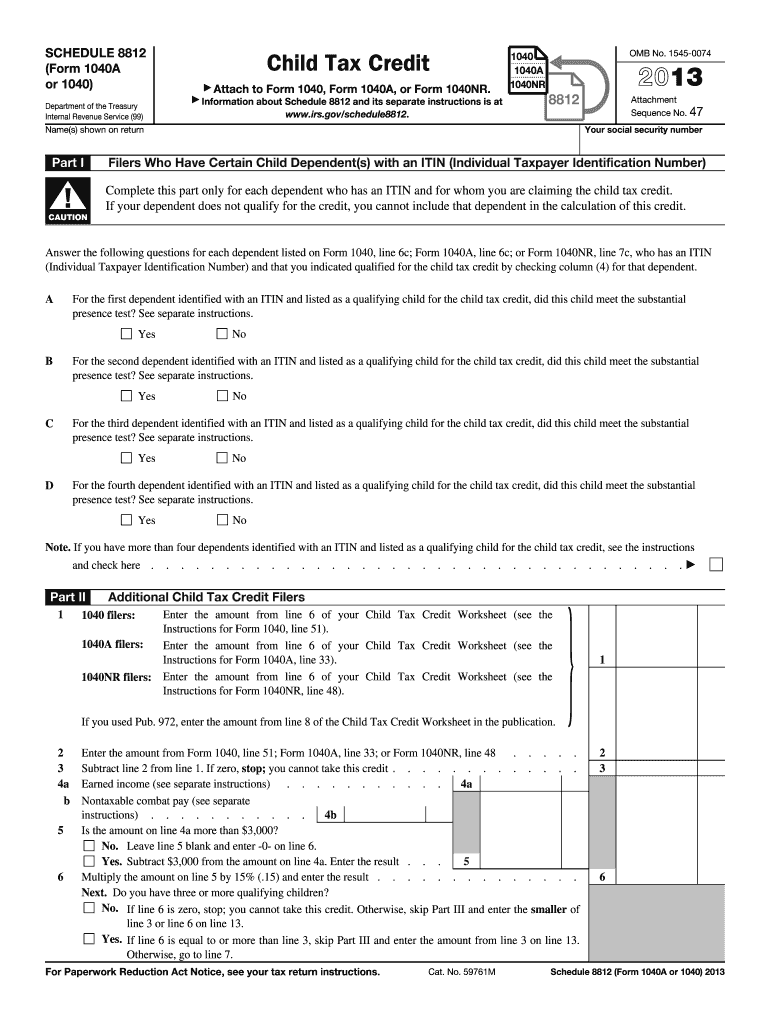

Irs Form 8812 2013

What is the IRS Form 8812

The IRS Form 8812, also known as the Additional Child Tax Credit, is a tax form used by eligible taxpayers to claim a refundable credit for certain qualifying children. This credit is designed to provide financial relief to families, allowing them to receive a portion of the Child Tax Credit even if they do not owe any federal income tax. The form is particularly beneficial for low- to moderate-income families who may not have sufficient tax liability to fully utilize the Child Tax Credit.

How to use the IRS Form 8812

To effectively use the IRS Form 8812, taxpayers must first determine their eligibility based on income and the number of qualifying children. Once eligibility is established, the form should be filled out accurately, reflecting the taxpayer's situation. The information required includes the taxpayer's filing status, the number of qualifying children, and any applicable income limits. After completing the form, it must be attached to the taxpayer's federal income tax return, whether filed electronically or by mail.

Steps to complete the IRS Form 8812

Completing the IRS Form 8812 involves several key steps:

- Gather necessary documents, including your tax return and information about your qualifying children.

- Determine your eligibility based on the income thresholds set by the IRS.

- Fill out the form, ensuring that all required fields are completed accurately.

- Calculate the credit amount based on the number of qualifying children and your income.

- Attach the completed Form 8812 to your federal tax return before submission.

