Form 1040 Schedule 8812 2024-2026

What is the Form 1040 Schedule 8812

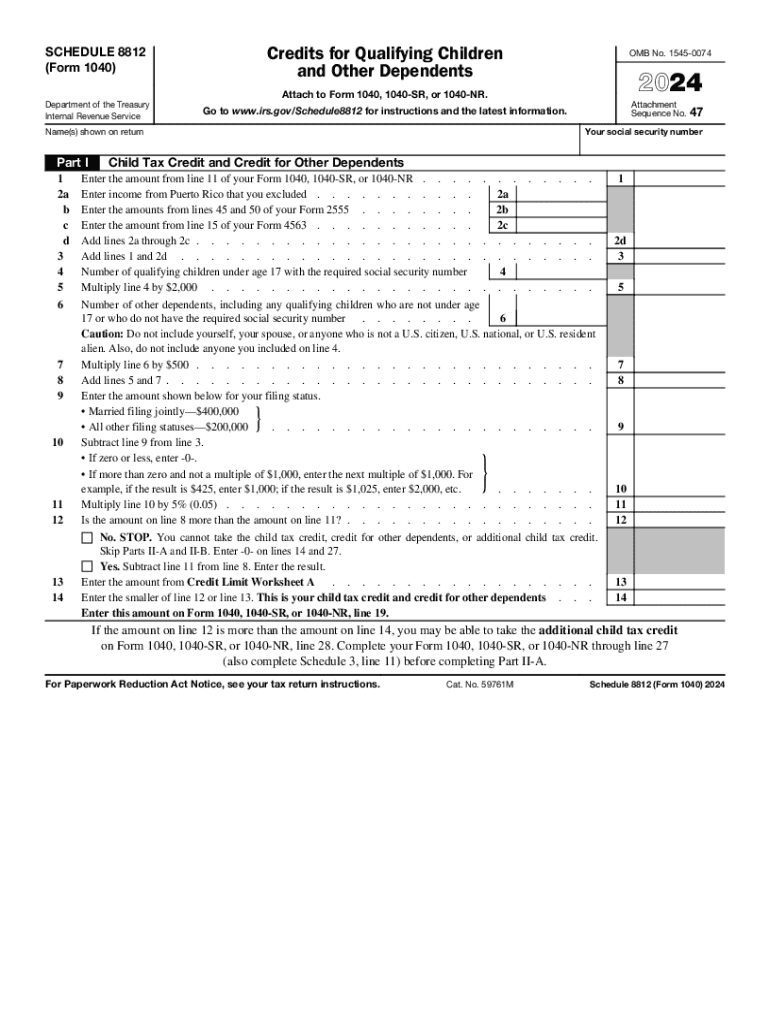

The Form 1040 Schedule 8812 is used by taxpayers to calculate the Child Tax Credit for qualifying children. This form allows families to claim credits that can significantly reduce their tax liability. The Child Tax Credit is designed to provide financial relief to parents or guardians, making it easier to support children under the age of 17. The form includes details about the number of qualifying children, their ages, and the taxpayer's income level, which can affect the amount of credit received.

How to use the Form 1040 Schedule 8812

To use the Form 1040 Schedule 8812, taxpayers must first determine their eligibility for the Child Tax Credit. This involves reviewing the criteria for qualifying children, which include age, relationship, and residency requirements. Once eligibility is confirmed, taxpayers should fill out the form by entering the required information, such as the number of qualifying children and the total income. It is essential to follow the instructions carefully to ensure accurate calculations and compliance with IRS guidelines.

Steps to complete the Form 1040 Schedule 8812

Completing the Form 1040 Schedule 8812 involves several key steps:

- Gather necessary documents, including Social Security numbers for each qualifying child.

- Determine eligibility based on the child’s age, residency, and relationship to the taxpayer.

- Fill out the form, providing details about income and the number of qualifying children.

- Calculate the total Child Tax Credit based on the information provided.

- Attach the completed Schedule 8812 to your Form 1040 when filing your taxes.

Eligibility Criteria

Eligibility for the Child Tax Credit involves several criteria that must be met. Taxpayers must have a qualifying child under the age of 17 at the end of the tax year. The child must be a dependent on the taxpayer's tax return and must have lived with the taxpayer for more than half of the year. Additionally, the taxpayer's income must fall within certain thresholds to qualify for the full credit. These criteria ensure that the credit is targeted to families who need it most.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule 8812 align with the standard tax filing deadlines in the United States. Typically, individual tax returns are due on April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates to ensure timely submission of their tax returns and to avoid penalties. Extensions may also be available, but they do not extend the time to pay any taxes owed.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 Schedule 8812, including detailed instructions on eligibility, how to calculate the credit, and what information is required. Taxpayers are encouraged to refer to the IRS website or the instructions that accompany the form for the most current information. Following these guidelines is crucial for ensuring compliance and maximizing the benefits of the Child Tax Credit.

Handy tips for filling out Form 1040 Schedule 8812 online

Quick steps to complete and e-sign Form 1040 Schedule 8812 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant service for optimum straightforwardness. Use signNow to electronically sign and send Form 1040 Schedule 8812 for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 schedule 8812

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule 8812

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 child tax credit?

The 2024 child tax credit is a financial benefit provided by the government to assist families with children. It offers a signNow reduction in tax liability, helping parents manage their expenses more effectively. Understanding this credit can help you maximize your tax return and support your family's financial health.

-

How can airSlate SignNow help with the 2024 child tax credit documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to the 2024 child tax credit. With our easy-to-use platform, you can quickly create, send, and eSign necessary forms, ensuring you meet all deadlines. This efficiency can save you time and reduce stress during tax season.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents related to the 2024 child tax credit. These tools ensure that your documents are organized and accessible, making the tax filing process smoother. Additionally, our platform is designed to enhance collaboration among users.

-

Is airSlate SignNow cost-effective for families applying for the 2024 child tax credit?

Yes, airSlate SignNow offers a cost-effective solution for families looking to manage their tax documentation for the 2024 child tax credit. Our pricing plans are designed to fit various budgets, ensuring that you can access essential features without breaking the bank. This affordability makes it easier for families to stay organized during tax season.

-

Can I integrate airSlate SignNow with other financial software for the 2024 child tax credit?

Absolutely! airSlate SignNow integrates seamlessly with various financial software, allowing you to streamline your workflow when preparing for the 2024 child tax credit. This integration ensures that all your financial documents are in one place, making it easier to manage your tax filings. You can connect with popular platforms to enhance your overall efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for the 2024 child tax credit, offers numerous benefits. You gain access to a secure and user-friendly platform that simplifies document management and eSigning. This can lead to faster processing times and reduced errors, ultimately benefiting your tax filing experience.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including those related to the 2024 child tax credit. We utilize advanced encryption and secure cloud storage to protect your sensitive information. This commitment to security gives you peace of mind while managing your important tax documents.

Get more for Form 1040 Schedule 8812

Find out other Form 1040 Schedule 8812

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple