8812 Irs Form 2016

What is the 8812 IRS Form

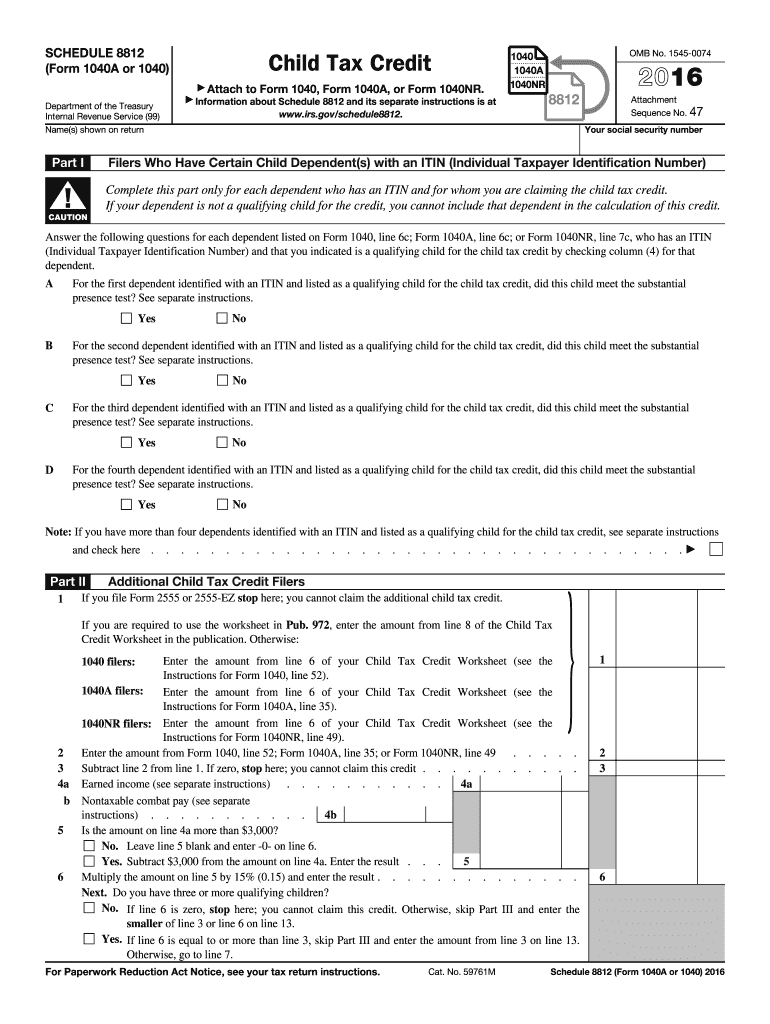

The 8812 IRS Form, also known as the Additional Child Tax Credit, is a tax form used by eligible taxpayers to claim a refundable credit for qualifying children. This form is particularly relevant for those who may not have received the full amount of the Child Tax Credit through their withholding or estimated tax payments. By using the 8812 IRS Form, taxpayers can potentially receive a refund even if they do not owe any federal income tax.

How to use the 8812 IRS Form

To use the 8812 IRS Form effectively, taxpayers need to first determine their eligibility based on their income and the number of qualifying children. Once eligibility is confirmed, the form must be filled out accurately, providing necessary information such as the taxpayer's filing status, the number of qualifying children, and their Social Security numbers. After completing the form, it should be submitted along with the main tax return, typically the Form 1040 or 1040-SR.

Steps to complete the 8812 IRS Form

Completing the 8812 IRS Form involves several key steps:

- Gather necessary documents, including Social Security cards for qualifying children.

- Determine eligibility by reviewing IRS guidelines on income limits and qualifying children.

- Fill out the form, ensuring all required fields are completed accurately.

- Calculate the credit amount based on the number of qualifying children and income level.

- Attach the completed form to your main tax return before submission.

Legal use of the 8812 IRS Form

The legal use of the 8812 IRS Form is governed by IRS regulations, which stipulate the requirements for claiming the Additional Child Tax Credit. Taxpayers must ensure that they meet all eligibility criteria, including income limits and the relationship of the children claimed. Misuse of the form, such as claiming ineligible children, can lead to penalties and disallowance of the credit.

