Form 990 Pf Instructions 2019

What is the Form 990 PF Instructions

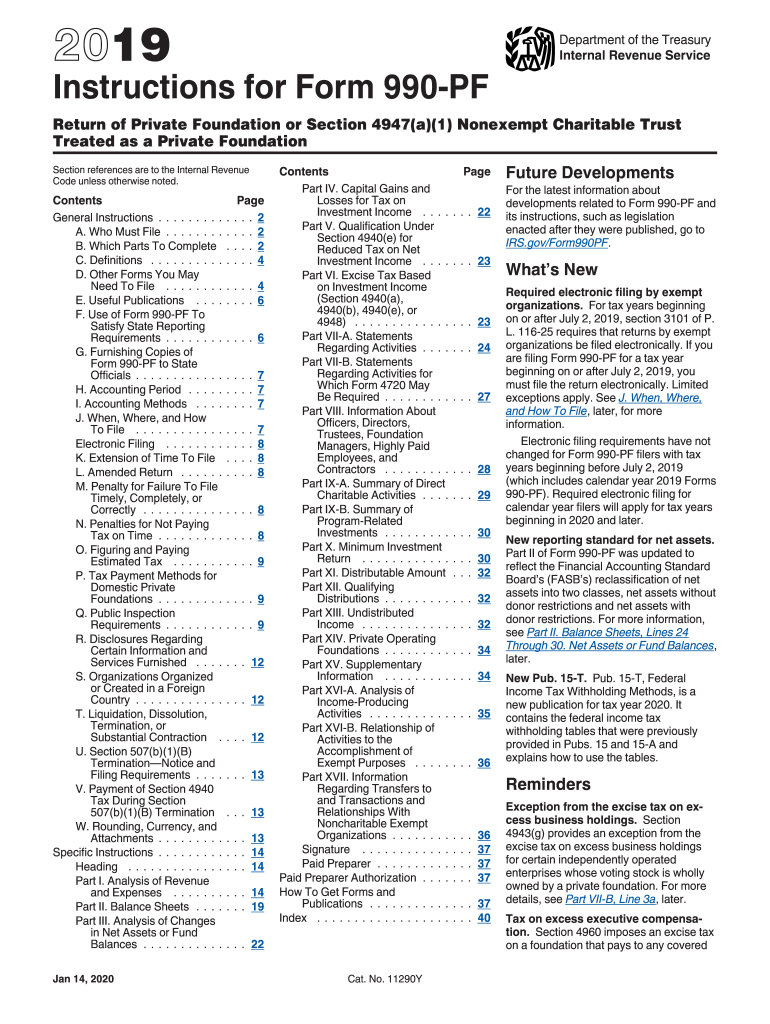

The Form 990 PF Instructions are guidelines provided by the IRS for private foundations filing their annual return. This form is essential for reporting financial information, activities, and compliance with federal tax regulations. The instructions detail how to complete each section of the form, ensuring that private foundations accurately disclose their financial status and adhere to legal requirements. Understanding these instructions is crucial for maintaining transparency and fulfilling obligations to the IRS.

Steps to Complete the Form 990 PF Instructions

Completing the Form 990 PF involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and details of grants made. Next, follow the instructions closely, filling out each section methodically. Pay particular attention to the sections on revenue, expenses, and net assets, as these are critical for IRS reporting. After completing the form, review it for errors or omissions before submission. Finally, ensure that all required signatures are in place, as this validates the form.

Legal Use of the Form 990 PF Instructions

The legal use of the Form 990 PF Instructions is essential for private foundations to comply with IRS regulations. The instructions provide a framework for accurately reporting financial activities, which is legally required for maintaining tax-exempt status. Failing to adhere to these guidelines can result in penalties, including loss of tax-exempt status. Therefore, understanding and following the legal stipulations outlined in the instructions is critical for every foundation.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 PF are crucial for compliance. Generally, private foundations must file their Form 990 PF by the fifteenth day of the fifth month following the end of their fiscal year. For foundations operating on a calendar year, this typically means a due date of May fifteenth. Extensions may be available, but they must be requested in advance. Keeping track of these important dates helps avoid late fees and potential penalties.

Required Documents

To complete the Form 990 PF, several documents are required. These include financial statements, a list of board members, and records of grants made during the year. Additionally, documentation supporting any significant changes in assets or liabilities should be included. Having these documents ready ensures a smoother filing process and helps maintain compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

Private foundations have multiple options for submitting the Form 990 PF. The form can be filed electronically through the IRS e-file system, which is often the most efficient method. Alternatively, foundations may choose to submit the form by mail, ensuring it is sent to the correct IRS address. In-person submission is generally not available for this form. Understanding the available submission methods helps foundations choose the best option for their needs.

Quick guide on how to complete fillable online parishschool ffr commitment cc auth form

Complete Form 990 Pf Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without holdups. Manage Form 990 Pf Instructions on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 990 Pf Instructions with ease

- Find Form 990 Pf Instructions and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign Form 990 Pf Instructions while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online parishschool ffr commitment cc auth form

Create this form in 5 minutes!

How to create an eSignature for the fillable online parishschool ffr commitment cc auth form

How to make an electronic signature for the Fillable Online Parishschool Ffr Commitment Cc Auth Form online

How to create an eSignature for your Fillable Online Parishschool Ffr Commitment Cc Auth Form in Google Chrome

How to create an eSignature for signing the Fillable Online Parishschool Ffr Commitment Cc Auth Form in Gmail

How to make an electronic signature for the Fillable Online Parishschool Ffr Commitment Cc Auth Form straight from your smart phone

How to generate an electronic signature for the Fillable Online Parishschool Ffr Commitment Cc Auth Form on iOS

How to generate an eSignature for the Fillable Online Parishschool Ffr Commitment Cc Auth Form on Android

People also ask

-

What are the key features of airSlate SignNow for handling Form 990 Pf Instructions?

airSlate SignNow offers a range of features that streamline the process of managing Form 990 Pf Instructions. Users can easily upload, edit, and eSign documents, ensuring compliance and accuracy. The platform's intuitive interface makes it simple to navigate through the requirements of Form 990 Pf Instructions, saving time and reducing errors.

-

How does airSlate SignNow simplify the completion of Form 990 Pf Instructions?

With airSlate SignNow, completing Form 990 Pf Instructions is straightforward and efficient. The platform allows users to fill out forms electronically, guiding them through each necessary section. This eliminates the hassle of paperwork and ensures that every detail of Form 990 Pf Instructions is accurately captured.

-

Is airSlate SignNow cost-effective for small nonprofits needing Form 990 Pf Instructions?

Yes, airSlate SignNow is designed to be a cost-effective solution for small nonprofits needing to manage Form 990 Pf Instructions. Our pricing plans are tailored to accommodate various budgets, providing essential features without breaking the bank. This makes it an ideal choice for organizations that require efficient document management on a tight budget.

-

Can I integrate airSlate SignNow with other tools for managing Form 990 Pf Instructions?

Absolutely! airSlate SignNow offers seamless integrations with popular software tools, enhancing your ability to manage Form 990 Pf Instructions. Whether you use CRM systems or accounting software, our integration capabilities ensure that all your important documents are interconnected, streamlining workflows and improving efficiency.

-

What benefits does airSlate SignNow provide for eSigning Form 990 Pf Instructions?

airSlate SignNow enhances the eSigning process for Form 990 Pf Instructions by offering a secure and legally binding way to sign documents online. This feature saves time and eliminates the need for in-person signatures, allowing users to complete their Form 990 Pf Instructions quickly and efficiently. Additionally, you can track the signing process in real-time for added convenience.

-

How do I ensure compliance when using airSlate SignNow for Form 990 Pf Instructions?

Using airSlate SignNow for Form 990 Pf Instructions ensures compliance through its built-in security features. The platform adheres to industry standards, providing encrypted storage and secure access to sensitive documents. Furthermore, airSlate SignNow's audit trail feature helps you maintain compliance by tracking modifications and signatures on your Form 990 Pf Instructions.

-

What support resources are available for users of airSlate SignNow regarding Form 990 Pf Instructions?

airSlate SignNow offers comprehensive support resources for users dealing with Form 990 Pf Instructions. Our support team is available to assist with any questions or issues you may encounter. Additionally, we provide detailed documentation and tutorial videos to help users navigate the platform effectively and utilize it for their Form 990 Pf Instructions.

Get more for Form 990 Pf Instructions

Find out other Form 990 Pf Instructions

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement