process?

The cancellation of debt credit card process involves negotiating with your credit card issuer to reduce or eliminate the outstanding balance. This can often lead to signNow savings, but it may also impact your credit score. Utilizing a service like airSlate SignNow can simplify the documentation process involved in these negotiations.

-

Are there fees associated with the cancellation of debt credit card service?

The fees for cancellation of debt credit card services can vary depending on the provider. airSlate SignNow offers a cost-effective solution for document management and eSigning, enabling you to manage paperwork related to your credit card negotiations efficiently. Always review any service fees before committing.

-

How can airSlate SignNow help with the cancellation of debt credit card?

airSlate SignNow streamlines the cancellation of debt credit card process by providing easy-to-use eSigning tools and document management features. This allows you to send and receive important documents swiftly, ensuring that you stay organized during negotiations. With our platform, you can focus on achieving better terms rather than managing paperwork.

-

What benefits does airSlate SignNow offer for managing credit card debt cancellation?

By using airSlate SignNow for the cancellation of debt credit card needs, you gain access to a user-friendly interface, secure document storage, and efficient eSign capabilities. These benefits enable faster decision-making and a more professional presentation of your proposals to creditors. Ultimately, this increases your chances of success in negotiations.

-

Is airSlate SignNow compatible with other debt management tools?

Yes, airSlate SignNow integrates seamlessly with various finance and debt management tools that assist in the cancellation of debt credit card process. This allows you to consolidate your efforts and improve efficiency when handling your financial affairs. Integration capabilities enhance your overall experience and streamline your workflow.

-

Can I track the status of documents related to my cancellation of debt credit card?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your documents throughout the cancellation of debt credit card process. This transparency ensures peace of mind as you can see when documents are viewed or signed by the necessary parties.

-

What types of documents are needed for the cancellation of debt credit card?

Typically, you will need statements, proof of income, and possibly letters outlining your financial situation for the cancellation of debt credit card. airSlate SignNow can help you compile and send these documents efficiently, ensuring that you have everything needed to support your case. Having organized documentation increases your chances for a favorable outcome.

Get more for Form 1099 MISC IRS Tax Forms

- Premarital agreements package iowa form

- Painting contractor package iowa form

- Framing contractor package iowa form

- Foundation contractor package iowa form

- Plumbing contractor package iowa form

- Brick mason contractor package iowa form

- Roofing contractor package iowa form

- Electrical contractor package iowa form

Find out other Form 1099 MISC IRS Tax Forms

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now