1099 R Form 2016

What is the 1099 R Form

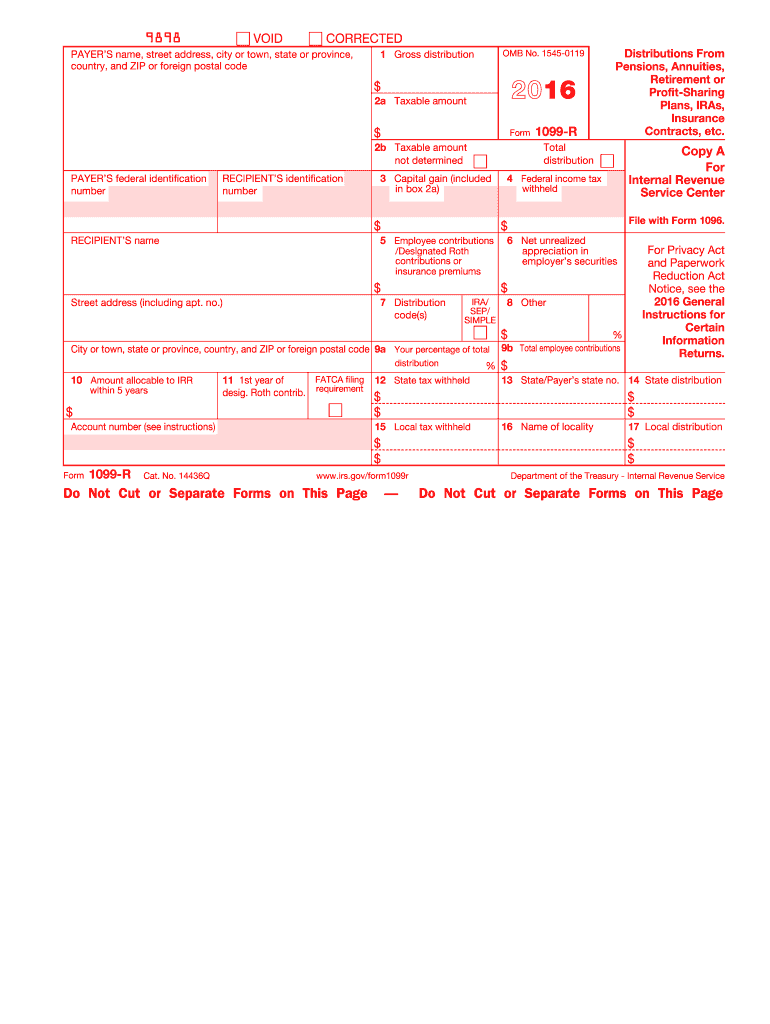

The 1099 R Form is a tax document used in the United States to report distributions from pensions, annuities, retirement plans, and other similar financial products. This form is essential for individuals who receive retirement income, as it provides the Internal Revenue Service (IRS) with information about the amount distributed and any taxes withheld. Recipients of the 1099 R Form must include this information when filing their tax returns to ensure accurate reporting of income.

How to use the 1099 R Form

Using the 1099 R Form involves several steps. First, recipients should carefully review the information provided on the form, including the payer's details, the distribution amount, and any federal or state taxes withheld. Next, this information must be reported on the individual’s tax return, typically on Form 1040. It is crucial to ensure that all details match the records to avoid discrepancies that could lead to audits or penalties.

Steps to complete the 1099 R Form

Completing the 1099 R Form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your Social Security number and details of the retirement plan.

- Fill in the payer's information, including their name, address, and identification number.

- Enter the total distribution amount received during the tax year.

- Indicate any federal income tax withheld from the distribution.

- Review the form for accuracy before submitting it to the IRS and retaining a copy for your records.

Legal use of the 1099 R Form

The legal use of the 1099 R Form is governed by IRS regulations. It must be filed by the payer when they make a distribution from a retirement account. The form serves as a record of income for the recipient and is legally binding when accurately completed and submitted. Failure to provide this form can result in penalties for the payer and potential tax liabilities for the recipient.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 R Form are crucial for compliance. Generally, payers must send the form to recipients by January thirty-first of the year following the distribution. Additionally, the form must be filed with the IRS by the end of February if submitted by paper, or by the end of March if filed electronically. Adhering to these deadlines helps avoid penalties and ensures timely reporting of income.

Who Issues the Form

The 1099 R Form is typically issued by financial institutions, retirement plan administrators, or employers who manage pension plans. These entities are responsible for reporting distributions made to individuals and must ensure that the information provided is accurate and complete. Recipients should expect to receive this form from their respective payers following any distributions made during the tax year.

Quick guide on how to complete 1099 r form 2016

Complete 1099 R Form effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage 1099 R Form on any device with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign 1099 R Form seamlessly

- Locate 1099 R Form and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes requiring new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign 1099 R Form and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 r form 2016

Create this form in 5 minutes!

How to create an eSignature for the 1099 r form 2016

How to make an eSignature for the 1099 R Form 2016 online

How to make an electronic signature for your 1099 R Form 2016 in Google Chrome

How to make an eSignature for signing the 1099 R Form 2016 in Gmail

How to generate an electronic signature for the 1099 R Form 2016 right from your smartphone

How to generate an electronic signature for the 1099 R Form 2016 on iOS devices

How to generate an eSignature for the 1099 R Form 2016 on Android

People also ask

-

What is a 1099 R Form and why is it important?

The 1099 R Form is a tax document used to report distributions from pensions, annuities, retirement plans, or IRAs. It is essential for both tax reporting and compliance purposes, ensuring that recipients accurately report their income to the IRS. Understanding how to handle the 1099 R Form is crucial for individuals receiving retirement income.

-

How can airSlate SignNow help with 1099 R Form management?

airSlate SignNow streamlines the process of sending and eSigning your 1099 R Form, making it easy to manage retirement distributions. With its user-friendly interface, you can quickly send out the form to recipients and collect signatures efficiently. This not only saves time but also enhances the accuracy of your tax documentation.

-

What features does airSlate SignNow offer for handling the 1099 R Form?

airSlate SignNow offers a range of features that simplify the handling of the 1099 R Form, including customizable templates, secure cloud storage, and real-time tracking of document status. These features ensure that your forms are completed accurately and submitted on time, reducing the risk of errors in your tax filings.

-

Is airSlate SignNow cost-effective for managing the 1099 R Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the 1099 R Form, with competitive pricing plans tailored to suit various business needs. You can save money by eliminating the need for physical paperwork and mailing costs, while also benefiting from a streamlined digital process.

-

What integrations are available with airSlate SignNow for the 1099 R Form?

airSlate SignNow seamlessly integrates with various accounting and financial software, making it easier to manage your 1099 R Form alongside your other financial documents. Common integrations include platforms like QuickBooks and Xero, ensuring that your tax reporting is organized and efficient.

-

Can I customize the 1099 R Form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the 1099 R Form to fit your business needs. You can add your logo, adjust formatting, and include any necessary fields to ensure the form meets all IRS requirements and your specific preferences.

-

What security measures does airSlate SignNow implement for the 1099 R Form?

airSlate SignNow prioritizes security by employing advanced encryption and secure cloud storage for all documents, including the 1099 R Form. This ensures that sensitive financial information is protected from unauthorized access, giving you peace of mind when managing tax documents.

Get more for 1099 R Form

Find out other 1099 R Form

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney