About Schedule 8812 Form 1040, Additional Child TaxAbout Schedule 8812 Form 1040, Additional Child Tax2020 Instructions for Sche 2022

Understanding Schedule 8812

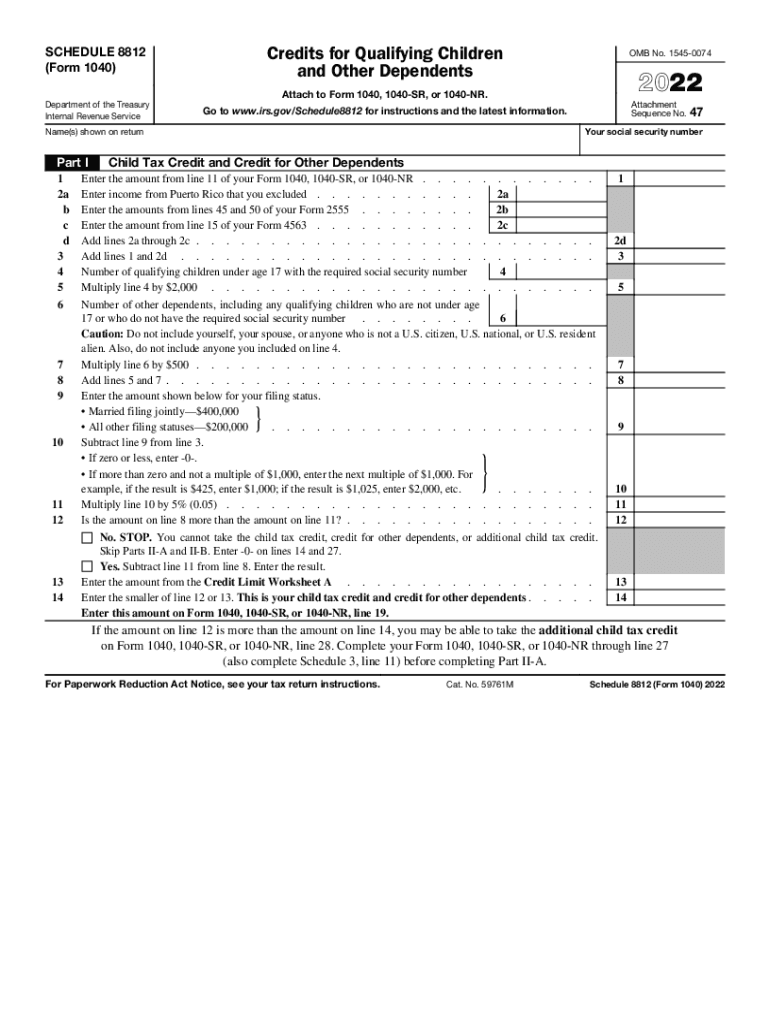

Schedule 8812 is a form used by taxpayers in the United States to claim the Additional Child Tax Credit. This credit is designed to provide financial relief to families with qualifying children. The form must be submitted along with your federal income tax return, typically Form 1040. By completing Schedule 8812, you can determine your eligibility for the credit and calculate the amount you may receive.

Steps to Complete Schedule 8812

Completing Schedule 8812 involves several steps:

- Gather necessary documents, including your tax return and information about your qualifying children.

- Fill out Part I of the form, which requires details about your children and their eligibility.

- Complete Part II to calculate the credit amount based on your income and the number of qualifying children.

- Review your completed form for accuracy before submitting it with your tax return.

Eligibility Criteria for Schedule 8812

To qualify for the Additional Child Tax Credit using Schedule 8812, you must meet specific criteria:

- Your child must be under the age of seventeen at the end of the tax year.

- You must have a valid Social Security number for each qualifying child.

- Your income must fall within certain limits set by the IRS.

- You must have filed a federal income tax return.

Filing Deadlines for Schedule 8812

It is essential to be aware of the filing deadlines for Schedule 8812:

- The form must be submitted by the tax return due date, typically April 15 of the following year.

- If you are filing for an extension, ensure that Schedule 8812 is included with your extended return.

Legal Use of Schedule 8812

Schedule 8812 is a legally binding document when completed accurately and submitted with your tax return. It is important to provide truthful information to avoid penalties. The IRS may review your submission for compliance, and discrepancies could lead to audits or denial of the credit.

Digital vs. Paper Version of Schedule 8812

Taxpayers can complete Schedule 8812 either digitally or on paper. The digital version allows for easier calculations and automatic error checking. Using electronic filing methods can expedite processing times and provide immediate confirmation of receipt. However, some individuals may prefer the traditional paper method for personal record-keeping.

Quick guide on how to complete about schedule 8812 form 1040 additional child taxabout schedule 8812 form 1040 additional child tax2020 instructions for

Effortlessly Prepare About Schedule 8812 Form 1040, Additional Child TaxAbout Schedule 8812 Form 1040, Additional Child Tax2020 Instructions For Sche on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to easily access the right form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage About Schedule 8812 Form 1040, Additional Child TaxAbout Schedule 8812 Form 1040, Additional Child Tax2020 Instructions For Sche on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign About Schedule 8812 Form 1040, Additional Child TaxAbout Schedule 8812 Form 1040, Additional Child Tax2020 Instructions For Sche with Ease

- Find About Schedule 8812 Form 1040, Additional Child TaxAbout Schedule 8812 Form 1040, Additional Child Tax2020 Instructions For Sche and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method of sharing your form—via email, SMS, invite link, or download it to your computer.

Eliminate the chaos of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Edit and eSign About Schedule 8812 Form 1040, Additional Child TaxAbout Schedule 8812 Form 1040, Additional Child Tax2020 Instructions For Sche to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule 8812 form 1040 additional child taxabout schedule 8812 form 1040 additional child tax2020 instructions for

Create this form in 5 minutes!

People also ask

-

What is a schedule 8812?

The schedule 8812 is a crucial tax form that families with children use to calculate the Child Tax Credit. By using the schedule 8812, you can determine your eligibility for credits, which can signNowly reduce your tax burden. Understanding this form is essential for maximizing your potential refunds.

-

How can airSlate SignNow help with schedule 8812?

AirSlate SignNow provides an efficient platform for electronically signing and submitting critical tax documents like schedule 8812. By streamlining the document workflow, airSlate SignNow ensures that you can quickly send and receive signed forms, helping you stay compliant and organized during tax season.

-

Is there a cost associated with using airSlate SignNow for schedule 8812?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, making it affordable for both individuals and businesses to manage documents like schedule 8812. The pricing structure is transparent, and you can choose a plan that best suits your budget while accessing essential features.

-

What features does airSlate SignNow offer for managing schedule 8812?

AirSlate SignNow offers features such as document templates, real-time tracking, and secure storage, which make it easy to manage your schedule 8812 efficiently. These features ensure that you can easily create, sign, and store your tax documents without the hassle of paper trails.

-

Can airSlate SignNow integrate with tax software for schedule 8812?

Absolutely! AirSlate SignNow integrates seamlessly with various tax software solutions, allowing you to handle your schedule 8812 effortlessly. This integration streamlines the signing and submission process, ensuring that your critical tax forms are submitted without errors.

-

What are the benefits of using airSlate SignNow for schedule 8812 filings?

Using airSlate SignNow for schedule 8812 filings offers several benefits, including enhanced document security, quicker turnaround times for signatures, and a more organized way to handle your tax documents. These advantages help reduce stress during tax season and ensure that you maximize your potential refunds.

-

Are the signed schedule 8812 documents secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents, including the signed schedule 8812. With advanced encryption methods and compliance with data protection regulations, you can trust that your sensitive information remains safe throughout the signing process.

Get more for About Schedule 8812 Form 1040, Additional Child TaxAbout Schedule 8812 Form 1040, Additional Child Tax2020 Instructions For Sche

- Mutual wills package with last wills and testaments for married couple with adult children nevada form

- Mutual wills package with last wills and testaments for married couple with no children nevada form

- Mutual wills package with last wills and testaments for married couple with minor children nevada form

- Legal last will and testament form for married person with adult children nevada

- Legal last will and testament form for a domestic partner with adult children nevada

- Nevada married form

- Nv legal form

- Nv minor form

Find out other About Schedule 8812 Form 1040, Additional Child TaxAbout Schedule 8812 Form 1040, Additional Child Tax2020 Instructions For Sche

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now