Eligibility Criteria

To qualify for the Additional Child Tax Credit via the IRS Form 8812, taxpayers must meet specific criteria:

- The taxpayer must have a qualifying child under the age of 17 at the end of the tax year.

- Income must fall below certain thresholds, which can vary based on filing status.

- The taxpayer must have earned income, which can include wages, salaries, or self-employment income.

- The child must be claimed as a dependent on the taxpayer's return.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8812 align with the general tax return deadlines. Typically, individual income tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file their returns and the associated Form 8812.

Legal use of the IRS Form 8812

The IRS Form 8812 is legally recognized as a valid means for claiming the Additional Child Tax Credit. To ensure compliance, taxpayers must accurately complete the form and adhere to IRS guidelines regarding eligibility and documentation. Using a reliable electronic signature solution can further enhance the legal standing of the submitted form, ensuring it meets all necessary requirements for acceptance by the IRS.

Quick guide on how to complete 2013 irs form 8812

Effortlessly Prepare Irs Form 8812 on Any Device

Digital document management has become increasingly favored by enterprises and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to access the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without any delays. Manage Irs Form 8812 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to Modify and Electronically Sign Irs Form 8812 with Ease

- Locate Irs Form 8812 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, either by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Irs Form 8812 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 irs form 8812

Create this form in 5 minutes!

How to create an eSignature for the 2013 irs form 8812

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is IRS Form 8812 and who needs to file it?

IRS Form 8812 is a tax form used to claim the Additional Child Tax Credit. Taxpayers who have qualifying children and are eligible for the Child Tax Credit must file this form to receive the credit and potentially increase their tax refund. If you’re unsure about your eligibility, consulting with a tax professional can be beneficial.

-

How can airSlate SignNow help with IRS Form 8812 submissions?

airSlate SignNow provides a streamlined platform for electronically signing and sending IRS Form 8812 securely. With our user-friendly interface, you can easily complete and manage your tax documents, ensuring that you meet all submission deadlines. This simplifies the filing process and helps ensure accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8812?

Yes, there is a subscription fee for using airSlate SignNow, but it offers a cost-effective solution for managing all your document signing needs, including IRS Form 8812. We provide various pricing plans to fit different business sizes and needs. You can choose a plan that best suits your requirements and budget.

-

What features does airSlate SignNow offer for managing IRS Form 8812?

airSlate SignNow offers essential features for managing IRS Form 8812, such as eSignature, document templates, and secure cloud storage. These features facilitate quick and easy completion of your tax forms while ensuring that they are stored safely and can be accessed anytime. Additionally, our platform supports real-time collaboration, making it easier for multiple parties to sign the form.

-

Can I integrate airSlate SignNow with other software for IRS Form 8812?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, enhancing your workflow for IRS Form 8812 and other documents. Whether you use accounting software or customer relationship management systems, our integrations help streamline your document management process, saving you time and reducing errors.

-

What benefits does airSlate SignNow provide for filing IRS Form 8812?

Using airSlate SignNow for IRS Form 8812 offers several benefits, including enhanced security for your sensitive tax information and the convenience of eSigning from anywhere. Our platform also helps reduce paper usage and speeds up the filing process, allowing you to focus more on your business rather than paperwork.

-

Is airSlate SignNow user-friendly for first-time users filing IRS Form 8812?

Yes, airSlate SignNow is designed with user experience in mind, making it simple for first-time users to file IRS Form 8812. Our intuitive interface guides you through the signing process, and our support resources are readily available to assist you. Even if you're unfamiliar with eSigning, you can easily navigate our platform.

Get more for Irs Form 8812

- Comparing information from your fafsa application with copies of yours and your parents 2017 federal tax

- Fill p card application ampamp change request pdf form fillio

- A spark of fire will start the principles of powder into atsu form

- Montclair state university routing form and routing approval

- To print oral robert university financial guarantee form

- Transcript request form oklahoma panhandle state university

- Mobap student portal form

- Prabhat matka form

Find out other Irs Form 8812

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF