Form 1099 R Distributions from Pensions, Annuities,Retirement or Profit Sharing Plans, IRAs, Insurance Contracts, Etc 2022

What is the Form 1099-R?

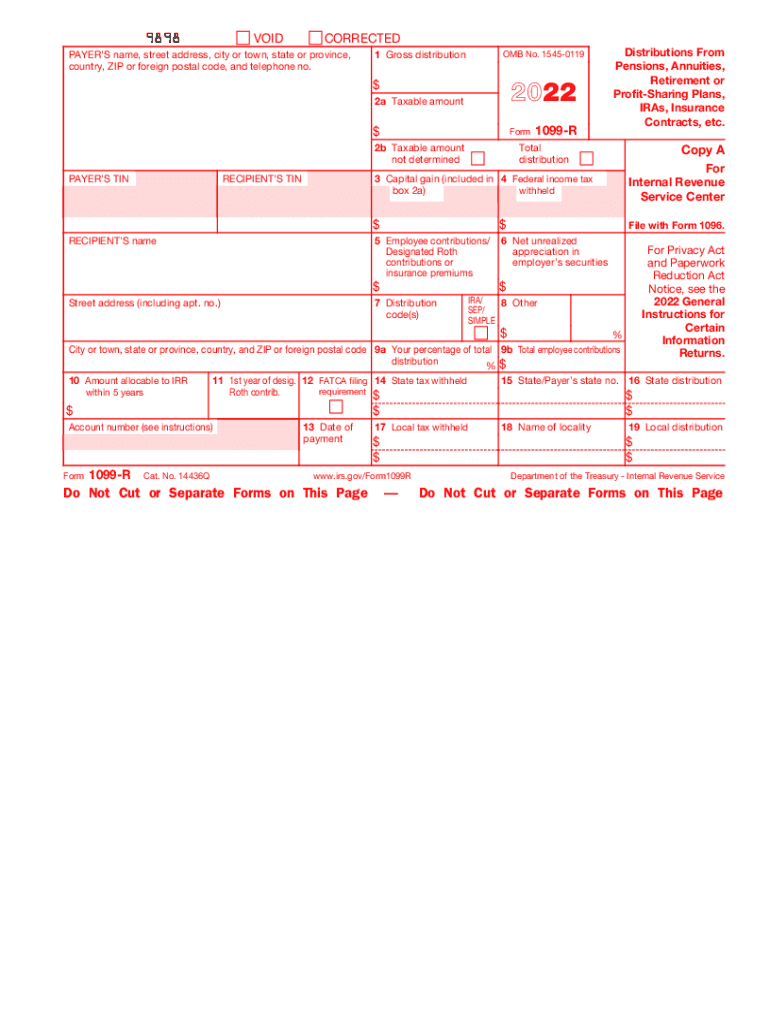

The Form 1099-R is a tax document used to report distributions from pensions, annuities, retirement plans, individual retirement accounts (IRAs), and insurance contracts. This form is essential for taxpayers who have received distributions from these sources during the tax year. It provides details regarding the amount distributed, the taxable portion, and any federal income tax withheld. Understanding this form is crucial for accurately reporting income and ensuring compliance with IRS regulations.

How to Use the Form 1099-R

Using the Form 1099-R involves several steps to ensure that the information is accurately reported on your tax return. First, you should receive this form from the financial institution or entity that issued the distribution. Once you have the form, review it for accuracy, including your personal information and the amounts reported. You will then need to report the distribution on your tax return, typically on Form 1040. It's important to keep this form with your tax records for future reference and verification.

Steps to Complete the Form 1099-R

Completing the Form 1099-R requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Social Security number and details about the distribution.

- Fill in the recipient's information, ensuring accuracy in names and addresses.

- Report the gross distribution amount in Box 1 and any taxable amount in Box 2a.

- Indicate any federal income tax withheld in Box 4.

- Complete any additional boxes as required, depending on the specifics of the distribution.

Legal Use of the Form 1099-R

The Form 1099-R is legally binding and must be filed with the IRS by the issuer. Recipients must also report the information accurately on their tax returns to avoid penalties. Compliance with IRS guidelines is essential, as failure to report distributions can lead to audits and potential fines. The form serves as proof of income received and is crucial for maintaining accurate tax records.

IRS Guidelines for Form 1099-R

The IRS provides specific guidelines regarding the use and filing of Form 1099-R. These guidelines include deadlines for issuing the form to recipients and filing with the IRS. Generally, issuers must provide the form to recipients by January 31 of the following year. Additionally, the IRS requires that the form be filed electronically if there are 250 or more forms. Understanding these guidelines helps ensure compliance and avoid unnecessary complications during tax season.

Filing Deadlines for Form 1099-R

Filing deadlines for the Form 1099-R are crucial for both issuers and recipients. The deadline to provide the form to recipients is January 31. For electronic filing with the IRS, the deadline is typically March 31. If these dates fall on a weekend or holiday, the deadline may shift to the next business day. Adhering to these deadlines is important to avoid penalties and ensure timely processing of tax returns.

Quick guide on how to complete 2022 form 1099 r distributions from pensions annuitiesretirement or profit sharing plans iras insurance contracts etc

Complete Form 1099 R Distributions From Pensions, Annuities,Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, alter, and eSign your documents swiftly without any holdups. Manage Form 1099 R Distributions From Pensions, Annuities,Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based procedure today.

How to alter and eSign Form 1099 R Distributions From Pensions, Annuities,Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc with ease

- Locate Form 1099 R Distributions From Pensions, Annuities,Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and has the same legal effect as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require additional printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Form 1099 R Distributions From Pensions, Annuities,Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1099 r distributions from pensions annuitiesretirement or profit sharing plans iras insurance contracts etc

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing model for 2020 r?

airSlate SignNow offers various pricing plans to accommodate different business needs in 2020 r. These plans range from a free tier for basic features to advanced paid options that provide enhanced functionalities. Each plan is designed to be cost-effective, ensuring businesses can find a solution that fits their budget while staying compliant with document eSigning requirements.

-

What essential features does airSlate SignNow provide for 2020 r?

In 2020 r, airSlate SignNow equips users with robust features, including document templates, real-time collaboration, and secure electronic signatures. The platform ensures that businesses can efficiently manage their document workflow and maintain compliance. These features help streamline operations and enhance productivity.

-

How does airSlate SignNow enhance security for 2020 r users?

Security is a top priority for airSlate SignNow in 2020 r. The platform employs advanced encryption methods to protect sensitive data during transmission and storage. Additionally, it complies with industry standards such as GDPR and eIDAS, ensuring that all electronic signatures are legally binding and securely managed.

-

What are the benefits of using airSlate SignNow in 2020 r?

Using airSlate SignNow in 2020 r brings numerous benefits, such as increased efficiency, reduced paper usage, and faster turnaround times for document approvals. This solution simplifies the eSigning process, enabling businesses to close deals and manage contracts effortlessly. By adopting this technology, companies can enhance their operations while supporting sustainability efforts.

-

Can airSlate SignNow integrate with other tools in 2020 r?

Yes, airSlate SignNow offers integrations with popular business tools in 2020 r such as Google Drive, Salesforce, and Microsoft Office. These integrations allow for seamless workflows and easy document management without needing to switch between different platforms. This connectivity enhances productivity and streamlines business processes.

-

Is customer support available for airSlate SignNow users in 2020 r?

Absolutely! airSlate SignNow provides comprehensive customer support to its users in 2020 r. You can access a variety of support channels, including live chat, email, and a knowledge base filled with helpful resources. This ensures that users have the assistance they need to maximize their use of the platform.

-

How does airSlate SignNow ensure compliance in 2020 r?

airSlate SignNow ensures compliance in 2020 r by adhering to established regulations like UETA and ESIGN, which govern electronic signatures. The platform is designed to meet rigorous compliance standards, providing users confidence that their electronic documents are legally binding and secure. This commitment to compliance helps users avoid potential legal issues.

Get more for Form 1099 R Distributions From Pensions, Annuities,Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc

- Ohio general form

- Revocation of general durable power of attorney ohio form

- Validity power attorney 497322554 form

- Essential legal life documents for newlyweds ohio form

- Essential legal life documents for new parents ohio form

- General power of attorney for care and custody of child or children grandparent as designated attorney in fact ohio form

- Small business accounting package ohio form

- Caretaker authorization form

Find out other Form 1099 R Distributions From Pensions, Annuities,Retirement Or Profit Sharing Plans, IRAs, Insurance Contracts, Etc

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract