1099 R Form 2015

What is the 1099 R Form

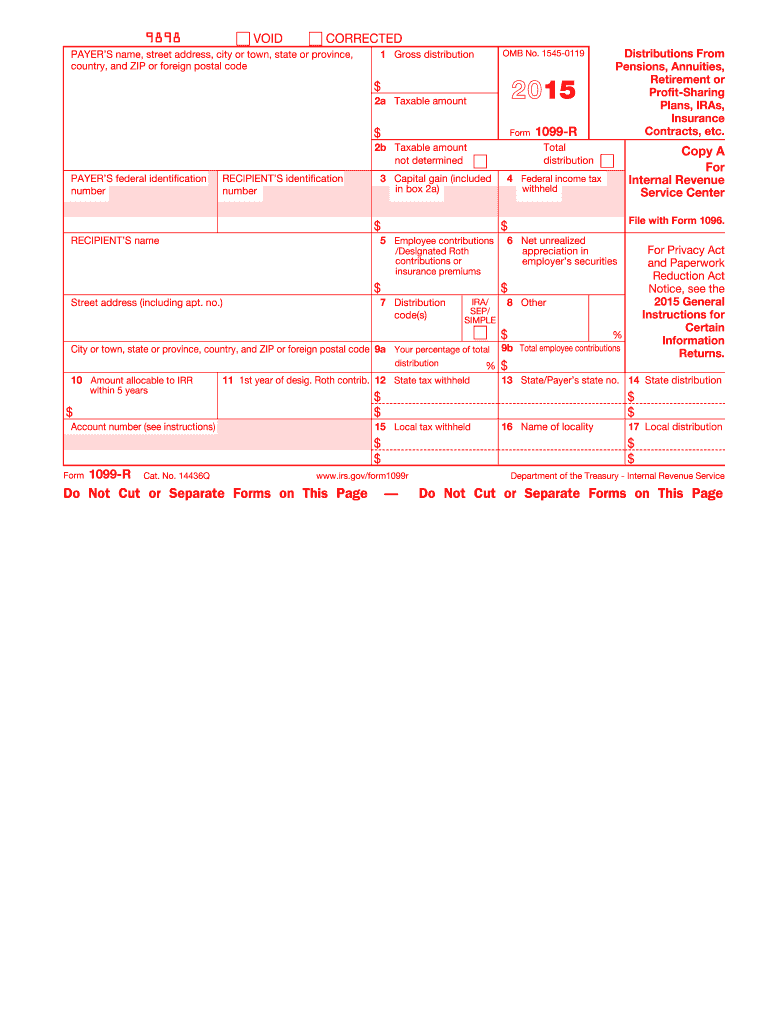

The 1099 R Form is a tax document used in the United States to report distributions from retirement accounts, pensions, annuities, and other similar sources. This form is essential for both the payer and the recipient, as it ensures that the recipient accurately reports income received during the tax year. The 1099 R Form includes various details, such as the total amount distributed, the taxable amount, and any federal income tax withheld. Understanding this form is crucial for proper tax filing and compliance with IRS regulations.

How to use the 1099 R Form

Using the 1099 R Form involves several steps to ensure accurate reporting of retirement distributions. First, recipients should review the form for accuracy, checking that all personal information, such as name and Social Security number, is correct. Next, recipients must report the amounts shown on the form when filing their federal tax return. The information from the 1099 R Form is typically entered on Form 1040 or other applicable tax forms. It is important to retain a copy of the form for personal records and future reference.

Steps to complete the 1099 R Form

Completing the 1099 R Form requires careful attention to detail. Begin by gathering all necessary information related to the retirement distribution, including account details and the amount received. Fill out the form by entering the payer's information, recipient's details, and the distribution amounts in the appropriate boxes. Ensure that you indicate any federal income tax withheld. Once completed, review the form for accuracy before submitting it to the IRS and providing a copy to the recipient. It is advisable to keep a copy of the completed form for your records.

Legal use of the 1099 R Form

The legal use of the 1099 R Form is governed by IRS regulations, which require accurate reporting of retirement distributions. This form must be issued by the payer to the recipient and filed with the IRS to comply with tax laws. Failure to comply with these regulations can result in penalties for both the payer and the recipient. It is important to ensure that the form is completed accurately and submitted on time to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 R Form are critical for compliance with IRS regulations. Generally, the form must be sent to recipients by January 31 of the year following the tax year in which the distributions were made. Additionally, the form must be filed with the IRS by the end of February if submitted on paper, or by the end of March if filed electronically. Adhering to these deadlines is essential to avoid penalties and ensure proper tax reporting.

Who Issues the Form

The 1099 R Form is typically issued by financial institutions, pension funds, or other entities that manage retirement accounts. These organizations are responsible for reporting distributions made to account holders. It is important for recipients to ensure they receive this form from the issuer, as it is necessary for accurate tax reporting. If a recipient does not receive the form, they should contact the issuer to obtain it.

Penalties for Non-Compliance

Non-compliance with the requirements surrounding the 1099 R Form can lead to significant penalties. The IRS imposes fines for failing to file the form on time, providing incorrect information, or not issuing the form to recipients. These penalties can vary based on the severity and duration of the non-compliance. To avoid these consequences, it is essential to understand the requirements and ensure timely and accurate filing of the 1099 R Form.

Quick guide on how to complete 1099 r 2015 form

Complete 1099 R Form effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle 1099 R Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign 1099 R Form effortlessly

- Obtain 1099 R Form and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign 1099 R Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 r 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 r 2015 form

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 1099 R Form and when do I need it?

The 1099 R Form is a tax document used to report distributions from pensions, annuities, retirement plans, and other similar sources. You typically need to file this form if you receive retirement income or distributions that exceed certain thresholds in a tax year. Understanding how to accurately complete the 1099 R Form is essential for proper tax reporting.

-

How can airSlate SignNow help me with the 1099 R Form?

airSlate SignNow offers a user-friendly platform for electronically signing and sending your 1099 R Form securely. With our solution, you can streamline the process of preparing and distributing this form, ensuring compliance and saving time. Utilizing airSlate SignNow enhances your efficiency when managing important tax documents.

-

Is airSlate SignNow affordable for small businesses needing to send 1099 R Forms?

Yes, airSlate SignNow provides a cost-effective solution for small businesses looking to manage their 1099 R Forms. Our pricing plans are designed to fit various budgets, ensuring that even small organizations can benefit from streamlined document management without breaking the bank. You can choose a plan that best suits your needs.

-

What features does airSlate SignNow offer for managing the 1099 R Form?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking, all of which are ideal for managing 1099 R Forms. You can create, send, and store your forms securely, making it easy to keep track of your tax documentation. These features enhance collaboration and improve overall efficiency.

-

Can airSlate SignNow integrate with accounting software for 1099 R Forms?

Absolutely! airSlate SignNow can integrate seamlessly with popular accounting software solutions, allowing you to manage your 1099 R Forms alongside your financial data. This integration simplifies the process of preparing and filing your taxes, ensuring that all necessary documents are easily accessible.

-

How secure is airSlate SignNow for handling sensitive 1099 R Form data?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure access protocols to protect your sensitive information, including 1099 R Form data. Our platform is designed to ensure that your documents remain confidential and secure throughout the signing process.

-

What is the process for sending a 1099 R Form using airSlate SignNow?

Sending a 1099 R Form with airSlate SignNow is a straightforward process. Simply upload your form, add the necessary recipients, and customize any fields for signing. Once everything is set up, you can send the document for eSignature, and track its status in real-time.

Get more for 1099 R Form

Find out other 1099 R Form

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure