Form 8812 2014

What is the Form 8812

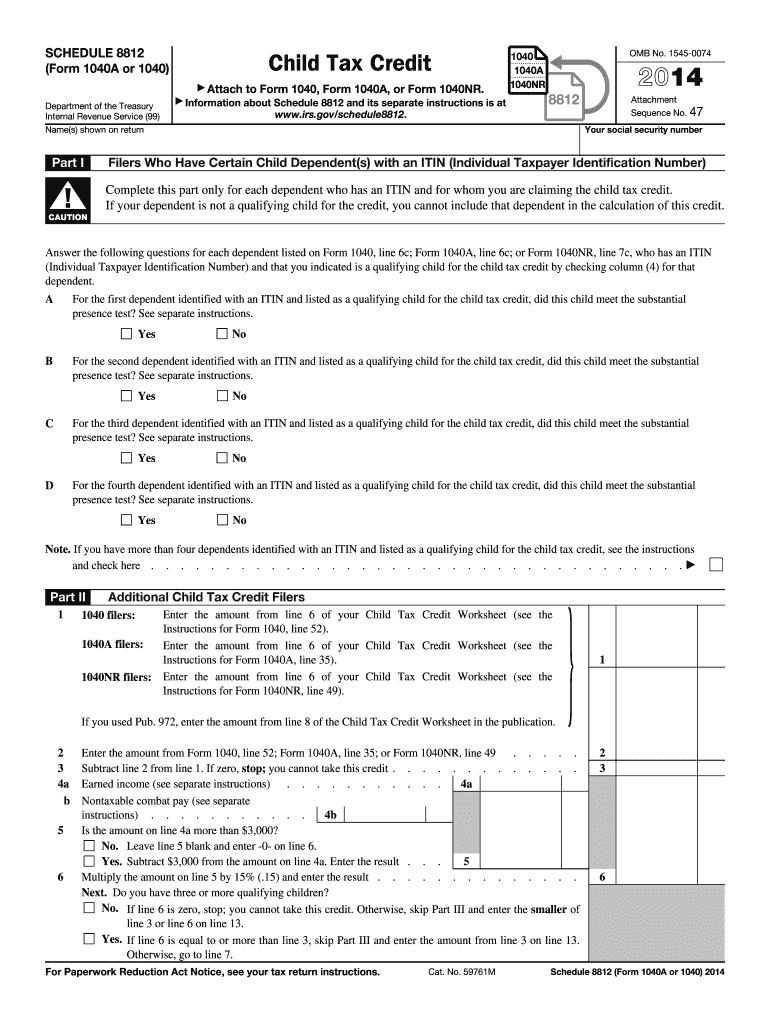

The Form 8812, also known as the Additional Child Tax Credit, is a tax form used by eligible taxpayers in the United States to claim a refundable tax credit for qualifying children. This credit is designed to provide financial relief to families and can significantly reduce the overall tax liability. The form is particularly relevant for those who have children under the age of 17 and who meet specific income requirements. Understanding the purpose and details of this form is essential for maximizing potential tax benefits.

How to use the Form 8812

Using Form 8812 involves several steps to ensure accurate completion and submission. Taxpayers must first determine their eligibility based on income and the number of qualifying children. After confirming eligibility, the next step is to fill out the form accurately, providing necessary details about the children and any other required information. Once completed, the form should be submitted along with the main tax return, typically the Form 1040. It is important to follow IRS guidelines closely to avoid errors that could delay processing or reduce the credit amount.

Steps to complete the Form 8812

Completing Form 8812 requires careful attention to detail. The following steps outline the process:

- Gather necessary documentation, including Social Security numbers for all qualifying children.

- Determine eligibility based on income thresholds and the number of children.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check calculations to confirm the correct credit amount is claimed.

- Submit the form with your tax return by the designated deadline.

Legal use of the Form 8812

Form 8812 must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to eligibility requirements and accurately reporting income and dependent information. The form is legally binding when submitted correctly and can be subject to audits by the IRS. Taxpayers should maintain records of all documents submitted with the form to support claims in case of inquiries or audits.

Filing Deadlines / Important Dates

Filing deadlines for Form 8812 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes in deadlines and consider filing for an extension if necessary. Keeping track of these dates is crucial for ensuring timely submission and avoiding penalties.

Eligibility Criteria

To qualify for the Additional Child Tax Credit using Form 8812, taxpayers must meet specific eligibility criteria. These include:

- Having a qualifying child under the age of 17 at the end of the tax year.

- Meeting income thresholds set by the IRS, which may vary annually.

- Filing a tax return, even if no tax is owed, to claim the credit.

Required Documents

When completing Form 8812, certain documents are necessary to support the information provided. These typically include:

- Social Security cards for all qualifying children.

- Income statements, such as W-2 forms or 1099s.

- Previous tax returns, if applicable, to verify prior claims.

Quick guide on how to complete 2014 form 8812

Effortlessly Prepare Form 8812 on Any Device

Online document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8812 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and eSign Form 8812 with Ease

- Locate Form 8812 and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Choose your delivery method for your form: via email, SMS, or link invitation, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Edit and eSign Form 8812 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8812

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8812

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 8812 and why is it important?

Form 8812, also known as the Additional Child Tax Credit, is a crucial tax form for families seeking to claim tax credits for dependents. Properly filling out Form 8812 can signNowly impact your tax refund, making it essential for eligible taxpayers. Using airSlate SignNow, you can easily access and eSign Form 8812 to ensure timely submission.

-

How does airSlate SignNow simplify the process of signing Form 8812?

AirSlate SignNow streamlines the eSigning process for Form 8812 with its intuitive interface, allowing users to quickly fill out and sign documents. With features like templates and automated workflows, airSlate SignNow ensures that you can manage your Form 8812 efficiently, reducing the time spent on paperwork.

-

Is there a cost to use airSlate SignNow for Form 8812?

AirSlate SignNow offers flexible pricing plans that cater to various needs, including individual users and businesses. You can start with a free trial to explore how airSlate SignNow can assist with Form 8812, and choose a plan that fits your requirements once you're satisfied with the service.

-

Can I integrate airSlate SignNow with other software for managing Form 8812?

Yes, airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Microsoft Office, allowing you to streamline your workflow when managing Form 8812. This integration helps you access, sign, and share your tax documents without switching between different platforms.

-

What features does airSlate SignNow offer for managing Form 8812?

AirSlate SignNow provides a range of features designed to simplify the management of Form 8812, including document templates, real-time tracking, and secure cloud storage. These features ensure that your tax forms are organized, accessible, and secure throughout the signing process.

-

How secure is airSlate SignNow when handling sensitive documents like Form 8812?

Security is a top priority for airSlate SignNow, which employs advanced encryption and authentication protocols to protect your sensitive documents, including Form 8812. This ensures that your personal information is safeguarded while you eSign and share your tax forms.

-

Can I use airSlate SignNow on mobile devices for Form 8812?

Absolutely! AirSlate SignNow is optimized for mobile devices, allowing you to fill out and eSign Form 8812 on the go. The mobile app provides a user-friendly experience, ensuring that you can manage your tax documents anytime, anywhere.

Get more for Form 8812

Find out other Form 8812

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document