8812 Form 2015

What is the 8812 Form

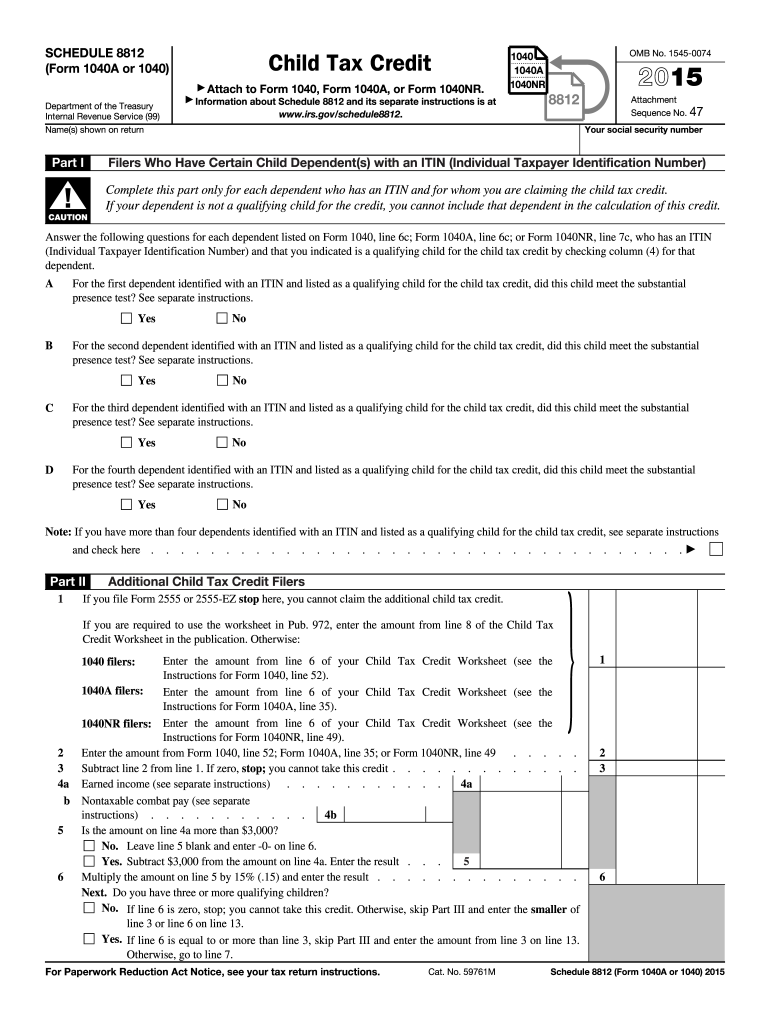

The 8812 Form, officially known as the Additional Child Tax Credit, is a tax form used by eligible taxpayers in the United States to claim a refundable credit for qualifying children. This form allows individuals to receive a portion of the Child Tax Credit that exceeds their tax liability, potentially resulting in a refund. It is particularly relevant for low to moderate-income families who may not owe enough taxes to benefit fully from the non-refundable portion of the Child Tax Credit.

How to use the 8812 Form

To use the 8812 Form effectively, taxpayers must first determine their eligibility based on the number of qualifying children and their income level. The form requires detailed information regarding the taxpayer's filing status, the number of dependents, and their respective Social Security numbers. After gathering the necessary information, taxpayers can complete the form and include it with their federal tax return, ensuring they maximize their potential refund.

Steps to complete the 8812 Form

Completing the 8812 Form involves several key steps:

- Review eligibility requirements to confirm that you qualify for the Additional Child Tax Credit.

- Gather necessary documentation, including Social Security numbers for all qualifying children.

- Fill out the form, providing accurate information about your income and dependents.

- Calculate the credit amount based on the instructions provided on the form.

- Attach the completed form to your federal tax return before submission.

Legal use of the 8812 Form

The 8812 Form is legally binding when filled out accurately and submitted in compliance with IRS guidelines. Taxpayers must ensure that all information is truthful and complete to avoid penalties or legal issues. The form must be submitted by the tax filing deadline, and any discrepancies may lead to audits or adjustments by the IRS.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 8812 Form. Typically, the deadline for submitting your federal tax return, including the 8812 Form, is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep in mind any potential extensions they may apply for, which can provide additional time to file.

Required Documents

To complete the 8812 Form accurately, taxpayers need to gather several essential documents:

- Social Security cards for all qualifying children.

- Income statements, such as W-2 forms or 1099 forms.

- Previous year’s tax return for reference, if applicable.

- Any additional documentation that supports claims for dependents or credits.

Who Issues the Form

The 8812 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS updates the form periodically to reflect changes in tax law and eligibility criteria, so it is essential to use the most current version when filing.

Quick guide on how to complete 2015 8812 form

Complete 8812 Form effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the right template and securely save it online. airSlate SignNow provides you with all the tools necessary to design, modify, and eSign your documents rapidly without delays. Manage 8812 Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign 8812 Form with ease

- Obtain 8812 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign 8812 Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 8812 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 8812 form

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the 8812 Form and why is it important?

The 8812 Form, also known as the Additional Child Tax Credit, is a crucial tax form that allows taxpayers to claim additional credits for eligible children. Understanding the 8812 Form can help you maximize your tax refund and ensure compliance with IRS regulations. With airSlate SignNow, you can easily prepare and eSign your 8812 Form, streamlining your tax filing process.

-

How can airSlate SignNow help with completing the 8812 Form?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out the 8812 Form. Our user-friendly interface allows you to input your information quickly and accurately, ensuring that your form is completed correctly. Additionally, you can eSign the 8812 Form securely, making it easy to submit your tax documents.

-

Is there a cost associated with using airSlate SignNow for the 8812 Form?

Yes, airSlate SignNow offers a range of pricing plans that cater to different needs, including individual users and businesses. Our plans are designed to be cost-effective while providing full access to features necessary for managing documents like the 8812 Form. You can choose a plan that suits your budget and enjoy seamless eSignature capabilities.

-

Can I store my completed 8812 Form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store your completed 8812 Form and other important documents in the cloud. This feature ensures that you can access your tax forms whenever needed, providing peace of mind and easy retrieval in case of audits or further tax inquiries.

-

What features does airSlate SignNow offer for electronic signing of the 8812 Form?

With airSlate SignNow, you can electronically sign your 8812 Form with just a few clicks. Our platform includes features like customizable signature fields, automated reminders for signers, and robust security measures to protect your sensitive information. These features make the signing process quick and compliant with legal standards.

-

Does airSlate SignNow integrate with tax software for the 8812 Form?

Yes, airSlate SignNow offers integrations with popular tax software, making it easier to manage the 8812 Form alongside your other tax documents. This integration streamlines your workflow, allowing you to eSign and store your forms directly within your preferred tax software environment.

-

What are the benefits of using airSlate SignNow for the 8812 Form?

Using airSlate SignNow for the 8812 Form brings numerous benefits, including enhanced efficiency, reduced paperwork, and easier collaboration with tax professionals. Our electronic signing solution is designed to be user-friendly, helping you save time and avoid errors in your tax filing process.

Get more for 8812 Form

- 2019 op 383 form

- Form au 724

- Form g 49 annual general exciseuse tax hawaiigov

- Required fields for appeal to be processed form

- Schedule k 1 form n 20 rev 2019 partners share of income

- Schedule ge form g 45g 49 rev 2019 general exciseuse tax

- Schedule k 1 form n 35 rev 2019 shareholders share of income credits deductions etc forms 2019

- Delinquent earned income tax department dear form

Find out other 8812 Form

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online