Filing Deadlines / Important Dates

Filing deadlines for the 8812 IRS Form align with the standard tax return deadlines. Typically, individual tax returns must be filed by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines, especially in light of potential legislative updates.

Eligibility Criteria

Eligibility for the 8812 IRS Form is determined by several factors, including:

- The taxpayer's adjusted gross income (AGI) must fall within specific limits set by the IRS.

- Taxpayers must have qualifying children under the age of seventeen at the end of the tax year.

- Children must have valid Social Security numbers.

Form Submission Methods

The 8812 IRS Form can be submitted in conjunction with the primary tax return through various methods:

- Electronically, using tax preparation software that supports IRS e-filing.

- By mail, sending the completed tax return, including the 8812 form, to the appropriate IRS address.

- In-person at designated IRS offices, although this method is less common.

Quick guide on how to complete 8812 irs 2016 form

Complete 8812 Irs Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly and without delays. Handle 8812 Irs Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign 8812 Irs Form effortlessly

- Obtain 8812 Irs Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or censor sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Verify all the information and click the Done button to save your changes.

- Select your preferred method of sharing your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign 8812 Irs Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8812 irs 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 8812 irs 2016 form

How to generate an eSignature for the 8812 Irs 2016 Form online

How to make an eSignature for your 8812 Irs 2016 Form in Google Chrome

How to generate an electronic signature for signing the 8812 Irs 2016 Form in Gmail

How to make an electronic signature for the 8812 Irs 2016 Form right from your smartphone

How to make an electronic signature for the 8812 Irs 2016 Form on iOS

How to make an eSignature for the 8812 Irs 2016 Form on Android

People also ask

-

What is the 8812 IRS Form?

The 8812 IRS Form, also known as the Additional Child Tax Credit, allows eligible taxpayers to claim a refund for unused tax credits. It is designed for taxpayers who qualify for the Child Tax Credit but do not owe enough tax to utilize the full credit amount. Understanding this form is crucial for maximizing your potential refund.

-

How can airSlate SignNow help with the 8812 IRS Form?

airSlate SignNow streamlines the process of completing and submitting the 8812 IRS Form by providing an easy-to-use platform for eSigning and sharing documents. You can quickly fill out necessary fields and ensure your form is submitted promptly. This efficiency can save you time and reduce the stress associated with tax season.

-

Is there a cost to use airSlate SignNow for the 8812 IRS Form?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including features for managing documents like the 8812 IRS Form. Pricing depends on the features you need, but there are affordable options for individuals and businesses. You can sign up for a free trial to explore the platform before committing to a plan.

-

What features make airSlate SignNow ideal for handling the 8812 IRS Form?

airSlate SignNow offers a range of features that simplify the handling of the 8812 IRS Form, including eSigning, template creation, and document storage. Its intuitive interface allows users to navigate easily, making the tax filing process more manageable. These features ensure that your documents are secure and accessible at all times.

-

Can I integrate airSlate SignNow with other software for the 8812 IRS Form?

Yes, airSlate SignNow supports integrations with various software tools, enhancing your ability to manage the 8812 IRS Form effectively. You can connect it with popular applications like Zapier, Salesforce, and Google Workspace, streamlining your workflow. This connectivity allows for efficient data transfer and improved productivity.

-

What are the benefits of using airSlate SignNow for tax documents like the 8812 IRS Form?

Using airSlate SignNow for tax documents, including the 8812 IRS Form, provides several benefits like increased efficiency, enhanced security, and simplified collaboration. With its eSigning capabilities, you can expedite the approval process and ensure compliance. Additionally, the platform helps keep your tax documents organized and easy to access.

-

How secure is airSlate SignNow when handling the 8812 IRS Form?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect your data when dealing with sensitive documents like the 8812 IRS Form. The platform also complies with major industry standards and regulations, ensuring that your personal information remains confidential. You can trust that your tax documents are secure while using our service.

Get more for 8812 Irs Form

Find out other 8812 Irs Form

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe