Form 1099 R 2014

What is the Form 1099 R

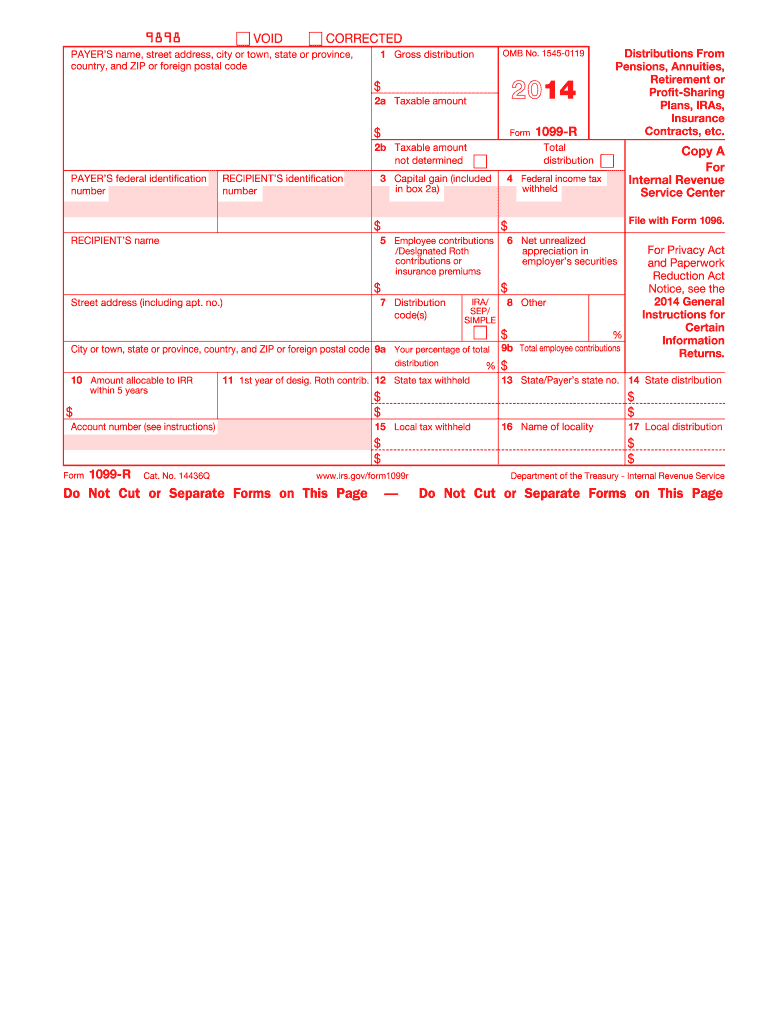

The Form 1099 R is a tax document used in the United States to report distributions from retirement accounts, pensions, annuities, and other similar financial instruments. This form is essential for individuals who have received payments from retirement plans or other qualifying accounts, as it provides necessary information for tax reporting. The Internal Revenue Service (IRS) requires payers to issue this form to recipients and the IRS when distributions exceed a certain amount, ensuring that all taxable income is properly reported.

How to use the Form 1099 R

Using the Form 1099 R involves several steps that ensure accurate reporting of retirement distributions. Recipients should first review the information on the form for accuracy, including the payer's details, the amount distributed, and any taxes withheld. This information is critical for completing the recipient's tax return. The form must be included when filing federal income tax returns, as it provides the IRS with a record of the income received. It is also advisable for recipients to keep a copy of the form for their records.

Steps to complete the Form 1099 R

Completing the Form 1099 R requires careful attention to detail. Here are the key steps:

- Gather necessary information, including the payer's name, address, and taxpayer identification number (TIN).

- Enter the recipient's name, address, and TIN accurately.

- Report the total distribution amount in Box 1, which reflects the gross distribution.

- Indicate any federal income tax withheld in Box 4, if applicable.

- Complete any additional boxes as required, such as the distribution code in Box 7, which specifies the type of distribution.

- Review the form for accuracy before submission.

Legal use of the Form 1099 R

The legal use of the Form 1099 R is governed by IRS regulations. This form must be filed correctly to avoid penalties for both the payer and the recipient. It serves as a formal record of income received from retirement accounts, which must be reported on the recipient's tax return. The form is also critical for compliance with federal tax laws, ensuring that all distributions are reported and taxed appropriately. Failure to report income from the Form 1099 R can lead to significant penalties and interest charges.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 R are crucial for both payers and recipients. Typically, payers must provide the form to recipients by January 31 of the year following the distribution. Additionally, payers must file the form with the IRS by the end of February if filing on paper, or by the end of March if filing electronically. It is important for recipients to be aware of these dates to ensure timely reporting of their income on their tax returns.

Who Issues the Form

The Form 1099 R is issued by financial institutions, retirement plan administrators, and other entities that manage retirement accounts. These entities are responsible for reporting distributions made to individuals from pensions, annuities, and other retirement plans. It is essential for recipients to ensure that they receive this form from the appropriate issuer, as it contains vital information needed for tax reporting.

Quick guide on how to complete 2014 form 1099 r

Effortlessly Prepare Form 1099 R on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed files, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without any hold-ups. Handle Form 1099 R on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign Form 1099 R with Ease

- Obtain Form 1099 R and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Form 1099 R and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 1099 r

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 1099 r

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is Form 1099 R and why is it important?

Form 1099 R is an IRS tax form used to report distributions from pensions, annuities, retirement plans, and other sources. It's important for both taxpayers and the IRS to ensure accurate reporting of taxable income. Completing this form correctly can help you avoid penalties and ensure compliance with tax regulations.

-

How can airSlate SignNow help me with Form 1099 R?

airSlate SignNow provides a user-friendly platform to electronically sign and send Form 1099 R securely. With features like templates and automated workflows, you can streamline the process of preparing and distributing this important tax document, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for Form 1099 R?

Yes, airSlate SignNow offers several pricing plans designed to fit different business needs. You can choose a plan that suits your volume of document handling, including options that allow unlimited access to features for managing Form 1099 R and other documents.

-

What features does airSlate SignNow offer for managing Form 1099 R?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage for managing Form 1099 R. These tools enhance efficiency and ensure that you can easily access and manage your tax documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other software for Form 1099 R processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, enabling you to streamline your Form 1099 R processing. This integration can help automate data entry and ensure that your documents are always up-to-date.

-

What are the benefits of using airSlate SignNow for Form 1099 R?

Using airSlate SignNow for Form 1099 R offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security for sensitive tax information. Additionally, the ability to eSign documents ensures that your Form 1099 R is processed quickly and securely.

-

How does airSlate SignNow ensure the security of my Form 1099 R?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your Form 1099 R and other sensitive documents. This commitment to security ensures that your information remains confidential and accessible only to authorized users.

Get more for Form 1099 R

- Frontier lifeline application form

- Dog license danbury form

- Dcps application to use facilities does dc form

- Florida retirement system frs certification form hillsborough hccfl

- Out of county field trip forms duval county public schools duvalschools

- Form fm 7335

- Personalfamily physician citystate office phone form

- Sunbiz amendment online form

Find out other Form 1099 R

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free