1099 R Form 2013

What is the 1099 R Form

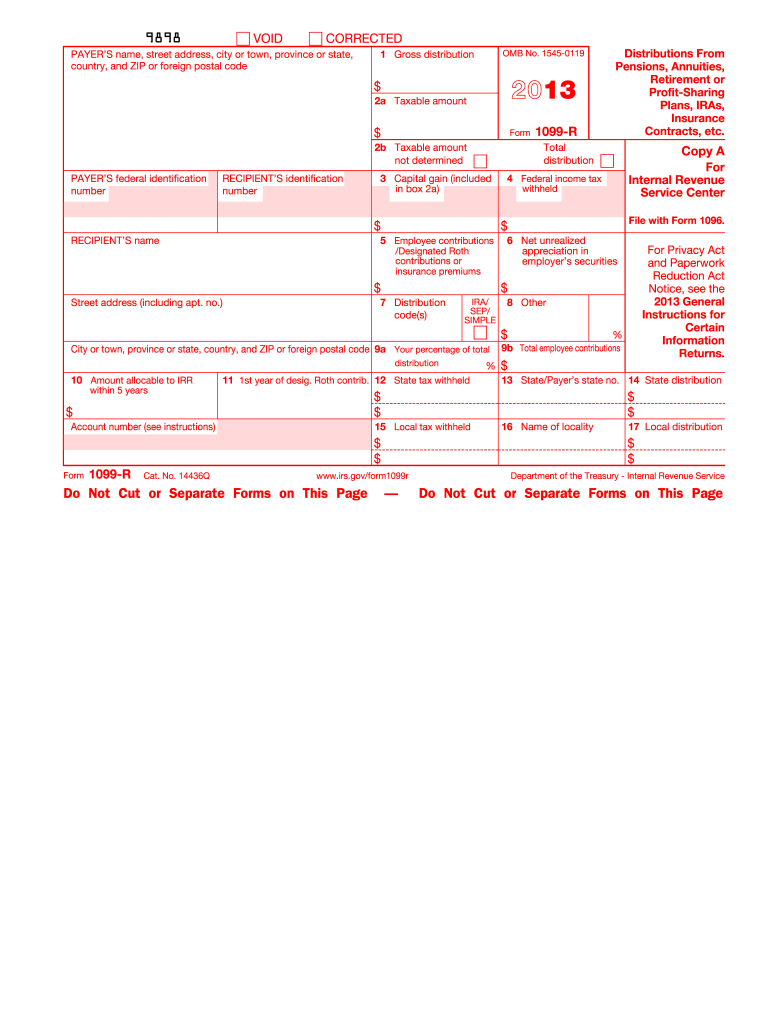

The 1099 R Form is a tax document used in the United States to report distributions from retirement plans, annuities, pensions, and other similar sources. It is essential for individuals who receive these distributions to accurately report their income to the Internal Revenue Service (IRS). The form includes vital information such as the total amount distributed, the taxable amount, and any federal income tax withheld. Understanding the details of this form is crucial for ensuring compliance with tax obligations.

How to use the 1099 R Form

Using the 1099 R Form involves several steps to ensure accurate reporting of retirement income. First, recipients should review the form for accuracy, confirming that all personal information and distribution amounts are correct. Next, taxpayers must report the information from the 1099 R Form on their federal tax return, typically on Form 1040. It is important to include any taxable amounts and withholdings as indicated on the form. Keeping a copy of the 1099 R Form for personal records is also advisable.

Steps to complete the 1099 R Form

Completing the 1099 R Form requires careful attention to detail. Here are the primary steps:

- Gather necessary personal information, including your Social Security number and details of the retirement account.

- Enter the payer's information, including their name, address, and taxpayer identification number.

- Fill in the distribution amounts, specifying the total distribution and the taxable portion.

- Indicate any federal income tax withheld from the distribution.

- Review the completed form for accuracy before submission.

Legal use of the 1099 R Form

The legal use of the 1099 R Form is governed by IRS regulations. It is essential for recipients to ensure that the information reported is accurate and complete, as discrepancies can lead to penalties or audits. The form serves as a formal record of income received from retirement accounts, and it must be submitted to the IRS by the designated deadline. Maintaining compliance with IRS guidelines is crucial to avoid legal issues associated with improper reporting.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 R Form are critical for taxpayers to observe. Typically, the form must be issued to recipients by January 31 of the year following the distribution. The IRS requires that the form be filed by the end of February if submitted by paper, or by March 31 if filed electronically. Adhering to these deadlines helps avoid potential penalties for late filing and ensures that tax returns are processed smoothly.

Who Issues the Form

The 1099 R Form is issued by financial institutions, pension plans, and other entities that make distributions to individuals. This includes banks, insurance companies, and retirement plan administrators. These organizations are responsible for accurately reporting the distributions made to their clients and providing them with a copy of the 1099 R Form for their tax records. It is important for recipients to keep track of the forms they receive to ensure all income is reported correctly.

Quick guide on how to complete 2013 1099 r form

Prepare 1099 R Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Manage 1099 R Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and electronically sign 1099 R Form without hassle

- Locate 1099 R Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specially designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to deliver your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 1099 R Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 1099 r form

Create this form in 5 minutes!

How to create an eSignature for the 2013 1099 r form

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is a 1099 R Form and who needs it?

The 1099 R Form is a tax document used to report distributions from pensions, annuities, retirement plans, or IRAs. Typically, individuals who receive these distributions must report them on their tax returns. Understanding the 1099 R Form is essential for accurate tax reporting and compliance.

-

How can airSlate SignNow help me manage my 1099 R Form?

With airSlate SignNow, you can easily create, send, and eSign your 1099 R Form digitally. Our platform offers a user-friendly interface that streamlines document management, ensuring that your forms are processed quickly and securely. This can signNowly reduce the time and hassle typically associated with handling tax forms.

-

What features does airSlate SignNow offer for electronic signatures on a 1099 R Form?

airSlate SignNow provides robust electronic signature features that are legally binding and compliant with eSignature laws. You can quickly add fields for signatures, initials, and dates on your 1099 R Form, making it easy for recipients to sign. The platform also allows you to track the status of your documents in real-time.

-

Is airSlate SignNow secure for sending sensitive documents like my 1099 R Form?

Yes, airSlate SignNow prioritizes security and uses advanced encryption methods to protect your sensitive documents, including the 1099 R Form. Our platform is compliant with industry standards, ensuring your data remains confidential and secure during transmission and storage.

-

Can I integrate airSlate SignNow with other applications for my 1099 R Form management?

Absolutely! airSlate SignNow offers seamless integrations with various applications that can enhance your workflow for managing the 1099 R Form. Whether you use accounting software, CRM systems, or cloud storage solutions, our platform can easily connect to streamline your document processes.

-

What are the pricing options for using airSlate SignNow for 1099 R Forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users. Our cost-effective solutions ensure you can manage your 1099 R Form and other documents without breaking the bank. You can choose from various subscription levels depending on the features and number of users you require.

-

Can I customize my 1099 R Form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your 1099 R Form to fit your specific needs. You can add your company logo, adjust the layout, and include any additional fields required for your documentation. This customization helps ensure that your form aligns with your brand identity.

Get more for 1099 R Form

- Florida residency declaration for tuition purposes form suspdf

- Request for verification of spouse or dependent status troy form

- Trident tech application update form

- Request for in state classification for tuition assessment form

- 2016 2017 proof of dependents worksheet office of financial aid wcupa form

- Student enrollment verification form california state

- 2020 21 graduate application for admission form

- Declaration of f inances admissions illinois state university form

Find out other 1099 R Form

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online